The final data on activity in the manufacturing sector of the Eurozone confirmed the complexity of the situation in which the economy is located. Due to the coronavirus pandemic, production fell in all countries at once, but Italy was most unlucky, were due to strict restrictive measures, production fell much more than in neighboring countries.

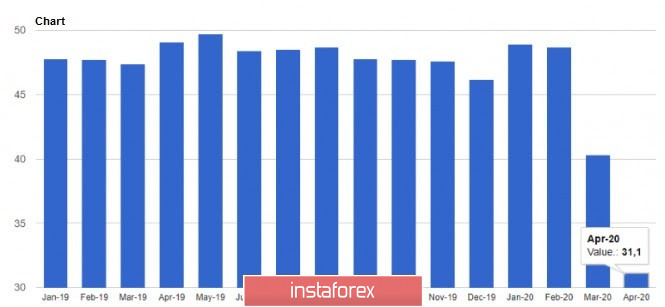

According to a report by Markit, the purchasing managers' index (PMI) for the Italian manufacturing sector in April this year fell to 31.1 points, while in March it was at the level of 40.3 points. Economists had forecast a decline to a level of 30.0 points. France is not far from Italy, where the purchasing managers' index for the manufacturing sector in April was 31.5 points against 43.2 points in March, with the forecast of economists of 31.5 points.

As for the Italian economy, today a report has been published at Citi Bank, according to which, with the current fiscal stimulus measures that the authorities promise to direct to mitigate the effects of the coronavirus pandemic, the growth of public debt in relation to GDP this year will increase immediately by 20 %, which will necessarily lead to the risk of lowering the credit rating, which was recently discussed in the world rating agencies S&P and Fitch. Therefore, it is not surprising that Italy is one of the first to advocate the introduction of nationwide bonds, which will lead to the generalization of the Eurozone's debt, allowing to shift its debt burden to the stronger northern EU countries.

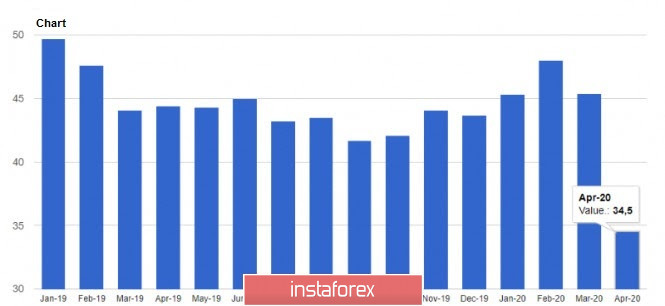

Activity declined the least in Germany, which is still trying to counteract the economic downturn on its own against the background of the coronavirus pandemic. According to the report, the purchasing managers' index (PMI) for Germany's manufacturing sector fell to 34.5 points in April from 45.4 points in March, with a forecast of 34.4 points. A sharp reduction in orders, disruption in logistics chains, as well as layoffs of employees of many manufacturing companies negatively affected activity in general, and it is still very early to say that the indicator has reached its bottom. Most likely, May will also be without much improvement, as the authorities are not in a hurry to cancel the quarantine measures and remove the restrictions imposed.

For the Eurozone, the purchasing managers' index (PMI) for manufacturing also fell significantly, to 33.4 points in April from 44.5 points in March. Given that the data almost coincided with the preliminary indicators, this did not put much pressure on the European currency, but it was also not possible to return the demand for risky assets after the Asian market fall.

Today, many traders focused on the report of the European Central Bank, whose analysts sharply lowered their forecasts for inflation and economic growth in the Eurozone in 2020. It is expected that inflation in the Eurozone in 2020 will be at the level of 0.4% against the January forecast of 1.2%. In 2021, the indicator is projected to gradually recover to the level of 1.2% and to 1.4% in 2022. As for real GDP, it forecasts a reduction of 5.5% against the January forecast of 1.1% growth. But by 2021, the increase will be more than 4.3%.

As for the technical picture of the EURUSD pair, it remained unchanged. Given that there is no activity on the part of buyers of risky assets, as well as no growth in the resistance area of 1.0980, which was expected in the European session, it is likely that the pressure on the euro will continue. At the moment, it is best to consider buying risky assets only after a correction to the support of 1.0890 or from a larger minimum of 1.0840.