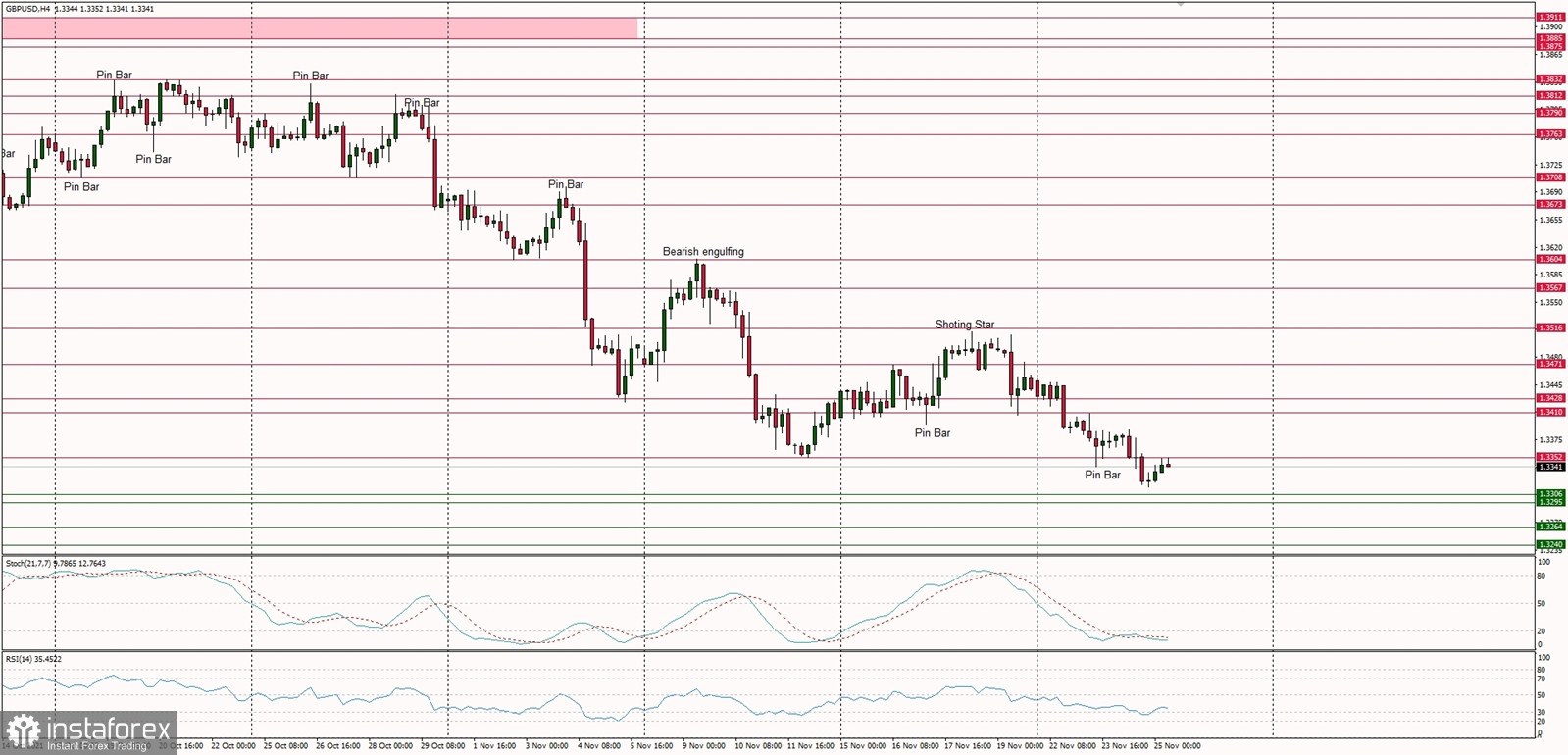

Technical Market Outlook

The GBP/USD pair has made another lower low at the level of 1.3315 as the down trend continues. The market trades below 50,100 and 200 WMA which is a definition of a down trend in the long-term. The next target for bears is seen at the level of 1.3306 and 1.3295. The key short-term technical resistance is located at the level of 1.3516, just below the 38% Fibonacci retracement of the last wave down located at 1.3536. The intraday technical resistance is seen at 1.3352 and 1.3410.

Weekly Pivot Points:

WR3 - 1.3619

WR2 - 1.3561

WR1 - 1.3497

Weekly Pivot - 1.3445

WS1 - 1.3383

WS2 - 1.3326

WS3 - 1.3259

Trading Outlook:

The down trend on a larger time frame charts is being continued, but only a sustained breakout above the level of 1.3514 would improve the outlook to more bullish with a target at 1.4200. 200 WMA is located at the level of 1.3387 and might provide some temporary support for bulls.