Last Friday, the US president blamed China for the coronavirus pandemic, explaining that the Chinese authorities, with the emergence of a focus of infection in the country at the end of last year, hid it from the world community in every possible way. Of course, this serious accusation caused a drop in global stock markets, increased demand for protective assets, and a rise in the US dollar.

The Americans, as always, began to look for the party who's guilty in their own miscalculations and mistakes in the horrible situation in the country with the COVID-19 pandemic. It naturally turned out to be China. Therefore, shifting their responsibility in hesitation to introduce protective measures, as, for example, Russia, Vietnam, South Korea and a number of other countries did this in the winter, the States received the largest number of deaths and patients from this scourge. And now blaming Beijing for everything, Washington is trying to whitewash itself, creating additional tension between countries that are already not simple.

Washington's attack towards China has raised fears of an escalation of tension between countries, which could lead to more serious problems if America decides to simply rob, and now everything's going to do exactly that. In fact, Beijing is refusing to pay interest on treasuries bought by China, and generally the probability of return of these funds. On the other hand, the states in the person of Trump say they want to receive compensation for losses received from the PRC.

Of course, such prospects scared investors and led to a strengthening of the dollar and a decrease in risk appetite in the markets.

The question arises: will this issue get its development and how will it respond to the markets?

We believe that so far all D. Trump's statements look like a verbal desire to whitewash himself personally on the miscalculation of the need to act energetically at the time the pandemic begins. If this is so and everything will remain only at the level of phrases and words, then the situation will quickly change and everything will return to normal. Investors, in turn, will focus on the prospects for a drug from COVID-19 from Gilead Sciences, which is reported to go on sale this week. In addition, the markets will again take into account in their investment models broad measures of support for the US from the Federal reserve and the US Treasury and the prospects for the end of the pandemic.

We believe that in the event that the topic of China's responsibility does not cross the line, negative sentiment will be weak and in this case, the dollar will be under pressure again. But if this situation develops and the United States actually decides to Rob China and Europe and other countries from the Anglo-Saxon Commonwealth – Canada, Australia and New Zealand-participate in this plundering, we should expect a noticeable deterioration in the risk appetite and an increase in demand for the dollar. However, this strengthening is likely to be temporary, as the world will be increasingly eager to move away from dollar assets and the dollar as such, as a safe haven asset. In this case, we expect an increase in demand for the euro, yen, pound and Swiss franc, as some alternatives to the US currency.

Forecast of the day:

The EUR/USD pair is correcting down on a wave of falling demand for risky assets. The pair may turn up after decline to 1.0905, if this level holds. At the same time, rising above the level of 1.0940 will lead to restoration of growth to the level of 1.1000.

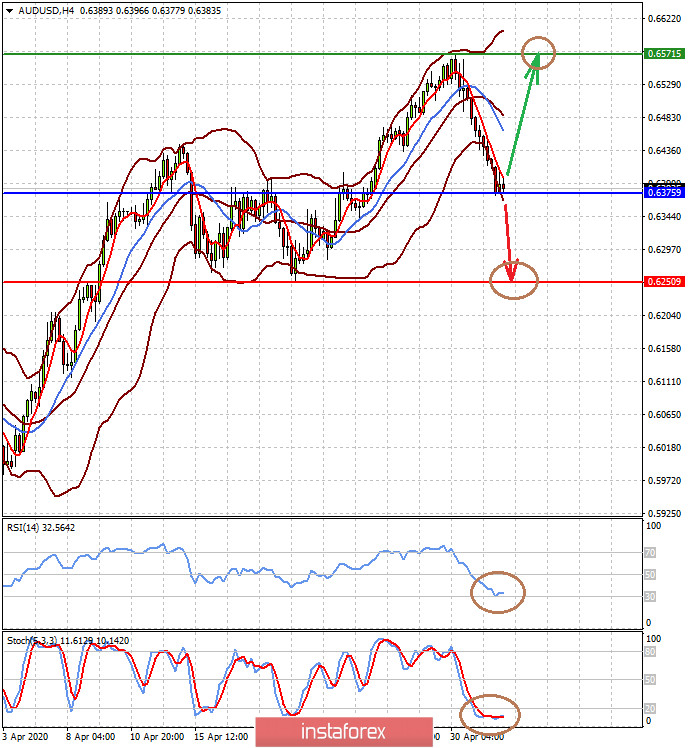

The AUD/USD pair is under pressure in the wake of claims to China. If the tense situation persists and the pair drops below the level of 0.6375, it will continue to fall to 0.6250. At the same time, a decline in tension can lead to a reversal of the pair up and growth to 0.6570.