US president Trump plans to investigate the origin of the coronavirus, after which he will decide on actions that will be applied to Beijing. Such conflict between the US and China may or may not cause a new trade war to brew, but the White House administration is obviously not going to stop on this topic. Just last week, Trump claimed that the virus arose in one of Wuhan laboratories.

The German court ruled yesterday that the ECB quantitative easing program does not violate the laws of Germany, and stated that the purchase of bonds by the ECB does not violate the ban on financing governments through monetary policy. However, the resolution suggested the Bundesbank to stop participating in the program over the next three months, the reason of which is the lack of proof on the necessity and benefits of the program. The ECB has not responded back so far, and the course of the EUR/USD pair halted in a side channel after a major decline caused by the weak macroeconomic reports. Further move will depend on the ECB's answer.

The report published yesterday by the US Department of Commerce indicated an increase in the US trade deficit in March 2020. According to the data, the deficit widened by 11.6% from $ 39.8 billion to $ 44.4 billion, as imports dropped by more than 6.0% to $ 232.2 billion, while exports fell by 9.6% to $ 187.7 billion. Such figures were due to the declines recorded on trades amid the coronavirus outbreak worldwide. Indicators are most likely to dip even further.

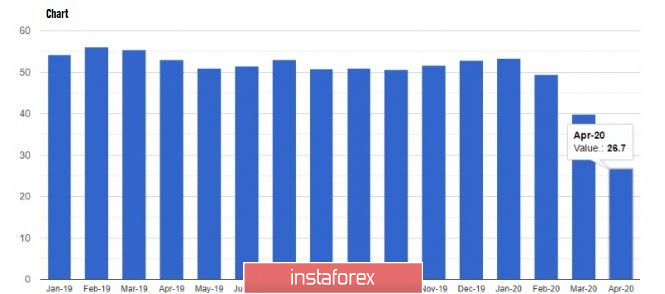

The data on business activity in the US services sector also disappointed traders, as a sharp drop in the index was recorded in April this year. According to the report by the IHS Markit, the PMI for the service sector fell to 26.7 points in April 2020, against a preliminary value of 27.0 points and March level of 39.8 points. Economists expected the index to be 27.0 points. The reported drop was due to the decline in activity, directly related to uncertainty and reduced labor caused by the quarantine. Unfortunately, such figures are only the beginning of a protracted recession, as the pandemic has not receded yet, and the self-isolation regime continues in May this year.

Meanwhile, the ISM report on the PMI for supply chain managers in the service sector revealed that the index reached 2009 lows in April and fell to 41.8 points, compared to 52.5 points in March. The largest decline was observed in finance, hospitality and transportation sectors.

Fed statements given yesterday once again promises a brighter future after the coronavirus pandemic recedes. According to Fed spokesman James Bullard, the recession will be short-lived, and crisis management will be successful. However, the current policy is designed only for a three-month pause in the economy, so the outcome in a longer one is quite difficult to imagine. A longer shutdown is inclined to create bigger problems.

Fed spokesman Richard Clarida also commented that the current plunge is the worst observed, but economic recovery can be expected earlier in the second half of this year. However, uncertainty remains, which is bound to create higher unemployment and economic downturn, but the Fed's emergency tools are ready and will be curtailed when needed.

As for the technical picture of the EUR/USD pair, demand for the euro will continue to decline, and any attempts at an upward correction will be perceived as a good level for sale. The nearest resistance is the area of 1.0855 and 1.0890, and a break of 1.0830 support will lead to a larger sell-off of risky assets in the area of the 1.0780 and 1.0730 lows.