Surprisingly, the market was incredibly obedient on Friday and strictly followed macroeconomic data. So the market periodically tries to pretend to be normal. Although in the context of the general epidemic of coronavirus and the associated restrictive measures, as well as the slide of the world economy into the deepest recession since the Second World War, this is probably an impossible task.

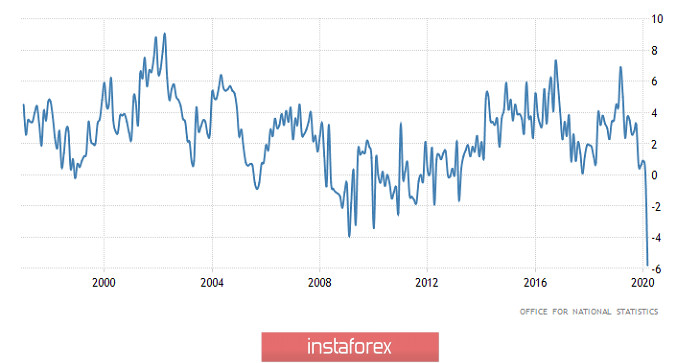

So the pound began to decline in the mornin against the backdrop of really catastrophic data on retail sales, which showed zero growth in February. At the end of March, the decline in annual terms amounted to 5.8%. Given the fact that restrictive measures were already introduced in March to curb the spread of the coronavirus pandemic, there is nothing surprising in the decline in retail sales. Frighteningly, this is the biggest decline in at least thirty years. At the same time, restrictive measures were introduced only closer to mid-March. In other words, this is only the beginning, as the April data will clearly show even worse results.

Retail Sales (UK):

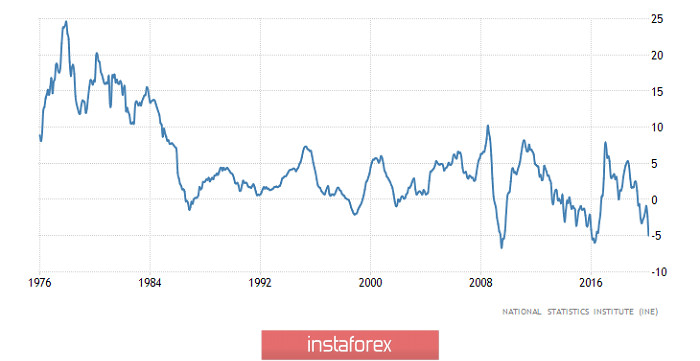

Nevertheless, the single European currency stood still in the morning, ignoring secondary macroeconomic data. Thus, the decline in production orders in Spain amounted to 0.2%. But not only are these data extremely uninteresting anyway, they are also for February unlike producer prices, which were published just in March. So, the rate of their decline accelerated from -2.3% to -5.0%. But let's be honest, the data on Spain, despite the fact that this is the fourth economy of the euro area, never really worried investors. Moreover, the rate of decline in producer prices has not yet reached record levels. In turn, German statistics is much more important, however, it is clear that IFO data are not significant. The business optimism index fell from 85.9 to 74.3, current situation assessment index fell from 92.9 to 79.5, and the index of expectations fell from 79.5 to 69.4.

Producer Prices (Spain):

The dollar began to confidently lose its position in the afternoon. This was especially noticeable in the single European currency. The pound was still held back by incredibly poor retail sales data. The reason for the weakening of the dollar lies in orders for durable goods, which fell by 14.4% in March. Not only is this worse than forecasts, but it is also one of the most serious cuts in the past thirty years. Moreover, the data is not for March, and the restrictive measures designed to contain the spread of the coronavirus epidemic, which are now all blamed, began to take effect only in the second half of the month. So in April, we may see a record reduction in orders. The worst thing here is that this indicator is leading for a number of other extremely important macroeconomic indicators. For instance, industry and retail. Indirectly, orders are related to employment. As the indicator itself depends on consumer activity, it also indicates a high probability of unemployment growth.

Durable Goods Orders (United States):

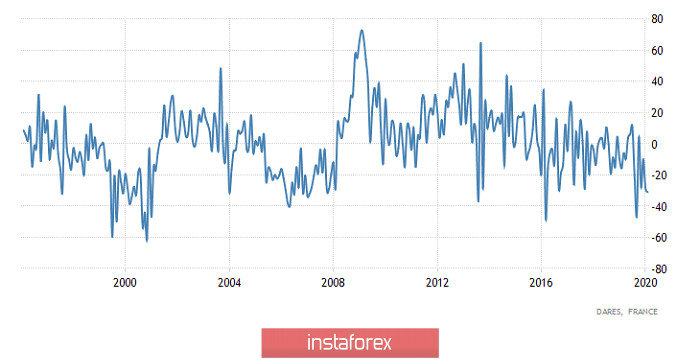

Frankly, macroeconomic statistics is almost empty today. To simply put, it is essentially not there. Only the data on applications for unemployment benefits in France are worthy of attention, the number of which should grow by 150 thousand. This is almost two more than it was in 2008. But it can be agreed that these data will only once again confirm what everyone already knows for a long time. The labor market is probably experiencing the worst times since the Great Depression.

Change in the number of applications for unemployment benefits (France):

Nevertheless, the dollar began to get cheaper in the morning. In fact, the dollar is getting cheaper solely on emotions. This was influenced by two factors that happened on the weekend, and they had to somehow win back from the very opening of the market. It is necessary to pay attention to the fact that the pound was the leader of growth. So, in general, the weakening dollar is due to the statement of the former adviser Donald Trump, Dr. Kevin Hasset, a doctor of economics. He predicted a rise in unemployment comparable to the Great Depression. The point here is that we do not have reliable data on the extent of unemployment during the Great Depression, so direct comparisons are incorrect. Therefore, Dr. Hasset's statement should be taken as a metaphor designed to emphasize how deep and terrifying the current economic downturn is. However, this terrible phrase from the mouth of a person, close to economic realities, as well as the political elite, sounded terrifying for the first time. After all, it turns out that the White House is preparing for the worst. And the most terrible thing in the Great Depression was that they got out of it for a very, very long time. It was a prolonged economic crisis that swept the world. According to the most conservative estimates, it lasted four years. But in a good way, a whole decade. In other words, the American economy is clearly in the worst state in recent decades. Now let's return to the pound, which is growing most actively due to unconfirmed rumors that London may start gradually easing restrictive measures ahead of time. In other words, we should systematically remove the economy from the state of quarantine. However, this is just a rumor that has been talked about before. And given the emotional nature of the dollar's weakening, it is worth keeping in mind the high probability of a sudden pullback.

The single European currency will most likely be traded in the level of 1.0825.

The pound will hang around the level of 1.2400.