Hello, dear colleagues!

For all the events related to the decisions of the world's largest central banks regarding their monetary policy, it was forgotten that yesterday the market closed another month. We will definitely return to the results of April trading, but first let's talk about yesterday's ECB decision and Christine Lagarde's press conference.

As expected, the European Central Bank (ECB) did not change the parameters of its monetary policy and kept the key interest rate at zero. The main attention of market participants was drawn to the speech of the President of the European Central Bank, Christine Lagarde.

According to the head of the ECB, the economic downturn in the Eurozone this year may be from 5 to 12 percent. Naturally, the reason for this is the COVID-19 epidemic and the uncertainty of recovery of economic activity after the end of the pandemic. Due to the negative consequences of the coronavirus, the ECB will continue large-scale lending to companies. The bank is ready to take new measures in the event of a second wave of a new type of coronavirus infection.

Regarding rates, there was a traditional statement that they will remain at the current low values until inflation reaches the target level of 2%. And in the context of the negative impact of COVID-19 on the economy of the region, it is not necessary to expect a tightening of monetary policy. That's probably all. Nothing extraordinary was announced, and this was expected by the vast majority of investors.

Today, the news background for the main currency pair will actually be absent. Except for the Institute for Supply Management (ISM) manufacturing index, which the United States will publish at 15:00 (London time). Thus, it is logical to assume that the last trading day of the week will be determined by the impact of technical factors, as well as the adjustment of positions before the weekend.

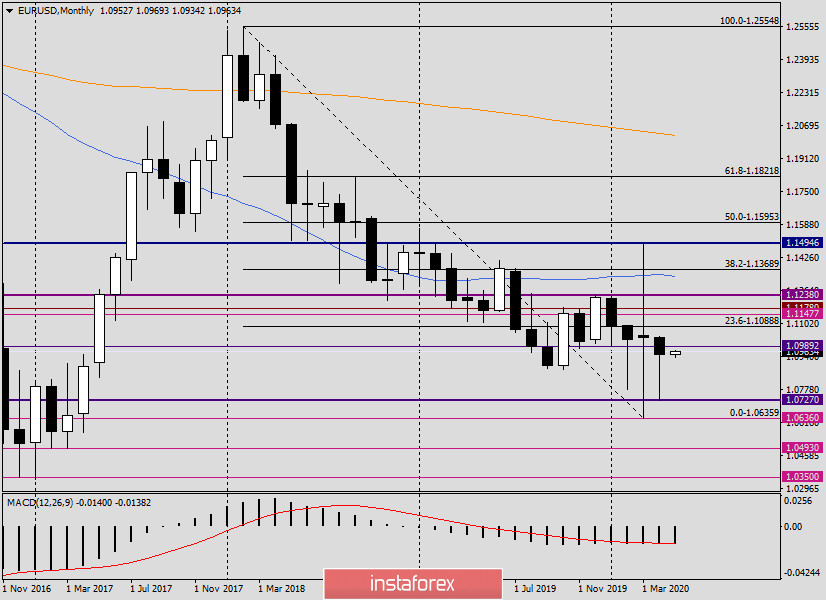

Monthly

After the March candle with huge upper and lower shadows, a candle with a particularly long lower shadow appeared at the end of April trading. The minimum values last month were shown at 1.0727, and the closing price was at 1.0952.

Looking at the last two monthly candles, we can conclude that the market does not want to decline and trade below the important mark of 1.0700. All attempts of the bears to push through this level and gain a foothold under it were not successful. Moreover, during April trading, the pair did not even touch 1.0700.

Since the market does not want to decline, we can assume with a high probability that this month we will see an increase in eur/usd. The most optimal target for the expected strengthening is the price zone of 1.1100-1.1150.

