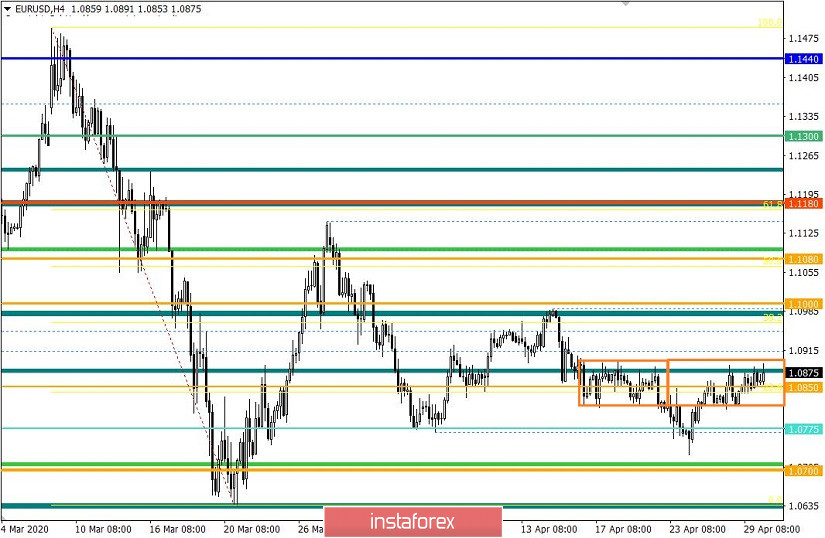

In terms of the complex analysis, we can see that trading is concentrated in the range of the previously specified levels. Now, let's get to details. Who could have thought that the technical correction from 1.0727 can last for so long. The quote fluctuates within 1.0815//1.0850//1.0885 and repeats the scenario of April 16-21. If we compare similar fluctuations in history, we will see that previously the amplitude stretched for 90 hours and an acceleration took place after that. Before major changes occured, the quote was concentrated at the mirror level of 1.0850. We can suggest that what is happening at the moment is similar to the previous fluctuation. Consequently, the pattern is fragile and we can expect an acceleration in the short term.

If we take a closer look at the past trading day, we can notice that after the quote consolidated at 1.0815 again, a series of long positions took place which returned the quote just above the mirror level of 1.0850. The following fluctuation occurred along the level of 1.0850.

As for a possible downward scenario, nothing has changed. Signals from a number of technical and fundamental factors continue to indicate a medium-term perspective. Time will show..

Volatility reflects sluggish dynamics. However, it is worth considering that the existing fluctuation takes place in the side channel where the activity of 68 pips is considered significant.

Volatility detales: Monday - 155 pips; Tuesday - 183 pips; Wednesday - 115 pips; Thursday - 278 pips; Friday - 166 pips; Monday - 151 pips; Tuesday - 234 pips; Wednesday - 243 pips; Thursday - 326 pips; Friday - 194 pips; Monday - 191 pips; Tuesday - 160 pips; Wednesday - 133 pips; Thursday - 188 pips; Friday - 194 pips; Monday - 134 pips; Tuesday - 127 pips; Wednesday - 136 pips; Thursday - 147 pips; Friday - 91 pips; Monday - 67 pips; Tuesday - 142 pips; Wednesday - 72 pips; Thursday - 110 pips; Friday - 33 pips; Monday - 74 pips; Tuesday - 84 pips; Wednesday - 134 pips; Thursday - 95 pips; Friday - 80 pips; Monday - 55 pips; Tuesday - 64 pips; Wednesday - 82 pips; Thursday - 90 pips; Friday - 101 pips; Monday - 49 points; Tuesday - 79 pips; Wednesday - 68 pips. The average daily indicator in regards to the dynamics of volatility is 87 points [see table of volatility at the end of the article].

Yesterday, we analyzed a breakout strategy of the established corridor 1.0815/1.0885.

Analyzing the trading chart in general terms and the daily period, we can notice consistent inertial fluctuations, where there is a downward bias.

Now let's take a looks at yesterday's news background. US GDP fell by 4.8% in the first quarter this year compared to the forecast 4.6%. However, this data did not reflect the impact of the quarantine measures since they were introduced only in the middle of March. Thus, we can expect a weaker GDP report in the US for the second quarter.

The market almost immediately showed a local weakening of the greenback amid statistical data.

The FOMC meeting was held later during the day. The refinancing interest rate remained steady at 0-0.25%.

