EUR / USD

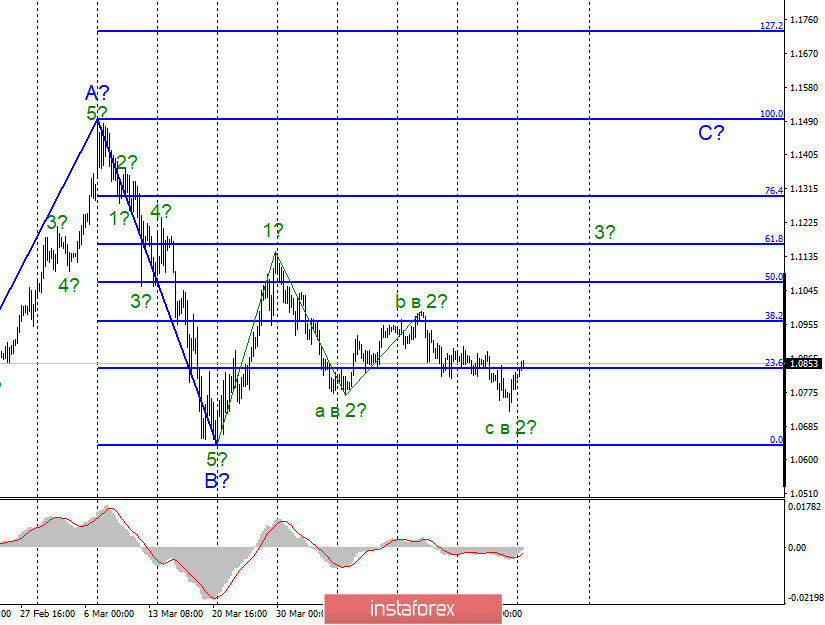

On April 24, Friday, the EUR / USD pair gained about 40 base points and attempted to complete the construction of the alleged wave 2, which took a 3-wave form. If this assumption is correct, then from the current positions the tool will resume the construction of the ascending wave C, the minimum targets of which are located around 11 figures. At the same time, the next update of the lows will significantly reduce the chances for the further construction of wave C and, probably, will require making adjustments to the current wave marking.

Fundamental component:

The was a news background for the pair on Friday. Orders for durable goods in the United States showed a huge drop in volumes. However, markets were not too surprised at the figure of -14.4% compared with February. What else would you expect from the month when the crisis started in full swing and quarantine was introduced due to the COVID-2019 pandemic? Moreover, reports, such as applications for unemployment benefits, showed that there would be no moderate deterioration in economic indicators. The US economy is contracting in huge leaps, and this week the markets will also know how much GDP fell in the first quarter. Some expect that to be around -4%, however, this may then turn out to be -5%. On Wednesday evening the results of the meeting of the FOMC Committee of the US Federal Reserve will be summarized. Although this time the markets do not expect a cut in the key rate, nevertheless, the views of many markets, especially American ones, will be riveted to the Fed. But the Fed can announce new loan programs and should summarize the results of March and April when record numbers of layoffs in the country were recorded, and economic and business activity were also greatly reduced. The Fed will also have to voice its revised forecasts for the current year on GDP and inflation. These figures will allow us to estimate the extent of economic harm due to the pandemic that awaits the American Central Bank. Well, of course, the worse the rhetoric of Jerome Powell, who will voice all this information, will be, the more likely

General conclusions and recommendations:

The EUR/USD pair has presumably begun to build the rising wave C. Thus, now I recommend buying the instrument with targets located near the levels of 1.1165 and 1.1295, which corresponds to 61.8% and 76.4% Fibonacci. I recommend placing Stop Loss protective orders below the wave minimum at 2.

The pair GBP / USD on April 24 gained just 25 base points. Thus, it remains unclear whether the construction of the proposed wave 2 or B is completed, or will it take on a three-wave form? In the first case, the quotes of the instrument will resume decline, in the second, the increase will continue. I believe that wave 2 or B will take a three-wave form because wave 1 or A has taken a clearly expressed five-wave. Thus, this week the decline in quotes may resume with targets located around 21 and 20 figures.

Fundamental component:

A news background for the GBP / USD pair was also present on April 24th. In the UK, March retail sales reports were released, which are expected to lose from 4.1% to 5.8% YoY. Thus, on Friday, the pound could be under pressure from the market, if not for even worse numbers from America. On Monday, no economic reports are listed on the calendars of Britain and the United States, and tomorrow we will find out how much retail trade has declined according to the Confederation of British Industrialists (CBI). It is projected to be -40% in April. Thus, April in economic numbers can be much more disastrous than March, both in America and in the UK. One should prepare for the worst.

General conclusions and recommendations:

The GBP/USD tool supposedly completed the construction of the first wave of a new upward trend section. Thus, now I recommend selling the pound with goals located around 22 and 21 figures, based on the construction of correctional wave 2 or B, or waiting for the completion of this wave, then to buy at the beginning of upward wave 3 or C.