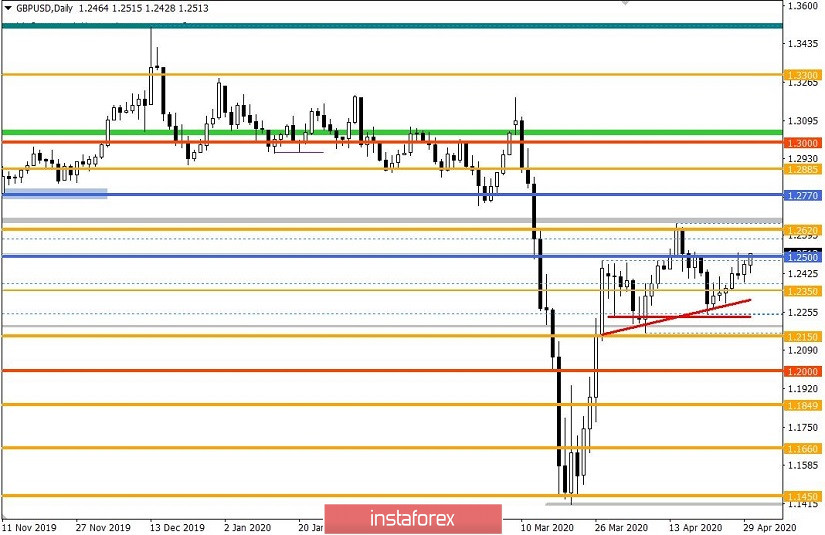

From the point of view of complex analysis, we see an accumulation that signals an upcoming acceleration. The variable fluctuation, after touching the level of 1.2500, led to the formation of a temporary corridor of 1.2400 // 1.2450 // 1.2500, where the quote developed with a slight error. The movement reflected not just a slowdown, but also the so-called accumulation, which can signal the upcoming acceleration in the event of a breakout in the variable boundaries.

The most notable point was the similarities of the oscillation to the slowdown recorded in April 15–20, which also has similar coordinates on the site from March 27 to April 2. This proves that the area of oscillation has a high concentration of trading forces, which strengthens the idea that acceleration will occur at the exit.

Trading also continued forming the "Head and Shoulders" pattern, the outline of which appeared in the daily period. The right shoulder accurately coincides with the left, from which the concentration of trading forces gives hope to a reversal, with all the conditions of the graphical analysis fulfilled.

Regarding further development, market participants consider a bearish mood, referring to trends, recovery, correlations, as well as many macroeconomic factors that, in terms of fundamental analysis, can put pressure on the British currency.

In the minute chart, quotes formed a V-shape formation, as short positions arose at the start of the European session, where quotes managed to reach the variable base of 1.2400, but was returned back by long positions at the start of the American session .

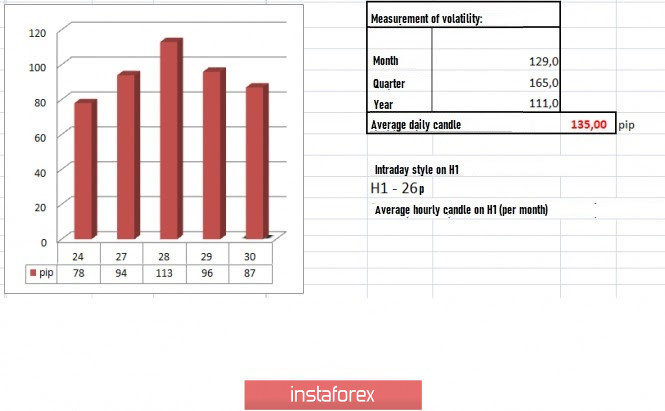

In terms of volatility, the indicator records 96 points, which is considered below the average level, but considering that the quote fluctuates within a conditional corridor, 96 points is already impressive.

Details of volatility: Monday - 165 points; Tuesday - 245 points; Wednesday - 172 points; Thursday - 358 points; Friday - 359 points; Monday - 144 points; Tuesday - 271 points; Wednesday - 676 points; Thursday - 354 points; Friday - 522 points; Monday - 267 points; Tuesday - 296 points; Wednesday - 333 points; Thursday - 452 points; Friday - 352 points; Monday - 148 points; Tuesday - 227 points; Wednesday - 108 points; Thursday - 126 points; Friday - 198 points; Monday - 116 points; Tuesday - 217 points; Wednesday - 131 points; Thursday - 122 points; Friday - 42 points; Monday - 87 points; Tuesday - 146 points; Wednesday - 193 points; Thursday - 119 points; Friday - 114 points; Monday - 86 points; Tuesday - 198 points; Wednesday - 111 points; Thursday - 106 points; Friday - 78 points; Monday - 94 points; Tuesday - 113 points; Wednesday - 96 points.

