The market essentially stood still in the absence of any pan-European or US macroeconomic data. It simply had no reference points. Markets were not even impressed by the news that the total number of confirmed cases of coronavirus infection exceeded three million. Partly because they are already getting tired of this topic. Moreover, everyone is much more concerned about the scale of the economic consequences, as well as how long the world economy will take to recover from the recession. In addition, many countries are encouraging plans to gradually lift restrictions imposed just to contain the spread of the coronavirus epidemic.

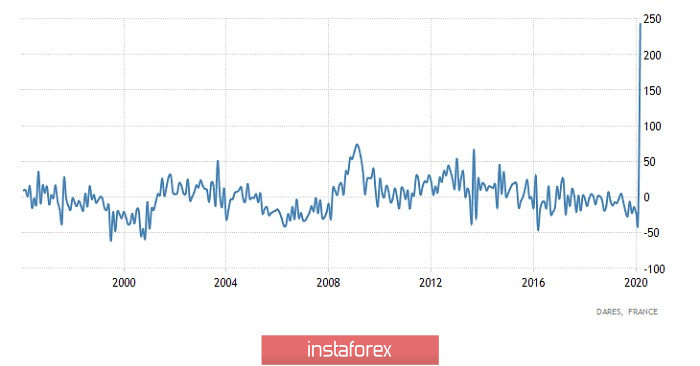

At the same time, the simple truth that the recession of the world economy could turn out to be the deepest over the past few decades is becoming increasingly apparent. This is clearly seen in the nightmare that is happening in the labor markets of almost all countries of the world, without exception. For example, the number of applications for unemployment benefits in France rose by a record 243,000. It was predicted to grow by 150,000, which is about two times more than the record value recorded in 2009. A truly crazy increase in unemployment does not only mean that the global recession will be incredibly deep. Rather, it indicates that it will take several years for the global economy to get out of this hole.

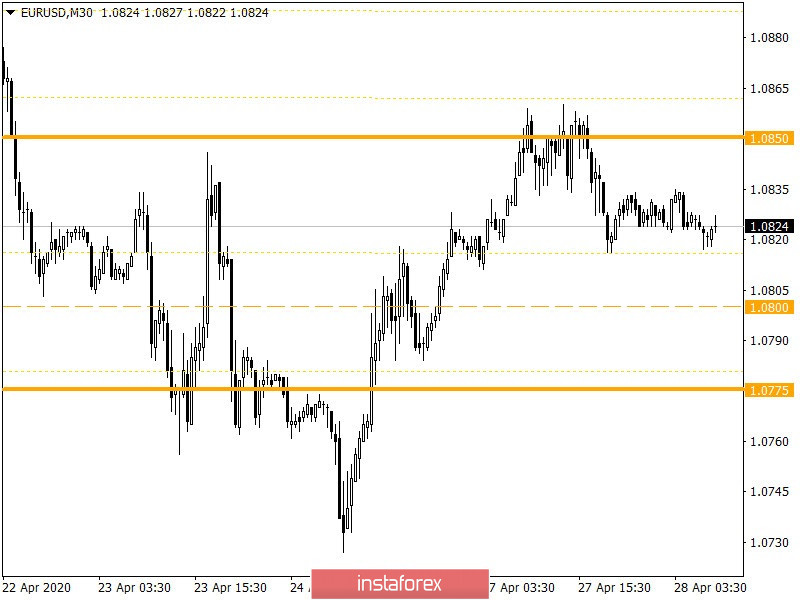

Change in the number of applications for unemployment benefits (France):

Data on the unemployment rate in Spain will be published today, which should grow from 13.8% to 15.5%. This, of course, is far from a record value, and the growth rate is not so impressive since it has seen an increase that was even worse. However, the labor market in Spain still can not recover from the shocks that it had to experience in 2009. In other words, Spain is a clear demonstration that the global economy to this day has not solved the problems that caused the crisis of 2008-2009. The market will ignore this data, as it neglected data from France yesterday.

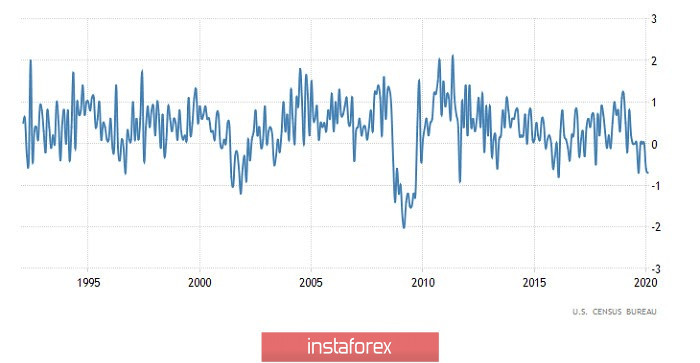

Unemployment Rate (Spain):

The market has somewhat come alive since the US session opened. Like it or not, but the data on wholesale inventories in the United States are somewhat more significant than the unemployment rate in Spain. And even more important than applications for unemployment benefits in France. So, these same stocks can grow by 1.0%. However, amid an unprecedented increase in unemployment, overstocking of warehouses automatically indicates that industry will recover for a very, very long time. And this will slow down the overall process of economic recovery.

Wholesale inventories (United States):

From the point of view of technical analysis, we see a corrective move from the local low of 1.0727, where the quote managed to return to the area of the previously passed level of 1.0850. The subsequent fluctuation occurred in the form of trading forces being concentrated at the level of 1.0850, where activity was significantly reduced.

In terms of a general review of the trading chart, the daily period, a stable downward trend is visible, where the quote is directed towards the March 23 low at 1.0636.

It can be assumed that trading forces at 1.0850 will remain in the market, where the quote will locally go towards 1.0860, but then it will slow down again, highlighting the variable framework 1.0815/1.0865.

Specifying all of the above into trading signals:

- We consider purchase positions higher than 1.0835, towards 1.0860.

- We consider selling positions lower than 1.0810, with the prospect of a move to 1.0775.

From the point of view of a comprehensive indicator analysis, we see an upward interest in hour and minute periods due to the corrective movement. Daily periods continue to indicate selling, reflecting the main mood.