Trade war between China and the US brews again as the US raises threats to China amid the global COVID-19 crisis. Agreements and issues concerning Huawei and purchases of agricultural equipment were already resolved at the end of last year, but for the second time in the last month, Donald Trump expressed his dissatisfaction with how the solution to these problems is proceeding. Yesterday, the US administration said that it is ready to introduce additional duties on goods from China, and the reason for this is the spread of the coronavirus. The US president also said that he may re-impose duties on Chinese goods if Beijing continues to ignore the claims of the US government to compensate for the damage caused by the spread of the coronavirus, the outbreak of which began precisely in China.

The Fed announced its decision to expand its business lending program yesterday, saying that it will reduce the minimum amount of loans from $ 1 million to $ 500,000 to help small businesses. New options for companies with higher debts were also added. Banks will now also issue loans and sell them to the Fed, leaving about 15% of the debt on the balance sheet, against the previous 5%, which reduces the burden of toxic assets, shifting them to the shoulders of banks. However, this do not have positive effects on lending volumes and on approval of applications from companies in need of assistance.

Weak data on US consumer spending weakened the US dollar and also led to a sharp decline in the stock market, as a 7.5% drop was recorded in the March index this year, which was due to the economic paralysis and closure of a number of business across the country that led to massive layoffs of employees. Income also fell by 2% in March, as reported by the US Department of Labor.

Workers' compensation in the US increased in the 1st quarter, but the report does not yet take into account the impact of the coronavirus in the economy. According to the report of the Department of Labor, the index of labor costs in the 1st quarter of 2020 increased by 0.8% compared with the previous quarter, while economists expected growth by 0.7%. Compared to the same period last year, compensation increased by 2.8%.

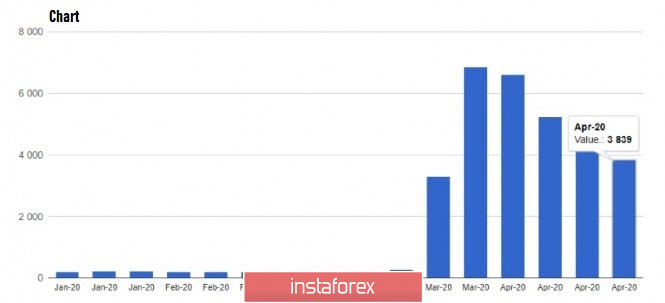

Yesterday, a report on US unemployment was published, which recorded more than 3.8 million new applications from April 19 to April 25. In total, since mid-March, the number of applications has been about 30 million, the reason of which is the massive lay-offs caused by the closing of a number of businesses due to the coronavirus outbreak. However, it is worth noting that compared with the previous week, the number of applications has decreased.

The report on Chicago PMI did not surprise traders, which collapsed in April due to a sharp decline in business activity, caused by the pandemic. According to the data, the index fell to 35.4 points. Values above 50 indicate an increase in economic activity.

As for the current technical picture of the EUR/USD pair, the euro's rally will continue, but it is unclear whether it will be the same as yesterday. Labor Day is celebrated throughout Europe today, so many markets are closed, which will limit the trading volume, as well as the upward potential of the European currency. A break above the resistance of 1.0990 is unlikely, but a test of the psychological level of 1.1000 is a good present for the holders of risky assets. However, if demand declines, attention should be paid to the support at 1.0920 and to the larger level of 1.0890, from where the bulls will try to continue the upward trend, forming a new lower boundary of the upward channel.