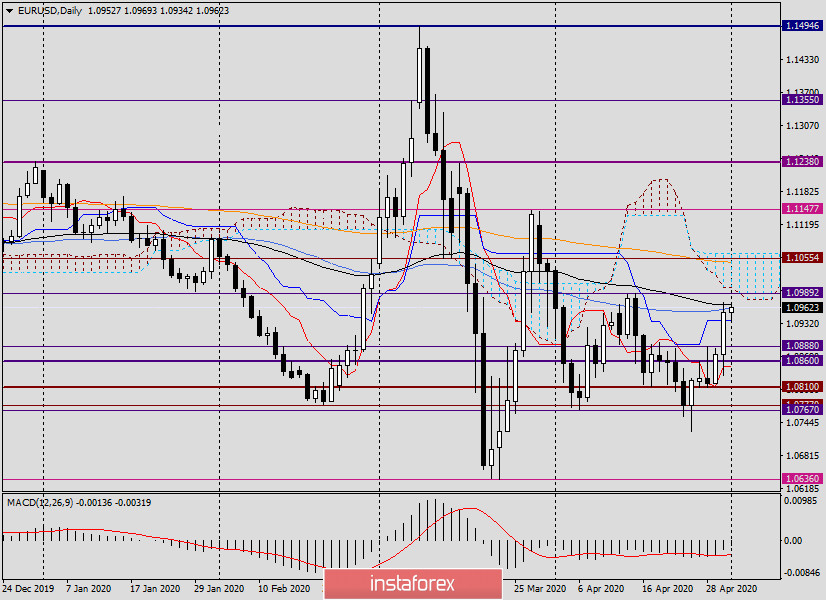

Daily

During yesterday's trading, the main currency pair showed quite good growth, as a result of which the previously indicated goals of 1.0957 and 1.0966 were achieved. These are the levels where the 50 simple and 89 exponential moving averages are located. It was here, as expected, that the quote met strong resistance and the upward movement stopped.

However, it can not be excluded that the euro/dollar will remain positive and today the rise will continue. At least, bulls on the instrument need to go up 50 MA from 89 EMA and close trades higher. Only then will it become clear that the pair is able to continue strengthening to higher prices, but we will talk about this on Monday.

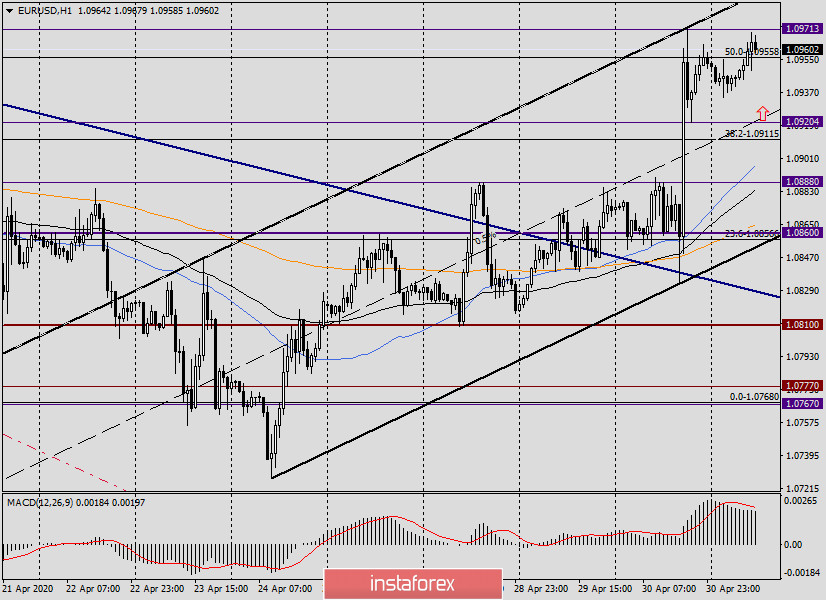

H1

On this chart, the euro/dollar is trading at the top of the ascending channel. If you look closely, you can see the formation of a figure for the continuation of technical analysis "Vympel". Perhaps this model can be characterized as a "Flag". In this case, this is not important, both models are bullish, which means that we should expect the price to continue to rise.

That's just to buy at the peak of the market no special desire. I recommend waiting for the euro/dollar to roll back to the middle (dotted) line of the channel, where the support level of 1.0920 is also located, and then buy eur/usd from there.

If there is no such pullback and the pair continues to grow from the current prices (1.0965), you can try buying at the breakout of the resistance of 1.0971, but with small goals. Do not forget that the important psychological and technical level 1.1000 is already very close.

Good luck with trading!