After the disaster in April, the oil market begins to revive in May. Low prices contribute to a reduction in production, while the gradual opening of the economies of the US, Italy, Spain, and other countries creates a fair wind for the recovery of global demand. The gradual decrease in the surplus pushes the quotes of Brent and WTI up. The question is how big it was in April. It is one thing if we were talking about reducing demand by 20 million b/d, and the second – if the figure actually reached 30 million b/d. The V or U-shape of the recovery of the black gold market depends on the answer.

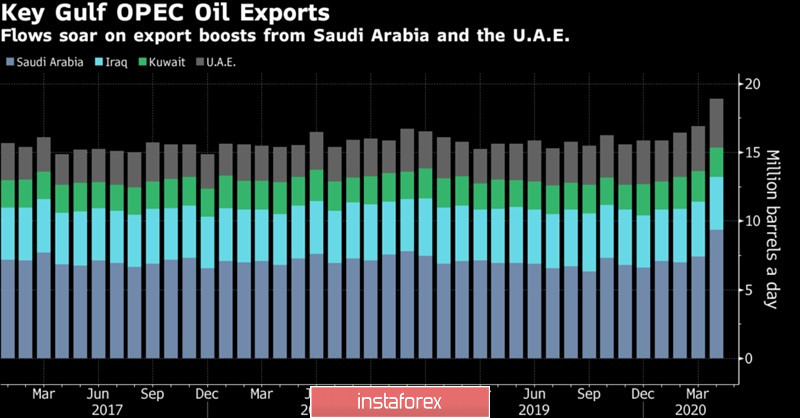

Data on the increase in exports from Saudi Arabia, Iraq, Kuwait, and the OEA, which account for about 70% of the total volume of OPEC supplies, to 18.9 million b/d (+2 million b/d compared to March), shows how serious the war between Riyadh and Moscow. If not for the intervention of Donald Trump, the situation risked becoming a disaster for many months. As it was, it came as a one-day shock when WTI collapsed below zero.

Dynamics of oil exports by individual OPEC countries

At the same time, the black gold market, due to the pandemic and social isolation, faced the largest reduction in demand in history. Many investors believe that it will take more than a year to restore the pre-crisis level of just over 100 million b/d. Pessimists are sure that it will never reach the above figure. On the contrary, UBS says that demand should be supported by the global economic recovery and forecasts the oil market to balance in the third quarter and a slight deficit in the fourth. As a result, by the end of 2020, Brent quotes will grow to $43 per barrel, and by the middle of 2021 - to $55 per barrel.

Dynamics of global oil demand

Pessimists and optimists can argue indefinitely, but, in my opinion, the key issue continues to be the size of the actual loss of global demand for black gold. If we assume that it amounted to 20 million b/d in April, then the reduction in OPEC+ production by 10 million b/d, and the US and Canada by 3-5 million b/d due to the collapse of WTI, together with the opening of the American and a number of European economies, should lead to a slowdown in the process of filling storage facilities. This is what Westpac says, claiming that in the week to May 1, oil reserves in Cushing increased by 1.8 million barrels, that is, by the smallest amount since mid-March. This circumstance, as well as the narrowing of the contango (the difference in prices between July and June futures contracts for the Texas variety), indicate a reduction in oil production in the United States.

In my opinion, if the US-China trade conflict does not escalate, Brent quotes will go up. In this scenario, long positions formed on the breakout of resistance at $25.75 and $28 per barrel should be kept and increased on declines. On the contrary, the new White House duties on Chinese imports are fraught with falling oil prices.

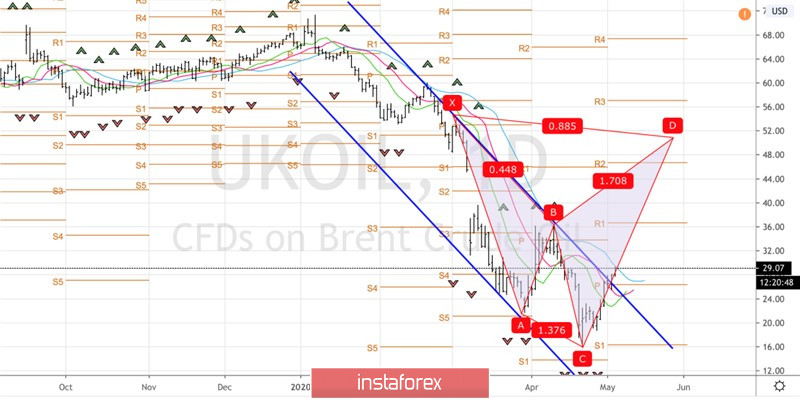

Technically, the exit of the North Sea variety quotes outside the descending trading channel increased the risks of activating the "Shark" pattern with a target of 88.6%. It is located above the $50 per barrel mark.

Brent, the daily chart