Dear traders, good day!

Following the results of trading on April 27-May 1, the pound/dollar currency pair strengthened, ending the week at 1.2488. However, questions remain about the future price direction of this currency pair.

First, the last weekly candle has a rather impressive upper shadow. Secondly, having shown the highs of the previous week's trading at 1.2641, the pair not only failed to stay close to the reached values but significantly rolled back, ending the trading under the most important psychological level of 1.2500.

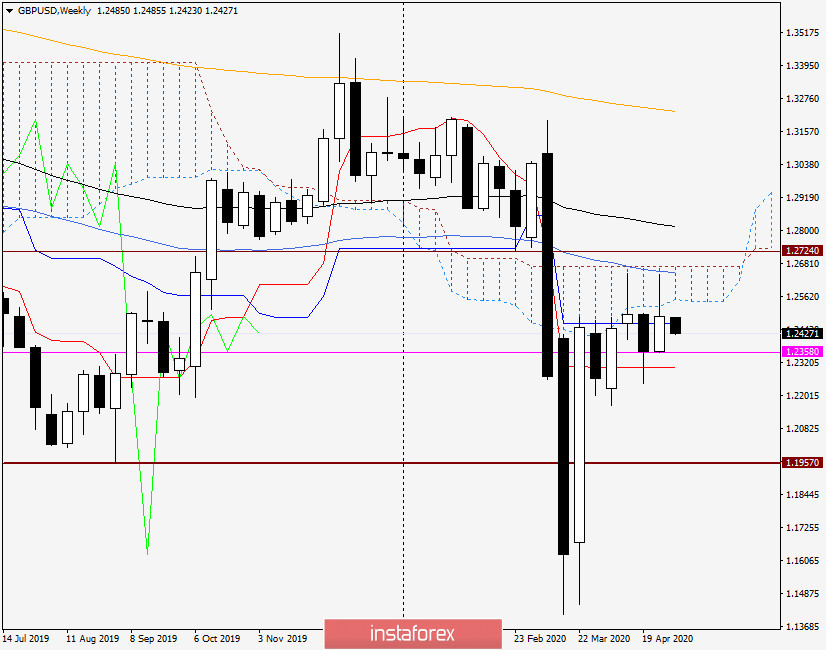

Weekly

Despite the fact that the last five-day trading ended above the Kijun line of the Ichimoku indicator, attempts to break through the 50 simple moving average and go up from the cloud were doomed to failure. From a technical point of view, this is the main uncertainty regarding the subsequent decline of the British currency. I believe that both scenarios should be considered in this situation.

To confirm the seriousness of the players' intentions to increase, they need to raise the rate to the previous maximum values of 1.2641, breakthrough 50 MA, withdraw the price from the Ichimoku cloud and end the current week higher. I would like to note that this task is not at all easy, and to achieve it, a number of factors must coincide. Naturally, in favor of the British pound.

On the other hand, the GBP/USD bears also need to make every effort to take control of the pair's trading. Downside players need not only to rewrite the previous lows at 1.2385 but also to close the week under the Tenkan line, which runs at 1.2305. In general, the bearish scenario will take on subsequent and quite real outlines, in the case of closing trades on May 4-8 under the important and significant level of 1.2300.

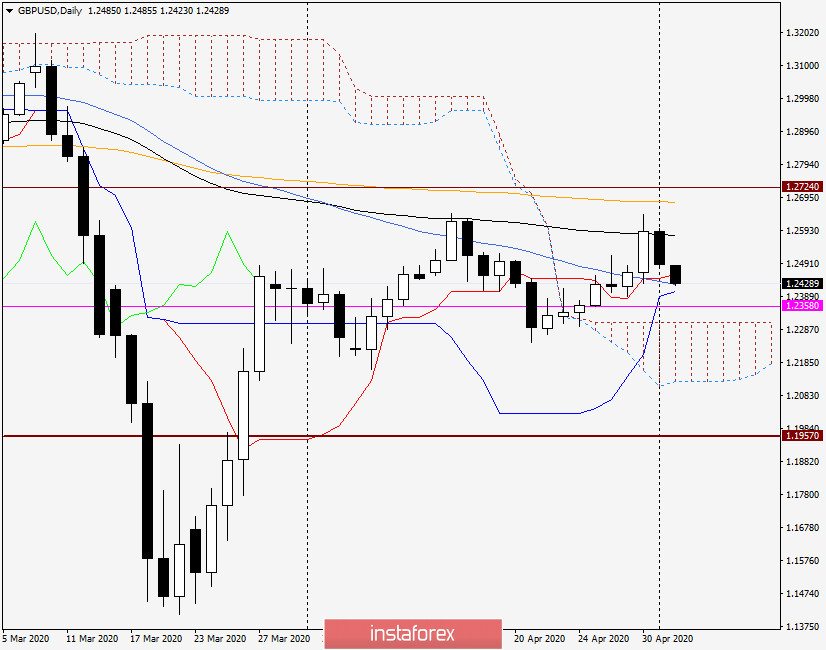

Daily

The true breakdown of the 89 exponential moving average never took place. After closing the candle for April 30 over this moving average, the next day the pair declined and ended the session at 89 EMA.

At the moment of writing, the pound is trading with a slight decrease and pushes the Tenkan line from 50 MA. If we take into account that the Kijun passes at 1.2405, the current support zone can be designated as 1.2457-1.2405. Overcoming the strong mark of 1.2400, with fixing below, will open the way to the area of 1.2310-1.2300, where the upper border of the daily Ichimoku cloud passes.

When considering the ascending scenario, buyers will again focus on the 89 exponential, which is located at 1.2577. But even after overcoming the 89 EMA, all the tasks of the bulls for the pair will not be considered solved. Above, in the area of 1.2641-1.2677, there are the maximum values of April 30 and 200 exponential moving average. I believe that only the breakdown of the level of 1.2641 and the overcoming of the 200 EMA will indicate the further ability of the pair to move in the north direction.

Conclusion and trading recommendations for GBP/USD:

Since the technical picture on the weekly and daily charts is far from unambiguous, we can assume both scenarios. The nearest purchases can be considered from the current support area of 1.2457-1.2405. An additional signal for such positioning will be bullish candle analysis models that will appear on the daily, 4-hour, and hourly charts. Purchases at lower and more favorable prices will be relevant after the pair falls to the area of 1.2310. However, even here it is better to see confirmation signals.

Sales are better considered after the appearance of bearish candle patterns after rising to the price area of 1.2485-1.2525.

Good luck!