While the global economy has not yet fully realized the depth of its own recession, financial markets are returning to their normal life. If in March, an unprecedented monetary stimulus from the Fed and the ECB's expansion of European QE by €750 billion led to an illogical strengthening of the US dollar and the euro, in April the situation began to fit into the theoretical constructions of fundamental analysis. The Eurozone economy is facing the most serious recession in the history of accounting, and the European Central Bank is not in a hurry to console it, limiting itself to half measures. Why can't EUR/USD grow against this background?

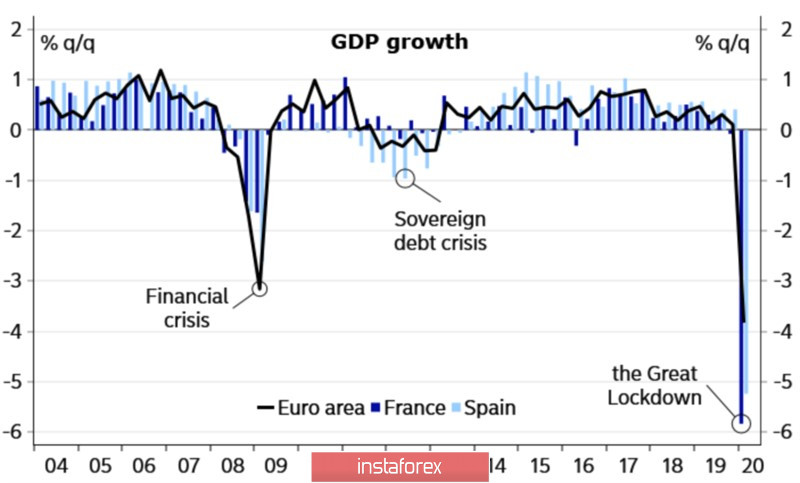

The currency bloc's GDP declined by 3.8% q/q in January-March, with France losing 5.8% and Italy losing 5.2%. The Eurozone faced a pandemic earlier than the US, so the rout of its economy in the first quarter looks logical. But in April-June, because of the quarantine, the situation promises to be awful. There is little doubt about the recession; the question is the depth of the recession.

Dynamics of European GDP

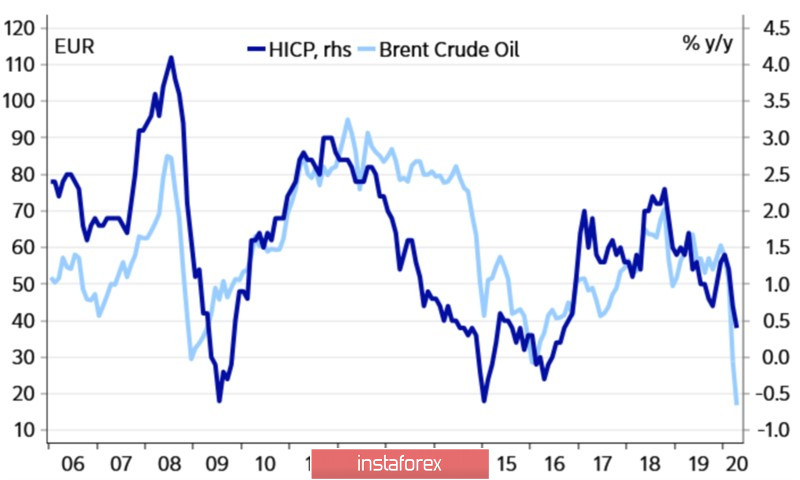

And if the United States has the White House and Congress, which supported GDP with $2.6 trillion in fiscal stimulus, and the Fed, which since the beginning of March has expanded its balance sheet by $2.3 trillion, buying not only treasury and mortgage but also corporate and municipal securities, then what is in the Old World? A modest €500 billion to support pants? EU Finance Ministers can not talk about the creation and distribution of funds for the rescue fund for €1 trillion, and the ECB pulls the cat by the tail, hinting at an increase in the scale of QE, but does not do so. But the Governing Council is faced with an overwhelming task, how to lay straws of inflation diving into the abyss?

Brent and dynamics of European inflation

The euro is growing against the US dollar thanks to the impressive rally of the US stock market, celebrated the best month in the last 33 years, and also due to the rapid growth of the Fed's balance sheet over the balance of the ECB. Is it a joke of $ 2.3 trillion against a little over € 600 billion?

At the same time, you need to understand that the rate of purchases of Treasury and mortgage bonds by the Federal Reserve is falling, expectations of the expansion of European QE, on the contrary, are growing, and stock indices against the background of a weak economy, gloomy corporate reporting and accounting for the monetary stimulus factor in stock prices do not increase indefinitely. Most likely, the S&P 500 will go down. The question is whether it will wait for the release of US labor market data for April or not. Reuters experts predict a rise in the unemployment rate from half-century lows to a historic high of 14% and a reduction in employment by a whopping 20 million!

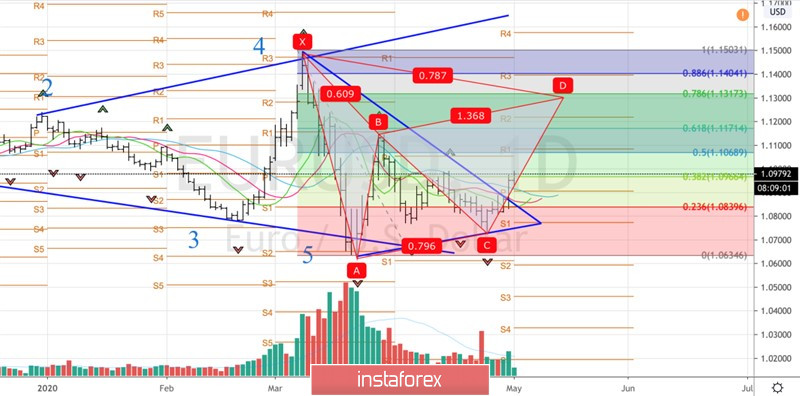

In my opinion, the EUR/USD rally will be short-lived. Technically, there is a high probability of wagering the "Expanding Wedge" pattern, when the rebound from the resistance at 1.107 and 1.117 or a fall below the support at 1.0965 will allow you to form short positions. What to do with longs from 1.09 opened according to the previous recommendation? If the trading day does not close below 1.0965, hold and partially fix the profit at the levels of 1.107 and 1.117, considering the possibility of a reversal.

EUR/USD, the daily chart