"The ongoing public health crisis will weigh heavily on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term. In light of these developments, the Committee decided to maintain the target range for the federal funds rate at 0 to 1/4 percent"

After that, Jerome Powell, the head of the Federal Reserve, talked about consequences of the pandemic on the country's economic activity in the second quarter at the press conference.

"The forceful measures that we as a country are taking to control the spread of the virus have brought much of the economy to an abrupt halt. Overall, economic activity will likely drop at an unprecedented rate in the second quarter. We are also committed to using our full range of tools to support the economy in this challenging time. Last month, we quickly lowered our policy interest rate to near zero. We stated then and again today that we expect to maintain interest rates at this level until we are confident that the economy has weathered recent events and is on track to achieve our maximum employment and price stability goals", – said Chair Powell.

The greenback eased right after the meeting. However, it managed to quickly recover later .

Today, the US weekly jobless claims report is expected to be released. According to statistics, the situation in the US labor market is catastrophic. Thus, the number of initial applications for unemployment benefits has reached 26.5 million for five weeks. This time, the initial jobless claims are expected to rise by 3,680,000, and secondary filings to increase by 18,900,000.

At the same time, the European Central Bank (ECB) will hold a meeting today. Market participants expect the regulator to hint about further monetary policy in the eurozone.

Further development

Analyzing the current trade chart, we can see we see speculative activity at the start of the European session, where the quote once again concentrated within the upper limit of the variable range of 1.0815//1.0850//1.0885. In fact, this is the third attempt to break through at 1.0885, which sparks close attention of market participants.

At the moment, the speculative interest can locally cause impulsive moves. It is important to be prepared for it when you open trades.

We can assume that the quote will soon break through the variable range 1.0815//1.0850//1.0885, which will be expressed in local acceleration. Thus, a breakout of established borders will be considered as the most ideal strategy.

Against this background, we can give trading recommendations:

- It is preferable to open buy deals above the level of 1.0910 with the target at 1,0950.

- It is better to open sell deals below the level of 1.0870 to 1,0850 and then - from 1.0840 to 1,0815. It is possible to continue selling the pair, if the price consolidates below 1.0810 with the target at 1.0775-1.0735.

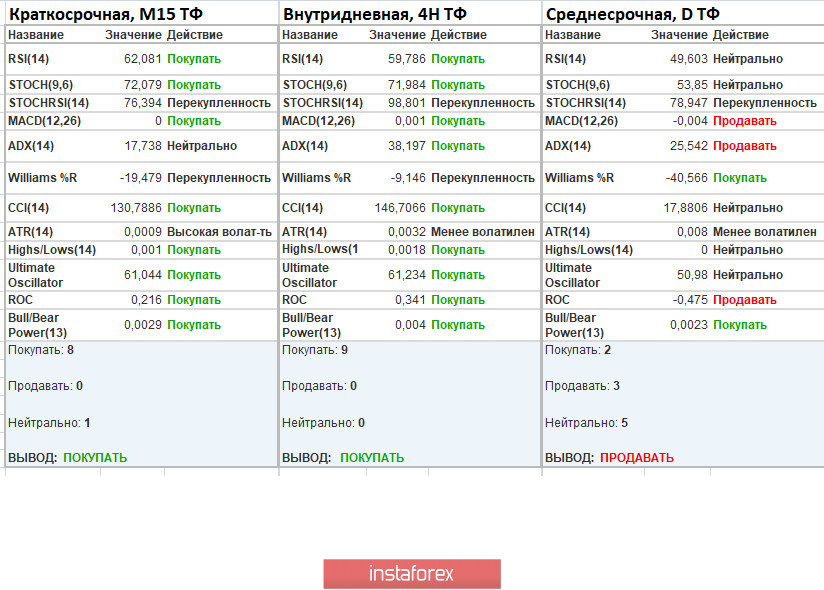

Indicator analysis

Analyzing different time frames (TF), we can see that the performance of technical tools in the minute and hour time frames signal buy deals. Daily intervals hold the sell signal showing us an earlier price movement.

Weekly volatility /Volatility Measure: Month; Quarter; Year

The volatility measure reflects the average daily fluctuation calculated for the Month / Quarter / Year.

(On April 30, it was built taking into account the time of the article publication)

The volatility is 40 points at the moment, which is half lower than the daily average.

Key levels

Resistance zones: 1,0885*; 1,1000***; 1,1080**; 1,1180; 1,1300; 1,1440; 1,1550; 1,1650*; 1,1720**; 1,1850**; 1,2100

Support zones: 1,0850**; 1,0815*; 1,0775*; 1,0650 (1,0636); 1,0500***; 1,0350**; 1,0000***.

* Periodic level

** Range level

***Psychological level