During the whole week, the US dollar has been trying to hold its ground. Currently, there are a lot of negative news that weigh on the greenback. The US dollar did not rest the bottom. However, it lost ground after the Federal Reserve Meeting.

For now, the American currency stays firm as it is still an attractive asset for investors. Additionally, this is a safe-haven asset. The greenback usually quickly recover after market turmoil. Now, risk appetite is returning to the market thus undermining the demand for the US currency.

Besides the US dollar dipped significantly after the Fed's decision on the key rate. The regulator kept the interest rate unchanged, noting that now it is better for the economy. The Fed left its interest rate unchanged at 0.00% -0.25%, saying that in the medium term, intervention would not be required.

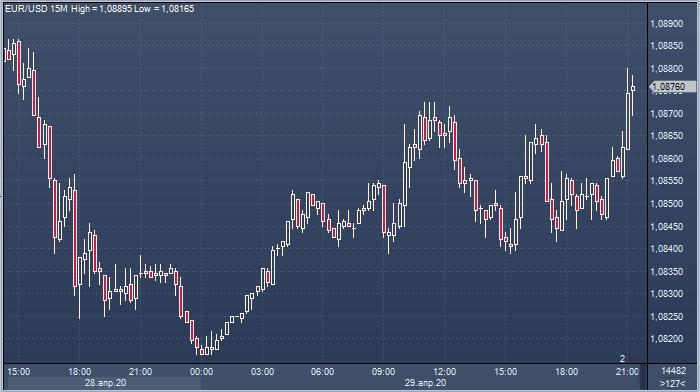

The US dollar sank to a two-week low after the Fed's decision. The EUR/USD pair jumped to 1.0880. Yet, analysts think that the current situation may affect both the euro and the US dollar. On Thursday, April 30, the EUR/USD pair was trading from the range of 1.0863–1.0865. In the future, the pair is likely to trade with a bullish bias.

Market participants were disappointed by the statements of Jerome Powell who did not provide any hints about the future of the monetary policy. He noted that rates would remain near zero until the country overcame the corona crisis. Powell did not say anything about the level of employment in the United States and the inflation. He stressed that the Fed "will continue to purchase Treasury securities and agency residential and commercial mortgage-backed securities in the amounts needed to support smooth market functioning.

The euro is most likely to face the same challenges, analysts believe. The ECB will probably follow the path of the Fed in keeping its key rates unchanged. Investors do not expect a drastic change in the ECB monetary policy, but complete inaction of the European regulator is also unlikely. The ECB has taken its interest rates into negative territory while its deposit rate is also at zero. Of course, the European regulator can reduce them even more (although it is unlikely to fall below zero). However, few believe that the regulator would resort to such measures.

One of the important reports eagerly anticipated by traders will be the eurozone GBP data for the first quarter of 2020. Analysts believe that during this period, the European economy may sink by 3.5% compared to the previous quarter. Experts assume that this indicator will allow speculators to compare losses in the US and European economies. In the case of relatively positive data on the euro area GDP, the European economy will gain an advantage over the American one. What is more, the euro will strengthen against the US dollar.

The US economy may contract more than the European one if the unemployment rate in the US continues to grow. If so, the greenback is sure to test new lows. Analysts are awaiting fresh jobs report. The number of initial jobless claims is expected to rise by 3.5 million. As a result, the number of initial claims for unemployment benefits over the past six weeks may reach 31 million, affecting the already unstable American economy.

According to experts, the US currency will soon regain footing. The US dollar will again become the strongest currency in the EUR/USD pair. This is why it is recommended to make bets on the US dollar in the short term.