Technical analysis recommendations for EUR/USD and GBP/USD on May 4

Economic calendar (Universal time)

There are no important events in the current economic calendar.

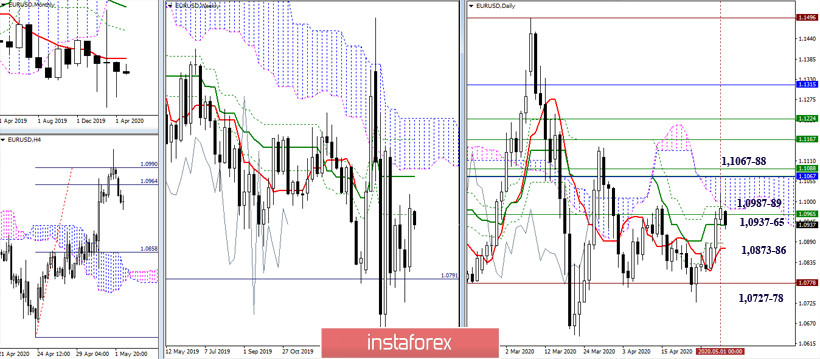

EUR / USD

After a very optimistic closing of the month, the players to increase managed to close the week just as well. If players to decline will not be able to level all the achievements of the opponent in the near future, then players to rise will be able to continue strengthening their moods. The nearest resistance can now be noted at 1.0987-89 (daily Fibo Kijun + Senkou Span A), but the most important zone, which allows players to open up new target ranges and prospects, is located at 1.1067 - 88. Breaking through this zone will allow us to enter the bull zone of the relative daily cloud and form a daily upward target, as well as enlist the support of a weekly medium term and a monthly short-term. The breakdown of support will be able to restore positions and help players to lower, which in this situation are at 1.0937-65 (daily Kijun + weekly Fibo Kijun) - 1.0886-73 (daily Tenkan + Fibo Kijun) - 1.0727-78 (minimum extreme + historical level).

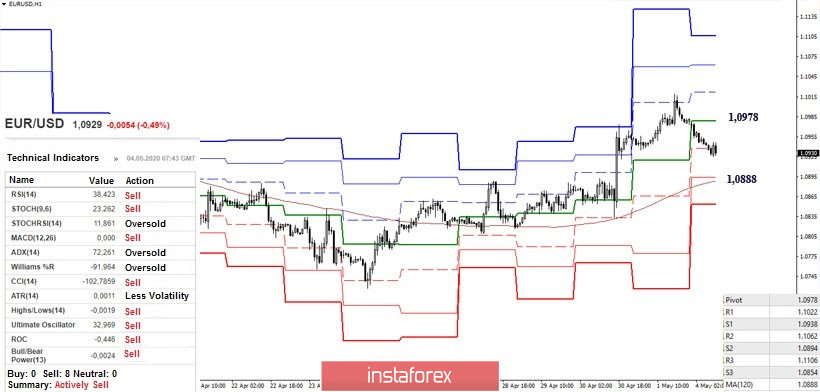

On H1, the pair is in the deep correction zone. Analyzed technical indicators were rebuilt to support the players to decline who left behind the central pivot level and are striving for a weekly long-term trend (1.0888). It is currently being tested for strength S1 (1.0938). As a result, the main task for players to decline in the lower halves is to break through the weekly long-term trend (1.0888), and for players to increase, restoration to the level of the central pivot level (1.0978) and consolidation above it can be important.

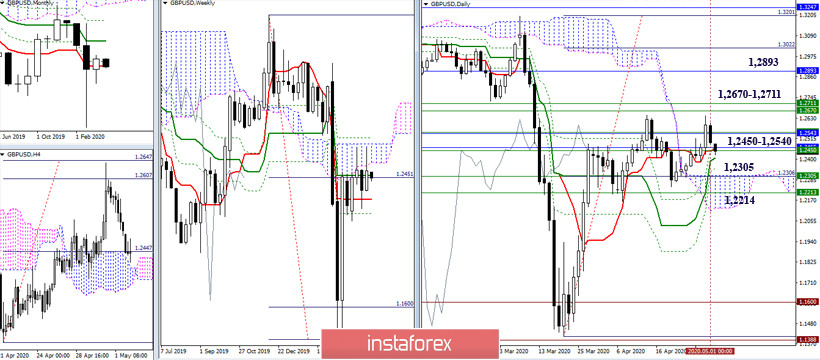

GBP / USD

The promoting players failed to maintain optimism during last week's closing. The passed zone and its attractions were too strong. As a result, we are currently performing a retest. If the players on the increase manage to keep 1.2450 - 1.2540 and gain a foothold above, then new ranges will open: 1.2670 - 1.2711 (the upper boundary of the weekly cloud + the final limit of the weekly dead cross) - 1.2893 (the monthly medium-term trend). The consolidation below 1.2450-1.2540 will return the pair to the daily cloud (1.2305), which is strengthened by the weekly Tenkan (1.2305) and Fibo Kijun (1.2214). The loss of voiced support will cancel the bullish prospects and return opportunities to strengthen the bearish sentiment.

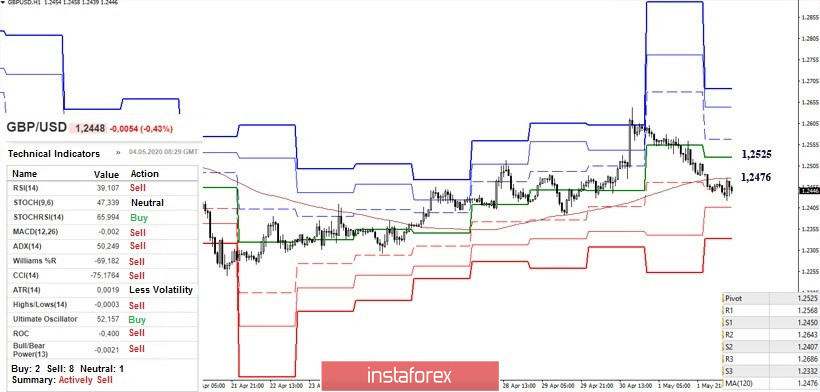

The bears almost took control of the situation in the lower halves. InIf the decline continues within the day, support can be provided by S2 (1.2407) and S3 (1.2332). The zone of change in the current balance of power is located fairly close to 1.2476 – 1.2525 (Central Pivot level + weekly long-term trend). Now, consolidating above will most likely lead to a new test of 1.2540, which will help restore bullish activity and prospects not only in the lower time intervals, but also in the upper ones.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)