The euro-dollar pair shows a corrective decline at the beginning of the trading week, following three days of strong growth. Such dynamics is due to the general growth of the US currency - the dollar index jumped from 99.0 to 99.5 points during the Asian session on Monday, reflecting demand throughout the market. The potential for further growth remains until the EUR/USD pair falls below 1.0880.

Let me remind you that at the end of last week, the dollar lost its position against the backdrop of an unexpected decision by the US central bank - the very day after the April meeting, the Federal Reserve announced the expansion of its lending program for small and medium-sized businesses. In addition, many market participants took profits at the end of the month, and this fact also played against the greenback.

But over the weekend, relations between the United States and China again escalated. The Americans accused China of intentionally concealing the scale of the epidemic. In particular, US Secretary of State Mike Pompeo said that the Chinese Communist Party "did everything possible" so that the world would not know in time about the new coronavirus. In turn, US intelligence claims that Beijing deliberately concealed the scale of the outbreak of coronavirus and the degree of its infectivity in order to stock up on relevant medical supplies. The Chinese Foreign Ministry rejected all the allegations, but the anti-risk sentiment in the market rose again, providing background support for the dollar.

China-US relations will be the focus of the forex market throughout the week. In addition,EUR/USD traders will respond to both US labor market data and the decision of the German constitutional court. The remaining macroeconomic reports are of a secondary nature (for example, the final assessment of the PMI indices for April will be published). Let us dwell on the main events of the current week.

So, tomorrow - May 5 - the Federal Constitutional Court in Karlsruhe (Germany) will announce its decision on the legality of the ECB's asset repurchase program. Here it is necessary to recall that three years ago, back in 2017, German judges already considered a similar complaint about the participation of the Bundesbank in the program of the European Central Bank for the purchase of bonds. The ex-deputy of the German Parliament, together with other euroskeptics, demanded that a private ruling be issued that would oblige the central bank of Germany to immediately cease participation in this program. However, the German constitutional court shifted the responsibility for making this decision to the European Court. In June 2017, they referred the case to the European Court for a preliminary decision. At the same time, the Federal Constitutional Court expressed its opinion by stating that the European regulator, using its program for buying bonds, "finances the budgets of European countries in an unauthorized way".

However, the European Court on December 11, 2018 ruled that the purchase of government bonds and other securities by the ECB did not contradict EU law. True, at the same time, the judges listed a number of requirements and rules that the central bank should adhere to when implementing QE (issuer limit, quality requirements for purchased securities, etc.). But extraordinary circumstances surrounding the coronavirus pandemic forced Christine Lagarde to step back from some of them. This factor increases the risk that a German court may find this program illegitimate, calling into question the participation of the Bundesbank in it. Naturally, such a decision will put strong pressure on the euro, especially considering the dynamics of key macroeconomic indicators. And vice versa - if the judges of the constitutional court take into account the extraordinary circumstances in which the ECB decided, the single currency will jump, and not only against the dollar. In other words, tomorrow's verdict is likely to provoke strong volatility in the EUR/USD pair.

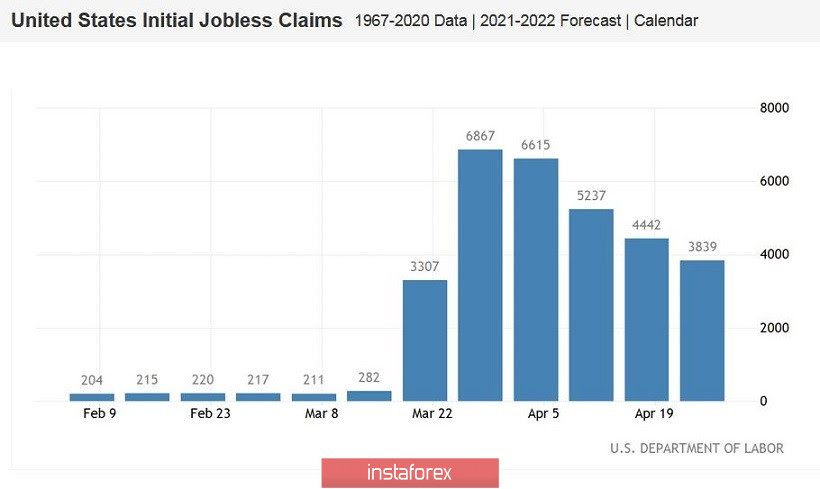

The second, most significant event of the week will be the Nonfarm report. March figures have already reflected the negative impact of coronavirus, but far from fully. But even the previous release came out much worse than the predicted values. So, the number of people employed in the non-agricultural sector in March decreased by 700,000, with a forecast of a decline of 100,000. The number of employed decreased by 713,000 in the private sector, and by 18,000 in the manufacturing sector. The unemployment rate jumped from 3.5% to 4.4%. But it is worth considering that Nonfarm is two weeks behind reports on applications for unemployment benefits. Let me remind you that this indicator initially jumped to three million, and then almost seven, after which it began to show a downward trend. Therefore, the April Nonfarm is likely to reflect the peak of unemployment in the United States. According to preliminary forecasts, the unemployment rate will jump to 16%, and the number of employees will decrease by 210,000. These figures are disastrous, but the market, by and large, is ready for them. If these indicators come out at a forecasted level, the dollar will be under background pressure, but no more. However, if the real numbers do not meet expectations, the volatility of the pair will be much higher (the vector of price movement will depend on which zone the release will be in - red or green).

However, Nonfarm is still far away. US-Chinese relations will set the tone for trading in the coming days. The aggravation of the conflict will allow dollar bulls to show character due to the growth of anti-risk sentiment. Furthermore, tomorrow's decision of the German court will affect the pair's dynamics. From a technical point of view, it is advisable to open short positions when the pair falls below 1.0880 (the middle line of Bollinger Bands, which coincides with the Tenkan-sen line on the daily chart). If the "round" resistance level of 1.1000 is exceeded (the upper line of the Bollinger Bands coincides with the lower border of the Kumo cloud on the same time frame), the bearish scenario will lose its relevance - in this case, it will be possible to open long positions to the 1.1070 level (upper border of the Kumo cloud).