The euro collapsed against the US dollar after the decision of the German Constitutional Court, which approved the bond-buying program launched five years ago by the European Central Bank. This suggests that the ECB now has far fewer obstacles to expanding its asset purchase program, which will help preserve the integrity of the Eurozone and ensure the recovery of the region's economy after the coronavirus pandemic.

Today, the German Constitutional Court ruled that the ECB's quantitative easing program does not violate the country's laws, and said that the ECB's bond purchases do not violate the ban on financing governments through monetary policy.

However, why did the euro fall? In addition to the legitimacy of the program, the court also ruled that the Bundesbank must stop buying government bonds under the ECB program within the next three months. This will not be done only if the European regulator is able to prove the need and benefit of this program to satisfy hardliners in the German Court. It was against this background that investors' risk appetite declined sharply, which led to a jump in Italian bond yields and a decline in the European currency against a number of world currencies. The report also says that the German Constitutional Court criticized the EU court's ruling of 2018. Let me remind you that it was in this document that the decision was made on the legality of bond purchases. However, as noted in the German court, this ruling did not take into account all the economic consequences that this program can lead to.

Thus, the ruling of the constitutional court only delayed the split within the European Central Bank, which is growing stronger against the background of the expansion of the asset purchase program. Now it remains to be seen what response the European regulator will prepare, which has three months until the German Bundesbank exits the program.

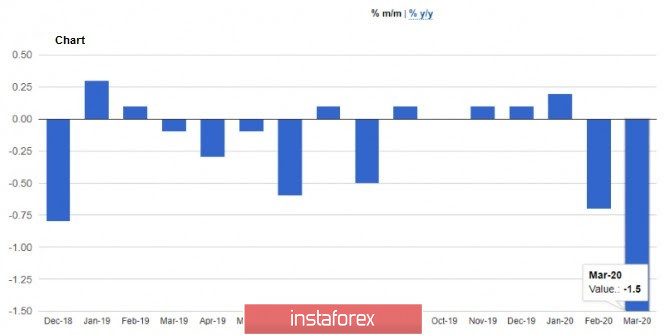

Today, a report on inflation in the Eurozone was published, which was expected to decrease. According to data, the Eurozone producer price index (PPI) in March this year fell immediately by 1.5% compared to February and fell by 2.8% compared to March 2019. Economists had expected a less active decline of 1.3% and 2.6%, respectively. If you subtract energy prices from producer prices, then inflation fell by only 0.2% in March and showed a minimal increase of 0.2% compared to March 2019. So far, the European Central Bank is not very concerned about inflationary problems, whose priority task is to save the region's economies. Until there is a reduction in GDP and an increase in unemployment, there is no need to worry about inflation. It is another matter how prices will react to positive changes in the economy after the pandemic, which will show a sharp jump thanks to the monetary pumping by the ECB, and low-interest rates, which the regulator will not change for quite a long time.

As for the technical picture of EURUSD, the pressure on the euro will continue, and any attempts at an upward correction will be perceived as a good level for selling. The nearest resistance is 1.0895, and a break in the support of 1.0840 will lead to a larger sale of risky assets in the area of the lows of 1.0780 and 1.0730.

GBPUSD

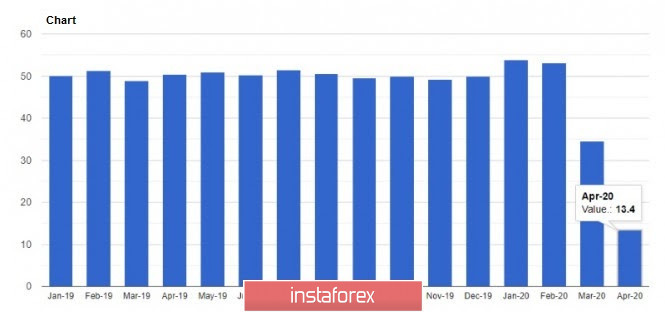

The British pound remained in a narrow side channel after a disastrous report on the services sector, whose activity fell to record lows. According to the Statistics Agency, the purchasing managers' index (PMI) for the UK services sector in April this year was slightly higher than the preliminary value and amounted to 13.4 points, while economists predicted it to fall to 12.3 points. Back in March, the PMI for the UK services sector was 34.5 points. Let me remind you that a value below 50 points indicates a decrease in the activity. Thus, the current values of the index suggest that in the 2nd quarter of this year, the country's gross domestic product may collapse immediately by 6-7%, but this is under the best scenario. Given that the data on the service sector does not reflect the entire contraction of the economy, the negative forecast assumes a drop in GDP to 15%.

As for the technical picture of GBPUSD, the sellers of the pound only need to break below the support of 1.2425, which will increase pressure on the trading instrument and lead to a sale in the area of new lows of 1.2340 and 1.2250, where I recommend fixing the profits. In the growth scenario, the bulls may have problems around the resistances of 1.2510 and 1.2560.