As discussed in the previous review , traders stubbornly waited for price consolidation below 1.2390, which would signal a change in tact, but in the end obtained a puncture in the shadow. The sale recommendation did not work and the deal was not opened, but the subsequent rebound provoked the opening of long positions, which ultimately brought an impressive profit.

[Purchases were positioned from the value of 1.2445, towards 1.2500]

The same upward turn, which stretches from the base point of 1.1411, is also present in the daily chart.

News yesterday contained preliminary data on the US GDP for the first quarter, where a 4.8% economic downturn was reported. However, indicators do not fully reflect yet the quarantine actions taken due to coronavirus, so GDP data for the second quarter will be even worse.

The market reaction was almost immediate, so dollar weakened locally.

The day ended with the FOMC results, where the regulator left the rates unchanged at 0-0.25%.

In fact, the Fed meeting did not bring the market anything new, and Fed Chairman Jerome Powell noted the same risks of economic decline.

The Fed promised not to touch the interest rates until the economy recovers.

Brexit negotiations also resumed, to which each side already managed to condemn each other and express their opinion. Head of the British Foreign Ministry, Dominic Raab, who supports England's position, said that the transition period has a schedule, which is before the year ends.

"England's position remains unchanged: the transition period will end in December. UK intends to conclude a trade agreement. Extending the negotiation period will only increase uncertainty and strike a blow at business," Raab said.

Today's news will contain weekly data on the US labor market, where 3,680,000 initial applications and 18,900,000 repeated applications for unemployment benefits are expected to come out today.

The recent five weeks reveal initial applications of about 26.5 million, which is an absolute record.

Further development

Traders concentrated within April 28's high, that is, in the region of the 1.2500 level. Attempts to surpass the variable upper bound were conducted, but it all looks like a local jump so far. Thus, fluctuations within the values of 1.2400 / 1.2500 may remain in the event of another rebound.

Local operation tactics also remain relevant, so profit is still ensured, even at the break of April 28's high down.

Movement will be directed sideways at 1.2450-1.2400 in the event of a rebound and price consolidation below 1.2490, but an alternative scenario will form at a price consolidation above 1.2525, in which we can theoretically return the movement upward.

Based on the above information, we derived these trading recommendations:

- Buy positions from the value of 1.2525, towards 1.2550-1.2580.

- Sell positions lower than 1.2490, towards 1.2450-1.2400.

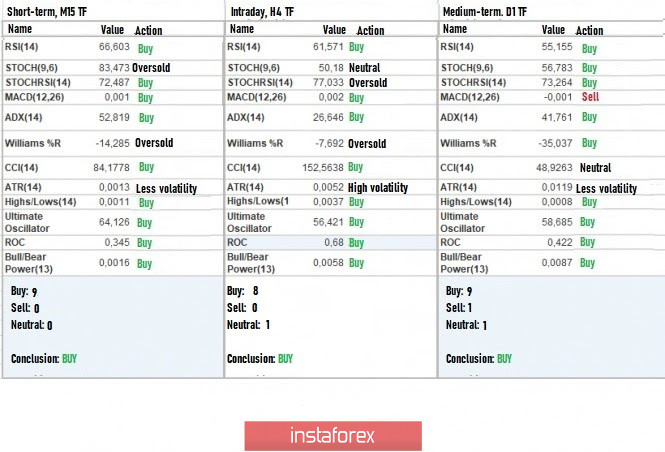

Indicator analysis

Bullish mood persists on all time frames, due to the return of quotes to April 28's highs.

Volatility per week / Measurement of volatility: Month; Quarter year

The volatility measurement reflects the average daily fluctuation, calculated per Month / Quarter / Year.

(April 30 was built, taking into account the time of publication of the article)

Current volatility is 87 points, which is 35% below the daily average. Activity will increase at a break of the variable range of 1.2400 / 1.2500.

Key levels

Resistance Zones: 1.2500; 1.2620; 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support areas: 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1,1000; 1,0800; 1,0500; 1,0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustments