The US dollar rallied amid the brewing trade war between the US and China. Issues relating to the coronavirus, as well as the accusations against the Chinese Communist Party, justified the decision of traders to adhere to safe assets. US Treasury Secretary Steven Mnuchin tried to calm the markets yesterday, saying that China did not intend to deviate from the terms of the deal. Donald Trump and some US officials claim that they do not intend to punish China economically, as long as Beijing complies with the obligations of the trade agreement. But if China refuses to fulfill its obligations, then very significant consequences will be made. Trump already voiced the possibility of returning trade duties on the part of the US at the beginning of last week, but steps have not been made yet.

The German court will rule today on the legality of the ECB's bond purchase program, as the regulator has already gone beyond the framework established by the European Court back in 2018, which led to fierce disputes and the refusal of Germany to participate in the program to stimulate the European economy. The Constitutional Office of Germany will decide whether the program is in accordance and applicable to German law or not, the result of which will point to a rally or collapse of the euro against the dollar. A decision not favoring the European regulator will put serious pressure on the euro, since this will further create disagreements and increase the split within the ECB. Germany may also be followed by other countries that do not intend to save the economies of their neighbors.

The euro also faces the problem of Italy's credit rating dipping to a "junk" level, which will lead to a sharp increase in bond yields, as many investors will begin to get rid of them. Judging by the government's plan, the high level of public debt in the country will only increase, which will further put pressure on investors and the credit rating, and widen the gap of bond yields with more stable European countries.

Moody's forecast yesterday expects the US unemployment rate to jump to 17% in the 2nd quarter of this year, which further strengthens the position of the US dollar as a safe haven asset. The negative outlook is mainly due to the closure of a number of businesses because of the pandemic.

A report was also published yesterday stating that the US government intends to borrow $ 2.99 trillion in the 2nd quarter of this year, which will be the most significant since the global crisis in 2008. However, the administration will not just stop there, and is said to increase borrowing in order to successfully deal with the pandemic. The US Treasury is expected to borrow at least $ 4.5 trillion by the end of fiscal 2020.

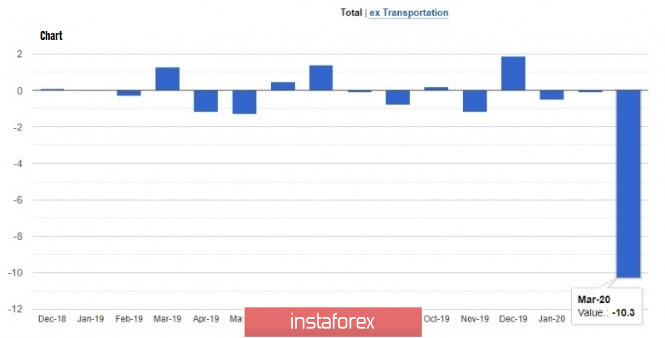

Yesterday's macroeconomic reports delivered by the US Department of Commerce revealed that production orders in the US fell by 10.3% in March 2020 and completed to $ 445.8 billion, worse than the forecasted 9.2% drop by economists. Of particular concern is the decline in orders for durable goods, which fell immediately by 14.7% in March. Excluding transport, production orders fell by 3.7% compared to the previous month.

As for the technical picture of the EUR / USD pair, a lot will depend on the decisions mentioned above. A break of the major support at 1.0895 will increase pressure on the euro and pull the instrument to the lows at 1.0850 and 1.0780. But with a favorable development of the situation, demand for risky assets may return, which will push the EUR / USD pair to the resistance at 1.0950, a break of which will provide the market a new bullish wave that can reach the highs of 1.1015 and 1.1090.

As for the technical picture of the EUR / USD pair, a lot will depend on the decisions mentioned above. A break of the major support at 1.0895 will increase pressure on the euro and pull the instrument to the lows at 1.0850 and 1.0780. But with a favorable development of the situation, demand for risky assets may return, which will push the EUR / USD pair to the resistance at 1.0950, a break of which will provide the market a new bullish wave that can reach the highs of 1.1015 and 1.1090.

AUD

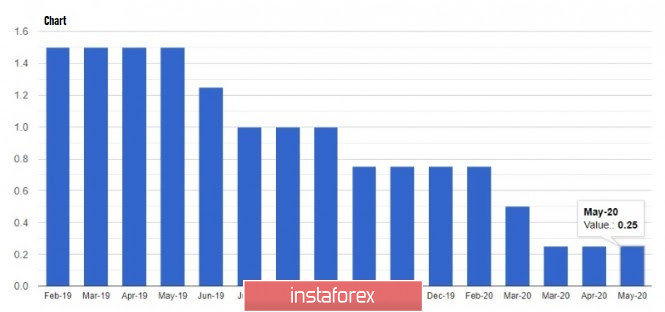

The RBA left its key interest rate unchanged at 0.25%, and the target yield of 3-year bonds at 0.25%. The decision was due to the regulator's forecast of a 10% reduction in Australia's GDP in the second half of 2020, and 10% increase in unemployment in the coming months. According to the RBA, it would do everything possible to support employment, incomes and businesses, so it would not raise the key rate until progress towards full employment was achieved. The decision did not affect the trading of the Australian dollar.

The Australian Finance Minister also said that old and new options for economic reform should be evaluated, the reason of which is to prepare to respond to a re-outbreak of the pandemic, which is expected to occur around the world.

As for the technical picture of the AUD / USD pair, the upward correction, which has been observed in the pair since mid-March of this year, will gradually be completed as the pair nears the fairly large resistance levels. Bulls need a break above 0.6570, which will lead to a test of the highs of 0.6680 and 0.6770. But if demand on the AUD / USD pair lessens, major support will be in the area of 0.6270, the break of which will quickly push the pair to the lows of 0.6100.