The market opened neutrally on Monday relative to Friday's closing, however, the Asian session gradually went into the red zone. The slowdown in the rate of spread of coronavirus was not strong enough to expand markets to increase.

To assess the prospects of a particular currency in the global currency market, it is necessary to evaluate the key factors affecting supply and demand. These factors have been known for so long - the state of the US economy, as the largest global economy, to which the monetary incentives of the Fed are attached, supplies dollar liquidity to world markets. Oil prices as an indicator of global demand. Inflationary expectations and the state of the labor market as an indicator of consumer demand.

In any of these parameters, not only that no positive changes are observed today, but also, forecasts are entirely negative. This means that the demand for risk will be under pressure for quite some time.

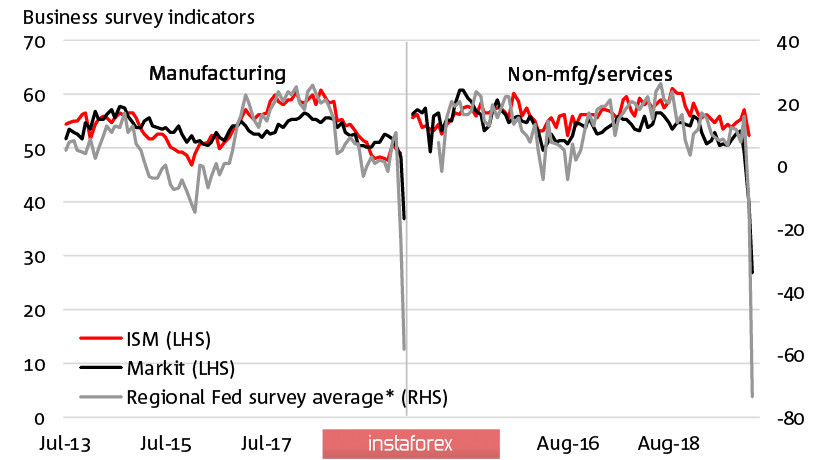

The US economy is preparing for a prolonged decline. The ISM index of business activity in the manufacturing sector fell in April to 41.5p, the employment index fell from 43.8p to 27.5p. And perhaps, the employment report on Friday may show an unprecedented decline in the entire history of observations.

The Fed's position does not look convincing. Powell at a press conference following a meeting of the Fed last week said that the Fed is considering several scenarios for the development of the situation, but it is not clear when the economic recovery will begin. The size of asset purchases is reduced to 8 billion per week, and it is not yet clear how the decline in purchases correlates with the needs of the government in financing the budget, if the appetite of the Ministry of Finance remains the same, then another liquidity crisis awaits the markets.

Oil cannot also be an impulse of growth in the near future. According to the Baker Hughes report, the number of drilling rigs in the United States fell to the lows of 2016, oil production in the United States fell by another 100 thousand barrels. Last week, everything indicates that another wave of panic is possible in the oil market in May.

As for inflation and wages, their dynamics is slightly behind economic indicators, which sharply increases the chances of inflation reduction in the 2nd quarter. The US economy will not be able to get any support from this side.

Therefore, despite the fact that the situation with the coronavirus, according to cautious estimates, has started to improve, the markets will not be able to take advantage of this positive news to start a recovery. The current demand for commodity currencies, such as AUD or CAD, is corrective, and the pendulum will swing again towards protective assets in May.

The CFTC Friday report confirms these findings - large speculators continue to build up long positions in protective currencies. The consolidated position on the yen increased to 32326 contracts for 763 million, on the franc growth from 4,924 to 5,576 contracts, the counter movement is observed for oil and gold - oil demand is falling, gold is growing.

Everything indicates that the second wave of panic is approaching.

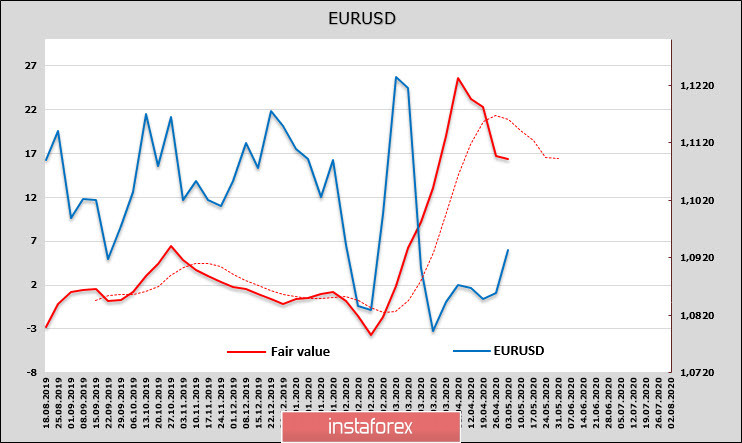

EUR/USD

The probability of a change in the policy of the ECB, as it became clear after the meeting on Thursday, is minimal at the current stage, and the euro does not have an explicit internal impulse. The CFTC report showed a decline in the total long position to $ 10.77 billion, but the predominance of the bulls is still very significant. The estimated fair price is much higher than the spot price. This is a bullish factor, but its dynamics has become negative, which means that the growth factor is slowly disappearing.

The key zone for EUR/USD is at 1.0910/40, if the euro does not stay at current levels, then selling can be considered if it falls below the level of 1.0910 with the target at 1.0830, as the probability of a deeper correction will increase. If the support holds, then an attempt to update the maximum of 1.1017 will become very likely. The goal is 1.1140.

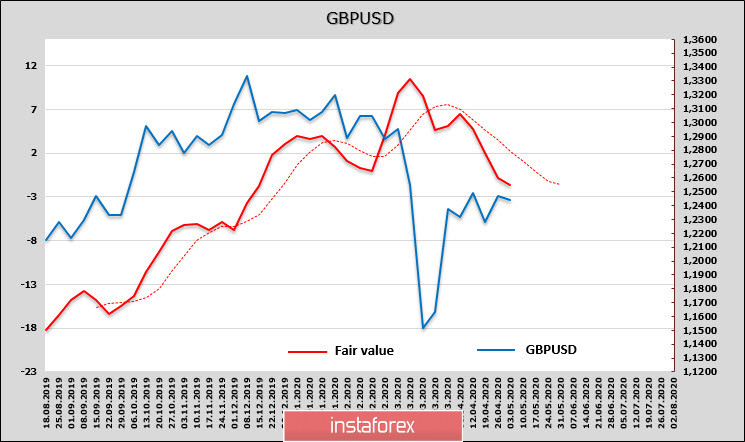

GBP/USD

The pound was the most affected currency last week. According to the CFTC report, a short position rose to 0.519 billion, the trend is negative, and a decline in the estimated price is likely to affect the decline in demand for the pound on the spot.

A double top at 1.2650 strengthens bearish sentiment, GBP/USD will target the zone of 1.2300/20, and short-term upward fluctuations will be blocked by stronger sales.