Hello, traders!

As noted in the previous euro/dollar review, the main event of today at 19:00 (London time) will be the Fed's decision on interest rates, updated FOMC economic forecasts and, of course, the press conference of Federal Reserve Chairman Jerome Powell, which is scheduled for 19:30 (London time). Preliminary data on the US GDP will be released earlier, at 13:30 (London time). I believe that this time we should expect the reaction of market participants to these events. But it is difficult to assume what it will be in the current conditions, so we will consider different scenarios.

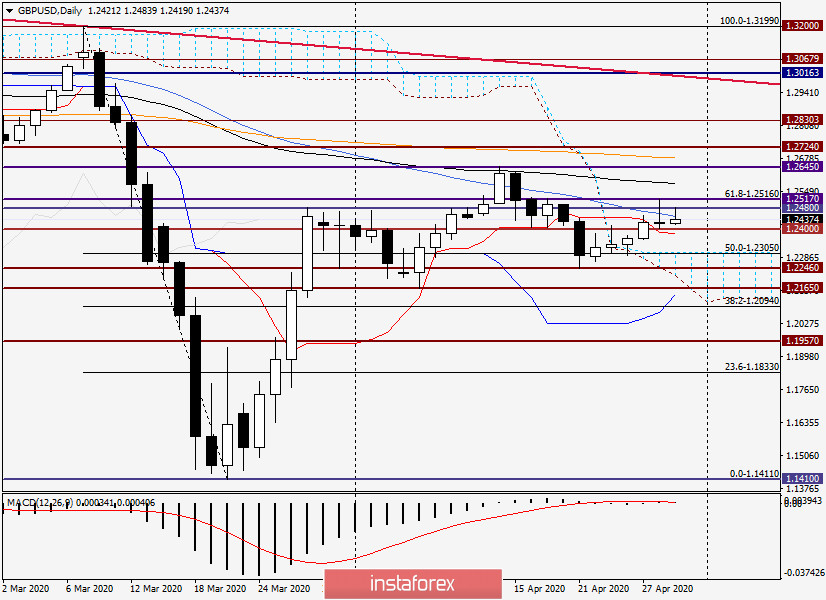

Daily

Although yesterday's data on consumer confidence in the US came out worse than expected (88) and amounted to 86.9, this did not confuse buyers of the US currency and did not put pressure on it.

As a result of yesterday's trading, a bearish candle with a long upper shadow appeared on the daily chart, resembling a reversal model of candle analysis "Tombstone", which can signal a subsequent decline in the British currency. However, there are several important points to note here. First, yesterday's candle has a lower shadow, although it is small. Second, the closing price of the session on April 28 was higher than the important and significant level of 1.2400. And third, the pair has already tested the most important psychological level of 1.2500 for a breakout, which leaves the prospects of repeated testing for a breakthrough, and a successful one, quite real.

The task for bulls on the pound is complicated by the 50 simple moving average, which is at the level of 1.2450. At the moment, it is 50 MA that blocks the pair's way up, but it is not yet evening. It is after the Fed decides on rates, the publication of updated economic forecasts, and during the speech of the head of the Federal Reserve that the most important and strong movements will occur, which will determine the course of today's trading.

From technical analysis, for the subsequent strengthening of the quote, it is necessary to close the day above yesterday's highs of 1.2517 and absorb the bearish Doji "Tombstone" candle. However, I almost forgot to note that this model has the greatest strength and chances of working out when it appears at the end of the upward movement. In this case, it would be relevant near the resistance level of 1.2645.

I will indicate resistance and support in this period. So, the nearest resistance is at 1.2517. If this level can be overcome, the road will open to further targets at 1.2582 (89 EMA), 1.2645 (highs on April 14), and 1.2682, where the 200 exponential moving average passes.

In the case of a downward scenario, the pound bears need to break through support in the area of 1.2402-1.2383, where yesterday's lows are marked and the Tenkan line of the Ichimoku indicator is located. The longer-term goal of sellers will be the upper limit of the daily Ichimoku cloud, which passes at 1.2310.

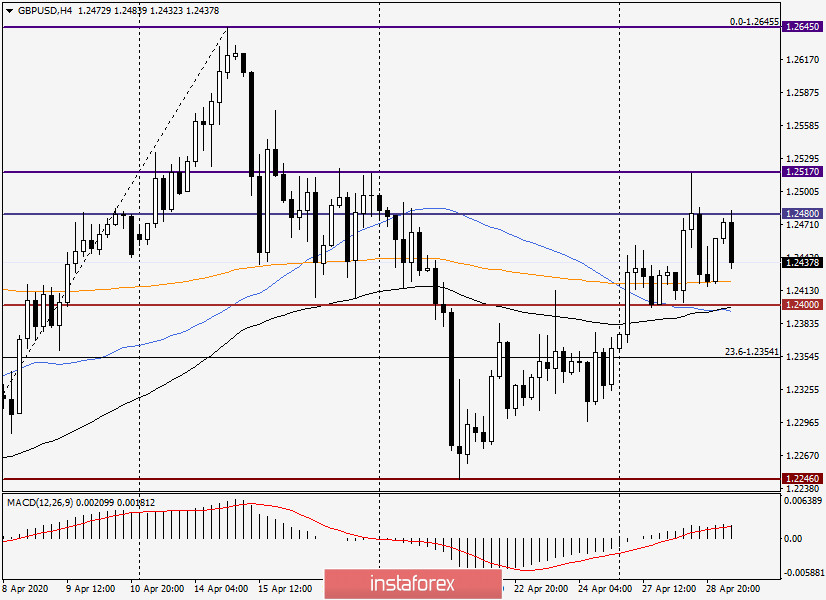

H4

Looking at the 4-hour timeframe, we see a continuing pullback, which had its start after reaching 1.2517. It is characteristic that the pair is trading above the used moving averages (200 EMA, 89 EMA, and 50 MA), each of which can provide strong support and return the quote to growth.

Trading recommendations for GBP/USD:

In my subjective opinion, the pair is more inclined to growth so the main trading idea for GBP/USD is purchasing, which is better to consider after a short-term decline to the price zone of 1.2425-1.2395 and the formation of bullish candle patterns here. Alternatively, for those who trade at the breakout levels, I recommend trying to open long positions at the breakout of 1.2473 and (or) 1.2517. It is more risky and aggressive to buy from the current price of 1.2450.

A day for trading is very difficult, and much will depend on the reaction of market participants to the Fed's decision on rates and Jerome Powell's rhetoric. In such circumstances, there is always room for an alternative scenario, that is, for sales. If candlestick signals are indicating a decline in the area of 1.2480-1.2500, it is worth using them to open short positions.

Good luck and profitable deals!