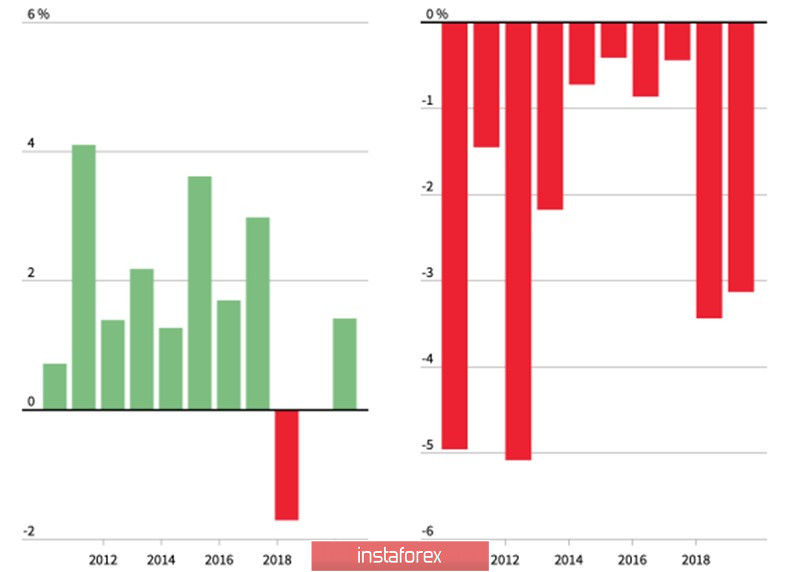

The tax period, the repatriation of capital to the homeland, and the inflow of dividends from investments in foreign assets allowed the British pound to grow in April for two decades where only 2004 and 2018 became an exception. On one hand, May is not traditionally set for sterling. Every year since 2010, GBP / USD quotes for the last month of spring closed in the red zone, while the average loss of the pound was 2.3%. Will the bears play into the hands of the seasonal factor in 2020?

British pound dynamics in April and May:

The success of sterling in April seems logical. Amid large-scale fiscal and monetary incentives, as well as hopes of opening the world's leading economies after quarantine, and the best rally of US stock indices for the GBP / USD pair over the past 33 years, the path to an upward trend was opened . The correlation of the pound with global risk appetite has increased significantly, while the growth of the pound has become a kind of tailwind for the bulls in the analyzed pair.

In May, the picture may radically change. The horrific corporate reporting and macro statistics added the risks of escalating the US-China trade conflict after Donald Trump accused Beijing of the laboratory origin of coronavirus and threatened with new duties. The main test for the S&P 500 and GBP / USD buyers will be the release of data on the American labor market. According to the consensus forecasts of the Wall Street Journal experts, the unemployment rate will reach a new historical maximum of 16.1%, and employment will decrease by 22 million, which is significantly more than the previous record of slightly less than 2 million that took place in 1945. A blow from statistics can trigger a wave sales in the US stock market and cause serious damage to sterling.

GBP / USD and S&P 500 dynamics:

The increased attention to the pound during the first week of May was also caused by the presence of the Bank of England meeting in the economic calendar. In March, Andrew Bailey and his colleagues launched the British QE for £ 200 billion and have since bought up bonds for £ 70 billion. If you continue at the same pace, then by June the supply of resources will run out. BoE faces a dilemma of either being proactive by announcing the expansion of the program at the next meeting of the Monetary Policy Committee, or wait until the debt yields increase, and then put all their efforts into reducing it. If the choice falls on the first option, this will be an unpleasant surprise for the bulls of GBP / USD.

I will not forget about the question hanging in the air on Brexit. Britain insists that the EU treats it as a sovereign state. It must exercise full control over coastal waters, like Norway, and cannot accept a number of European restrictions in the field of environmental and labor legislation, as well as state aid. A deadline of 8 months before a complete break creates additional pressure on the pound. In case of a successful support test at 1.235 and 1.229, traders will have a great opportunity to form shorts at GBP / USD.

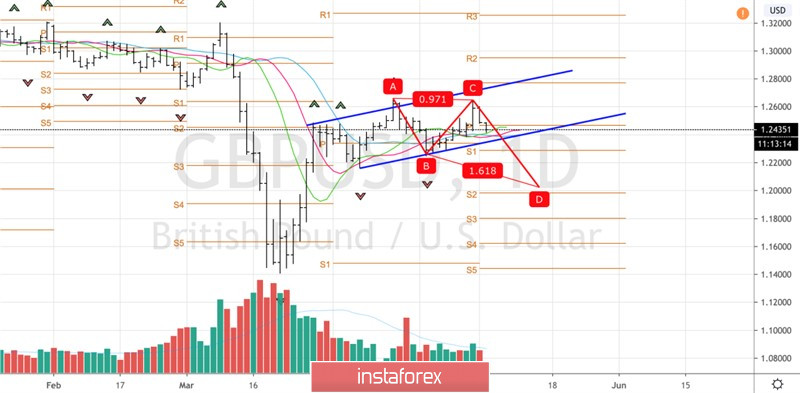

Technically, the quotes of the pair beyond the limits of the upward trading channel will increase the risks of implementing the AB = CD pattern with a target of 161.8%.

GBP / USD daily chart: