The European currency is currently weakening against the US dollar. Weak macroeconomic reports further justifies the ECB's fears that the Eurozone GDP will dip from 5% to 12% in 2020, which discourages traders from trading risky assets. Slowdown in the global economy is also recorded, and a further decline is projected. Nevertheless, the ECB expects the Eurozone GDP to grow from 4% to 6% in 2021, but will remain much lower than 2019's level. Today, the European Commission will publish a report, the content of which will include prospects and forecasts of economists.

Last Friday, US Secretary of State, Mike Pompeo, accused China of hiding the situation with the coronavirus intentionally. Pompeo firmly claims that he could confirm the fact that the Chinese Communist Party did everything to hide the outbreak of COVID-19 in Wuhan, and said that the US demands financial compensation. Similar statements were made by the US about the death of North Korean President Kim Jong-un, which turned out to be untrue.

The business lending program in the US has begun to operate. According to the report of the Department of Finance, late last week, small and micro businesses received more than 2.2 million loans worth $175 billion, with an average loan size of about $ 80,000. The first lending program, which totaled $ 500 billion, was directed more to large companies, and issued about 3.8 million loans. Another business assistance program by the Fed is anticipated to be approved soon.

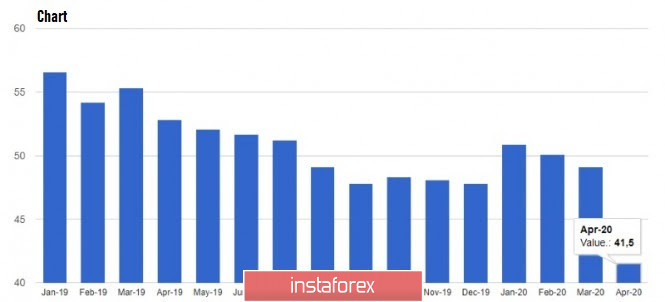

The report released by the ISM on Friday showed that the decline of activity in the US manufacturing sector due to quarantine measures was better than economists had predicted. According to the data, the PMI for the US manufacturing sector fell to 41.5 points in April 2020, better than the forecasted 35 points. An index value below 50 indicates a decrease in activity. Many ISM economists expect a bottom to form soon, followed by a powerful recovery push, the scale of which will take place the same time the quarantine measures are completely lifted in the US and the economy begins to recover.

Meanwhile, IHS Markit, thinks otherwise. Its report stated that a more than rapid drop in orders, as well as the destruction of logical chains, will lead to a further reduction in the index, so it is not correct to expect a quick recovery in production activity right after the pandemic leaves. The company recorded a decline of 36.1 points in April, against 48.5 points in March.

Fed members made statements about a rapid economic recovery after the pandemic recedes, but Dallas Fed President Robert Kaplan surprised everyone with his claims that the Fed's actions, for the most part, only mitigated economic damage, rather than stimulate GDP growth, so fiscal stimulus measures need to be increased. In addition, he forecasts that unemployment rate in the US will reach 20%, and by the end of 2020, it will be 8-10%. 2nd quarter GDP will lose more than 30% per annum, and over the year, it will decrease from 4.5% to 5.0%. As for inflation, its deceleration is the main risk for the price's growth over the next few years, so a change in the interest rates over the next few years should not be expected. Rates will most likely remain low for a longer period, as the Fed will have to make more efforts to restore the US economy.

Data on Friday indicating a growth in US construction spending were disregarded by traders, since the index in March was not yet affected by the pandemic. According to the report, construction costs increased by 0.9% in March and amounted to $1.381 trillion, much better than economists forecast of a 3.2% decline. Compared to the same period in 2019, construction costs increased by 4.7%.

As for the technical picture of the EUR/USD pair, Friday's test of the psychological level of 1.10 caused large profit taking on long positions, which resulted in sell-offs today in the Asian session. Purchase risky assets only after a correction to the support of 1.0890, or from a larger low of 1.0840. Bulls will try to pull the market today at the resistance of 1.0980, but from there, large sellers will place new active sales of the euro.

GBP/USD

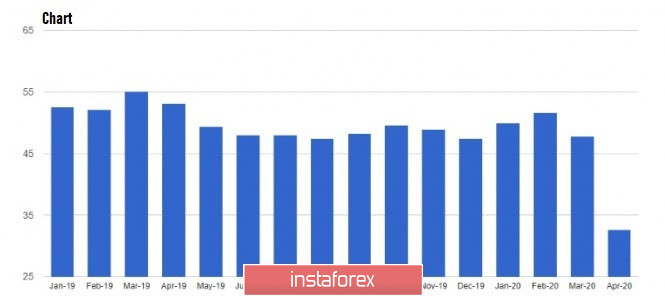

The British pound continues to slide down against the US dollar. Data on the collapse of manufacturing activity in the UK in April this year clearly did not add optimism to pound buyers last Friday.

According to the report, the PMI for the UK manufacturing sector fell to 36.6 points in April, slightly better than economists' forecast of 32.7 points. However, a value below 50 indicates a decrease in activity.

This week anticipates the Bank of England meeting, where the regulator may extend the bond purchase program, at least until July of this year. Many traders also expect the bank to give a first assessment on the economic impact of the pandemic, which may put pressure on the pound, which is now gradually moving into a new bearish phase. Weakening expectations regarding economic growth and inflation could increase pressure on the GBP/USD pair in the short term. The results of the BoE meeting will be published on May 7.

As for the technical picture of the GBP/USD pair, the further direction of the pair depends on the support of 1.2400, a break of which will quickly return the pound to the lows of 1.23300 and 1.2250. Growth will again be limited by the 1.2510 and 1.2570 resistances, which did not allow the bulls to continue rising the pair at the end of last week.