Technical analysis recommendations for EUR / USD and GBP / USD on April 27

Economic calendar (Universal time)

No important events today in the economic calendar.

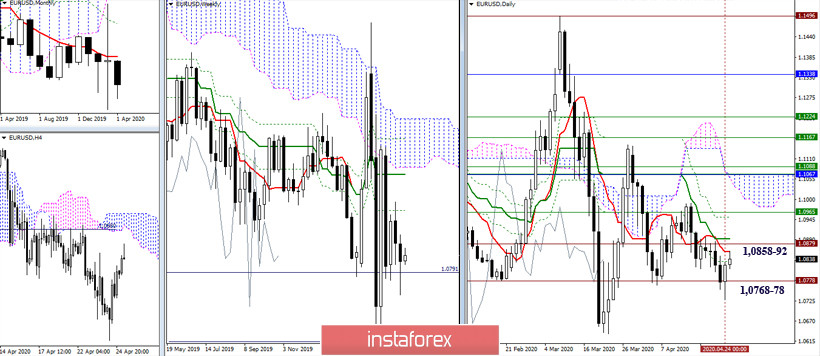

EUR / USD

On Friday, the pair failed to overcome the support levels of 1.0778-68 (historical level + minimum extremum), which did not only indicate a slowdown, but also formed a daily rebound from the levels, fixing it with a long weekly candle shadow. To date, an upward correction to the daily short-term trend (1.0858) has already been completed. The daily cross (1,0858-92) and historical level (1,0879) are the most significant resistances of this area. Consolidation above will allow the rebound from the support to develop, which will result to new prospects, such as 1.0952-65 (daily and weekly Fibo) and 1.1067-88 (daily cloud + weekly levels + monthly Tenkan). Successful resistance of the daily Tenkan will trigger the next testing of support levels 1.0778-68 (historical level + minimum extremum).

In the lower time frames, bullish players are now testing the first resistance level of the classic Pivot - 1.0858 (R1). Overcoming it will pave the way to today's resistance levels at 1.0894 (R2) and 1.0960 (R3), which is important to execute, as all the rising benchmarks of today's lower time frames are more profitable. Key support are the levels 1.0825 (weekly long-term trend) and 1.0792 (central Pivot level). Just below are the support for the higher time frames (1.0778-68). Interaction with the indicated supports will determine further prospects.

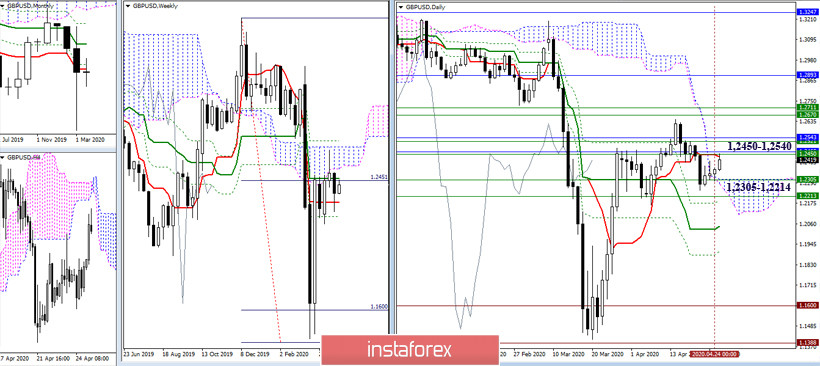

GBP / USD

Friday closed above the daily cloud, and in weeks remained above the short-term trend, which inspired players to increase activity. To date, the pair has again returned to the significant resistance zone at 1.2540 - 1.2450 (monthly Tenkan + weekly Kijun and Senkou Span A + monthly Fibo Kijun + daily Tenkan). Overcoming it will trigger a bullish mood, but a rebound will return the pair to the strengthened supports in the area of the daily and weekly levels (1.2305 - 1.2214).

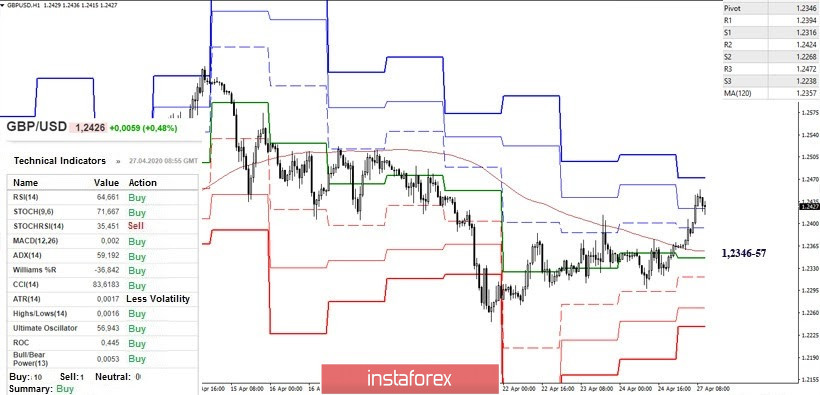

Bullish players currently hold an advantage. The technical tools on H1 support the bullish mood. Today's key level is R3 (1.2472), while the supports responsible for the distribution of forces on it are located within 1.2346-57 (central Pivot level + weekly long-term trend).

Ichimoku cloud (9.26.52), Pivot Points (classic), Moving Average (120)