To open long positions on GBPUSD, you need:

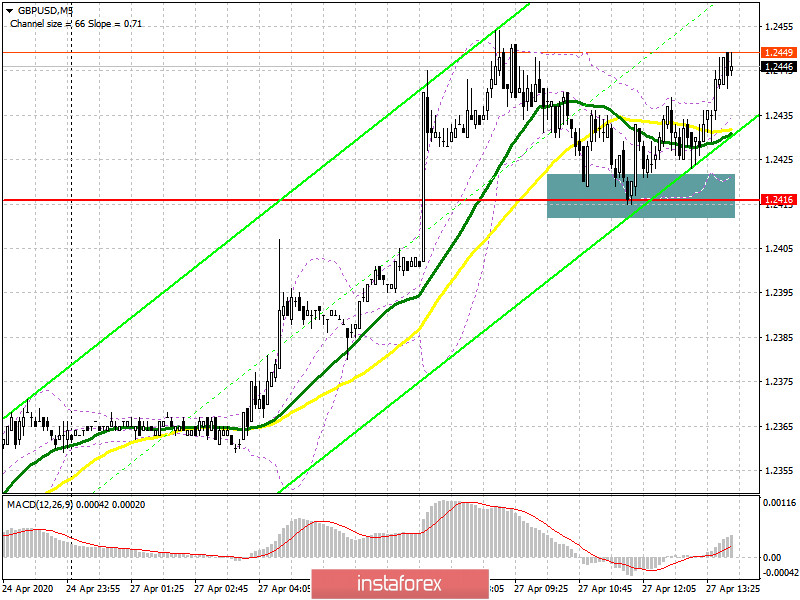

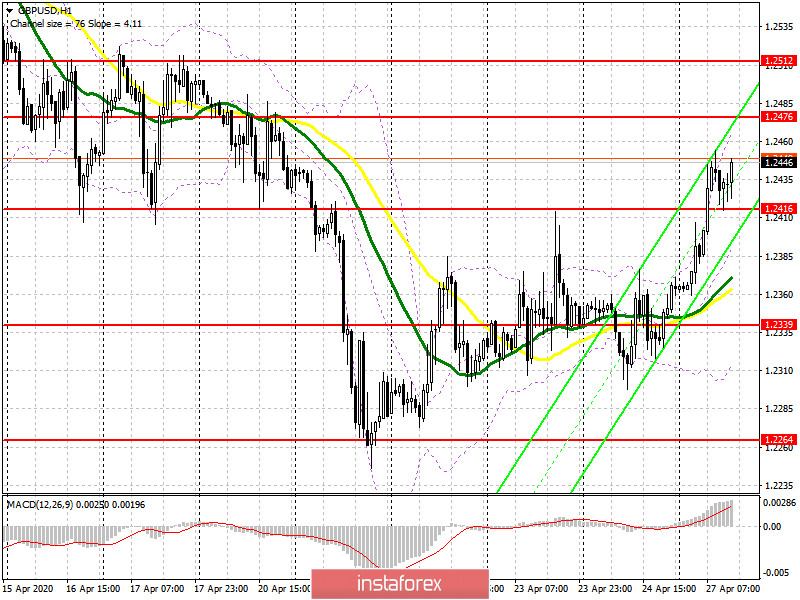

In the first half of the day, I paid attention to the importance of the level of 1.2416 and recommended opening long positions from it in case of fixing on it, which happened. The entry point is clearly visible on the 5-minute chart, from where the bulls continued their purchases after testing the level from top to bottom. At the moment, while trading is conducted above the area of 1.2416, you can expect a further upward correction to the resistance area of 1.2476, as well as a test of a larger maximum of 1.2512, where I recommend fixing the profits. In the scenario of GBP/USD returning to the level of 1.2416, the bulls can quickly leave the market, which will lead to a downward movement in the pair. Therefore, it is best to return to long positions on the test of large support of 1.2339, counting on a rebound of 30-40 points within the day.

To open short positions on GBPUSD, you need:

The bears missed the resistance of 1.2416 without even attempting to form a false breakout. The main task for the second half of the day is to return GBP/USD to this level since only in this case you can expect a larger downward correction to the area of the minimum of 1.2339, where I recommend fixing the profits. However, given the fact that the release of important fundamental statistics is not planned today, the bulls will try to continue the growth of the pound. In this scenario, I recommend considering new short positions only after the resistance test of 1.2476, or for a rebound from a larger maximum of 1.2512 with the aim of correcting by 30-40 points within the day.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily averages, which indicates a further upward correction in the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of a downward correction, support will be provided by the average border of the indicator in the area of 1.2390, and you can buy the pound immediately on the rebound from the lower border in the area of 1.2325.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20