Technical analysis recommendations for EUR/USD and GBP/USD on May 1

EUR / USD

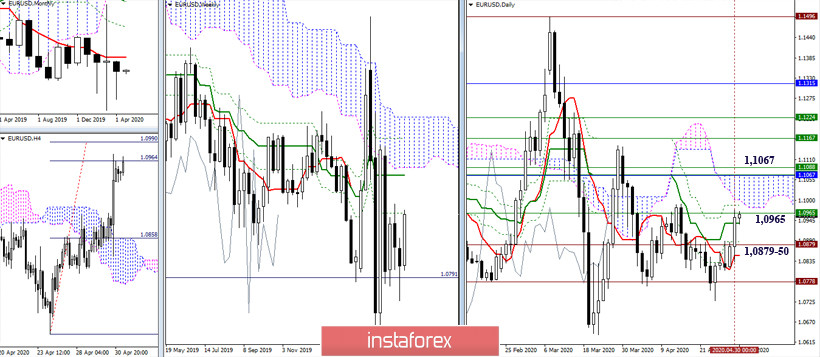

Players on the increase confirmed their advantage. Yesterday, they managed to work out the goal for the breakdown of the H4 cloud according to the first target (1.0964), closed the day above the medium-term trend, tested the resistance of the weekly Fibo Kijun (1.0965) and formed an optimistic lower shadow on the monthly candle in April. Today, they can fill up their achievements with a weekly candle with the most bullish character. As a result of this, new plans will appear, which will include breaking through the daily cloud and defeating the monthly short-term (1.1067), as well as the subsequent struggle to change the weekly cross of Ichimoku and breaking through the resistance of the weekly cloud. The daily medium-term trend passed yesterday (1.0937) can now act as support in the lower halves. On the other hand, a more strengthened support area is located today within 1.0879-50 (historical level + daily Tenkan).

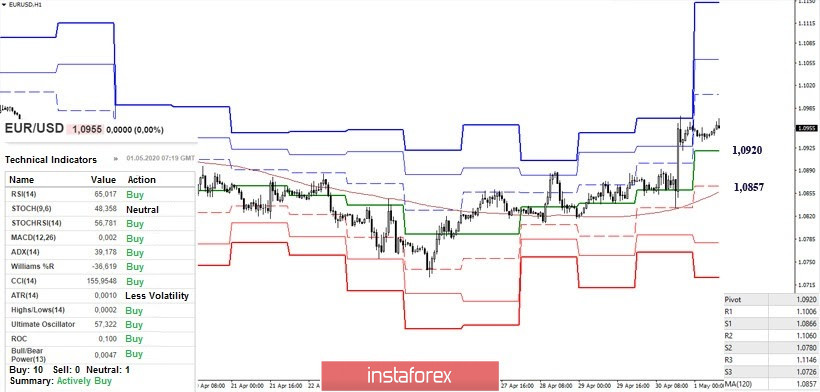

The key support for the lower halves coped with the task again yesterday, while retaining the benefits for the players to increase. The pair continued to rise. At the moment, bullish players retain the advantage and support of all the analyzed technical instruments. The upward guidance within the day in the form of classic Pivot levels is located today at 1.1006 - 1.1060 - 1.1146. The key supports responsible for the balance of power on H1 are now at 1.0920 (Central Pivot level) and 1.0857 (weekly long-term trend).

GBP / USD

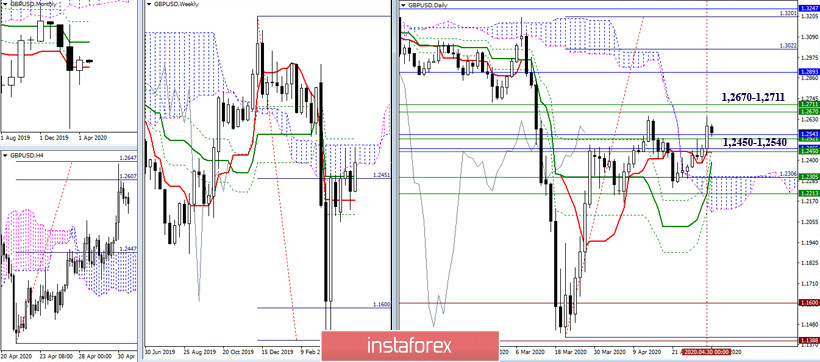

Toward the close of the month, the players to increase managed to cope with several significant resistance at once and closed April with a candle with a bullish character. If it is now possible to maintain a location above the covered zone (1.2450 - 1.2540), which has turned into important support, as well as optimistic to close this week, then the following tasks will appear among the new upward prospects - the breakdown of the weekly cloud and the formation of the upward goal (1.2670), the elimination of the weekly dead cross (1.2711), developing the daily target for the breakdown of the cloud (1.3022 - 1.32201) and testing the subsequent resistance of the monthly half time (1.2893 Kijun + 1.3243 Fibo Kijun).

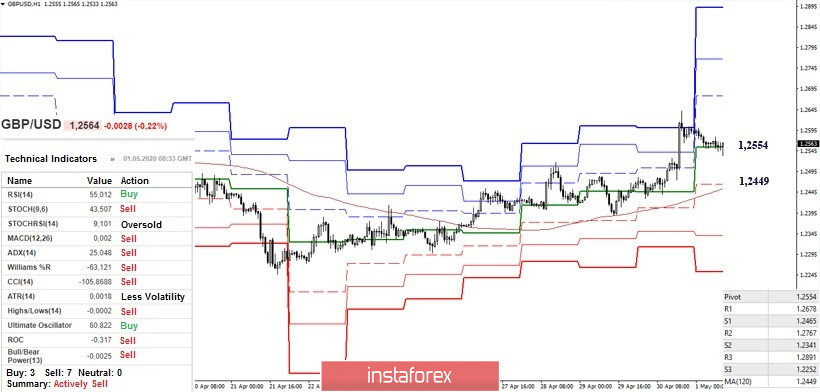

The upward players continued its upward movement after saving the key support of the lower halves yesterday. At the moment, the main advantage is still on the side of the players to increase, but the pair is in the correction zone and is testing the central Pivot level (1.2554) for strength. Loss of support and reliable consolidation below will allow developing a downward correction, the main pivot point of which will be the support of the weekly long-term trend (1.2449). Saving the current support (1.2554) and leaving the correction zone will open the way to the resistance of the classic Pivot levels (1.2678 - 1.2767 - 1.2891).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)