Boeing already had a terrible year in 2019, when it suffered a loss of $ 3.4 billion. In 2020, the conditions are much worse, as the global quarantine not only led to a lack of demand for flights, but also reduced the demand for new aircraft.

The dreadful report on Boeing's first quarter earnings is not surprising, and most airline executives agree that it will take a long time to restore demand for air travel. Thus, Boeing's pain may continue for many years.

Shipments from Boeing also slowed again last quarter, with the company delivering a total of 50 commercial aircraft, most of which are 787 Dreamliners. As a result, the commercial aircraft segment reported a loss of $ 2.1 billion, including a $ 336 million repair fee for the low-quality component of older 737 aircraft.

Defense business also recorded loss last quarter due to the hectic KC-46 military tanker program, with the only positive side being the service sector bringing operating profit of about $ 708 million (an 8% increase in year on year), and revenue of about $ 4.6 billion. Net loss was about $ 1.7 billion.

Investors continue to be increasingly concerned about Boeing's cash flow, especially since Boeing's loss last quarter was about $ 4.7 billion, much more than its annual profit in 2019, and is likely to continue doing so throughout 2020. This may cause Boeing to increase its loans, despite the company ending the first quarter with debt of about $ 38.9 billion, and cash and investment of about $ 15.5 billion.

Boeing management acknowledges that it will take time to return to normal, especially for the wide-body aircraft that serve long-distance international flights. Thus, by 2022, the company will cut the production of 787 in half (from 14 per month to 7 per month), and next year, it will reduce the production of the 777 family from 5 per month to 3 per month. This will hopefully help keep the company afloat and not go down to zero.

Boeing also announced earlier its plans to cut the production of the 787 Dreamliner to 10 per month by early 2021, but intends to increase production again by 2023.

Production of the 737 MAX will also be slower than previously planned, thus, by the end of 2021, production will be about 31 per month, which was previously planned to be 57 per month.

Boeing is doing everything possible to cut costs, but a sharp decline in production will put pressure on profitability and lead to lesser cash flow than the $ 13.6 billion that the company received in 2018.

Since demand continues to plummet, airlines are desperately reducing production and cutting costs, especially on the commercial side of the Boeing service division.

By the end of this year, Boeing is likely to have at least $ 35 billion net debt, and a retirement deficit of about $ 20 billion. Management expects to gain profit next year, but this is only due to a one-time tailwind delivery of many 737 MAX aircraft assembled last year, which is currently in storage.

Boeing knows that it needs to strengthen its balance sheet by paying off the debt it took last year, but cash flow may remain weak for a longer period of about five years or more. Until then, company dividends and share buybacks will be suspended.

Because of the current situation, weaker airlines are bound to fail, and carriers that rapidly grew by offering low fares may be forced to cut back, which may affect aircraft demand after 2025.

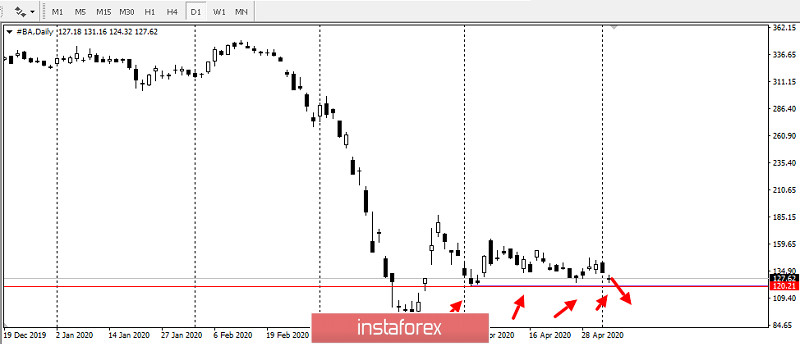

Technical analysis shows that pressure persists on the price level of $ 120 per share.