The last week of April promises to be a real benefit for central banks. The Bank of Japan has already announced its intention to buy an unlimited amount of government bonds in order to keep lending rates in its country low. The Fed, which has already embarked on an unprecedented monetary stimulus, is likely to report that it is ready to expand it if necessary. The most mysterious is the meeting of the Governing Council of the ECB. An official statement is expected from the European regulator on the purchase of "fallen angel" bonds securities, the rating of which can be lowered from investment to "garbage" level. However, Christine Lagarde and her colleagues, will most likely, not stop. The Frenchwoman has already proved to everyone that she is ready to present surprises.

The Bank of Japan did not surprise the markets. Even before the meeting of the Board of Governors, there were rumors at Forex that Haruhiko Kuroda would report an unlimited scale of QE, which in fact cannot be considered a weakening of monetary policy. The fact is that pursuing a yield curve targeting strategy, BoJ buys as many securities as needed, and in recent years it has not even reached the mark of £ 80 trillion. This is the exact amount of QE that is nominally documented. The actual figure is significantly lower, so the phrase about the unlimited scope of the quantitative easing program is nothing more than an attempt to frighten opponents with a blank shot in the air.

The balance sheet of the Bank of Japan

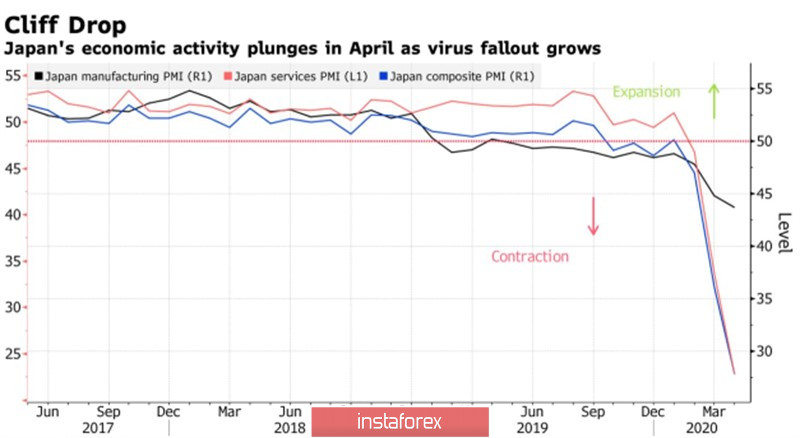

Expanding corporate debt purchases to £ 20 trillion, three times the previous target, is good news for Japanese companies, but not for bulls in USD / JPY. Nikkei, TOPIX, and the yen grew amicably in response to the announcement of the results of the April BoJ meeting. Kuroda considers the prospects for achieving the 2% inflation target to be vague and argues that one should not expect feats in this area in the next three years. All forces will be thrown into the fight against the recession, which promises to be very deep. Judging by the record collapse of business activity in the services of Japan and the fall of the index of purchasing managers in the manufacturing sector to the very bottom since the previous world economic crisis, we can assume that GDP in the second quarter will drop by 20 %

Dynamics of business activity in Japan

The situation in the eurozone does not look good. According to Bloomberg research, even in the best-case scenario, the currency bloc's economy will shrink by 8%. If European officials fail to agree on the creation and use of the Salvation Fund, things will be much worse. A tremendous effort is required from the ECB, including both active support for the debt markets of the countries most affected by the coronavirus and the expansion of QE by € 500-1000 billion. While, 27% of economists surveyed by Bloomberg believe that Christine Lagarde will take this step on April 30.

Technically, the bears' breakthrough on EUR / JPY support by 115.95-116 will increase the risks of implementing the AB = CD pattern and allow forming short positions with a target of 114.70-114.75.

EUR / JPY daily chart