Good day, dear traders!

Of the majority of major currencies that showed a decline against the US dollar, the British pound was the leader, losing 1.07% in trading on April 20-24. But first let's talk about the topic of COVID-19, which concerns absolutely everyone, including market participants.

Despite the fact that the number of deaths from coronavirus in the UK exceeded 20,000 people, in the United Kingdom, the number of infected people began to decline, as well as a decrease in deaths. British Prime Minister Boris Johnson, who had a coronavirus, has taken up his duties. It is possible that from May 7, the UK will lift a number of restrictions for its citizens, at least this possibility is being considered. However, the final decision will depend on the subsequent dynamics of the number of infected and dead from the insidious pandemic.

If you look at the economic calendar, we will see that there will be no important and significant macroeconomic statistics from the UK this week, so the fundamental background for the GBP/USD pair will be set by American reports. Here, of course, it is necessary to highlight the decision of the US Federal Reserve System (FRS) on rates and the press conference of the head of this department, Jerome Powell. We will talk about this in more detail directly on the day of the release of these important events, that is, on Wednesday.

In the meantime, let's look at the charts of the pound/dollar currency pair, and start with the results of the past trading week.

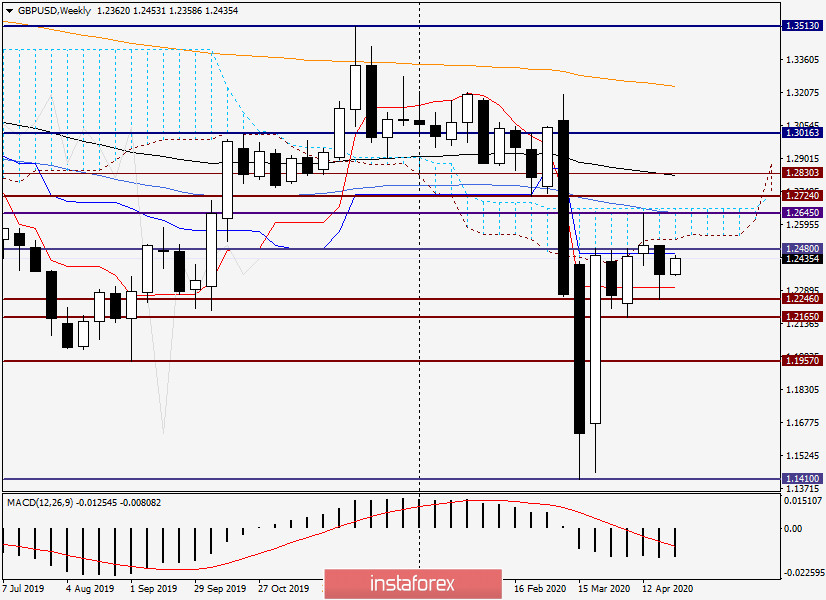

Weekly

As noted at the beginning of the article, the pair declined at the trading on April 20-24 and ended the session at 1.2361. However, there are some technical nuances that I would like to pay attention to.

The last weekly candle has a long enough lower shadow to suggest that the market is unwilling to continue to follow the southern direction. In addition, the week closed above the Tenkan line of the Ichimoku indicator and significantly above the important and significant mark of 1.2300. Based on this, we can hope that at the current trades, the GBP/USD will strengthen, which is observed at the time of writing this article.

If the growth continues, then its nearest targets will be the Kijun line (1.2462) and resistance level of 1.2480. However, this is not all the tasks that need to be solved by players to improve the course. After overcoming 1.2480, bulls on the pound need to raise the quote above the important psychological and technical level of 1.2500 and fix themselves above it. Next, you need to rewrite the maximum values of the week before 1.2645, breakthrough the 50 simple moving average, and bring the price up from the Ichimoku cloud. Only then can we be optimistic about the future prospects of strengthening the British currency.

To tell the truth, these tasks are quite difficult, they will be quite difficult to solve without a strong driver, which may be the Fed's decision on rates and the press conference of the US Central Bank. At least from a technical point of view, I will give priority to the ascending scenario on the weekly chart.

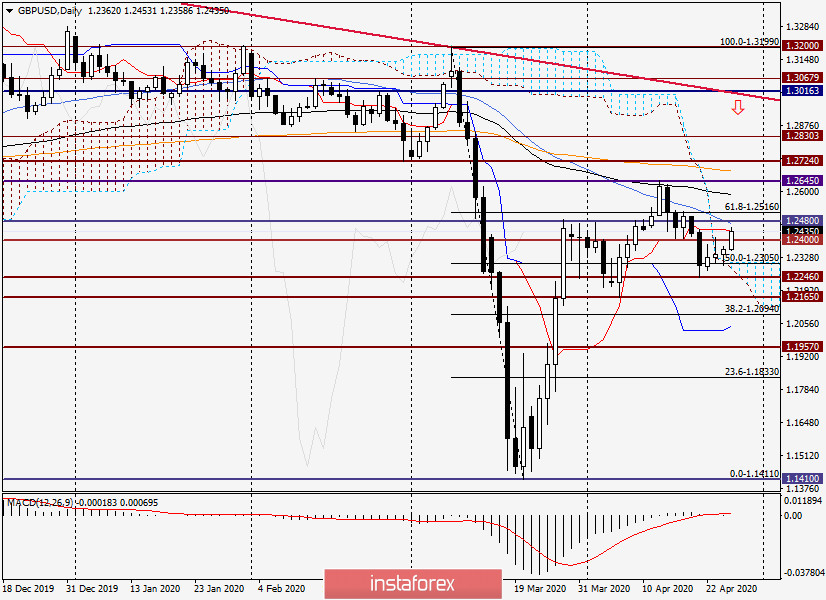

Daily

The picture on the daily chart also indicates that the pound bulls will have to work very hard to take the pair under their control. And on this timeframe, we allocate 50 MA, which runs in the immediate vicinity of the falsely broken resistance of 1.2480. Passing this level and 50 MA will open the way to a strong price zone of 1.2580-1.2600, where the 89 exponential moving average is located. Finally, it will make sure that the bulls control the trading on GBP/USD, the breakdown of an important and key resistance of sellers at 1.2645 with mandatory fixing above this mark.

The nearest daily support is located near 1.2300, where the upper limit of the daily Ichimoku cloud passes in addition to the most significant level.

Conclusion and trading recommendations for GBP/USD:

Taking into account the last weekly candle and the picture that is currently observed on the daily chart, I would venture to assume that the pair has every reason to grow, and I will leave the most relevant trading ideas for purchases. The most aggressive purchases can be tried after the quote drops to the price zone of 1.2420-1.2400. We are looking for lower prices to open long positions after the decline to the area of 1.2385-1.2360.

However, this opinion is purely personal and does not mean that there are no options for sales, which are better considered near all the resistances listed in this article.

The confirmation signal for opening positions in both directions will be the corresponding candle signals on the daily four-hour and one-hour timeframes.

Good luck!