Suddenly, market participants shifted their attention from macroeconomic statistics and news reports on the spread of the coronavirus epidemic into the courtroom of the German constitutional court, where a lawsuit against the European Central Bank was being considered. A group of German entrepreneurs and economists appealed to the German constitutional court saying that the ECB's actions contradict European Union law prohibiting direct financing of public debts. According to the plaintiffs, this is what the ECB is doing when buying government bonds. There is no decision yet, but the ECB has three months to prepare a justification for the legality of its actions. And this was enough to give the market a shock. After all, if the ECB stops buying government bonds, then the European Union countries will have nowhere to take money. The size of public debt is simply crazy, and despite the negative yields on debt securities, most of the EU countries can only service both debts and other obligations at the expense of new debts. So if the ECB suddenly stops providing financial support to them, many countries will simply be bankrupt. This in itself is simply appalling, but if you add to this the current economic downturn, the picture is generally disastrous.

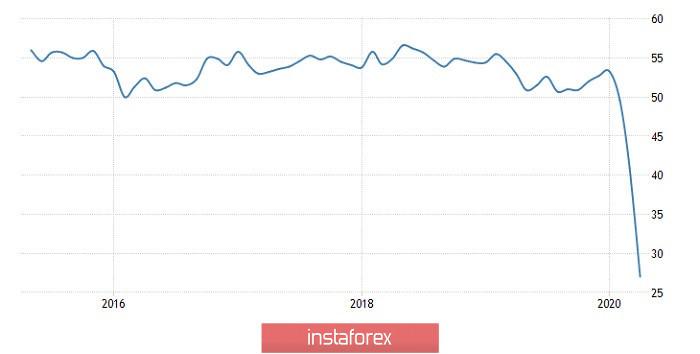

However, if you look at European macroeconomic statistics, the single currency did not have much reason to grow. At least in the first half of the day. The rate of decline in producer prices accelerated from -1.4% to -2.8%, which was worse than the forecasts of -2.4%. So the threat of deflation is increasing every day, but the ECB has no choice but to flood the economy with money in order to somehow disperse inflation. However, the economy itself is not functioning yet, due to restrictive measures introduced to curb the spread of the coronavirus epidemic.

The index of producer prices (Europe):

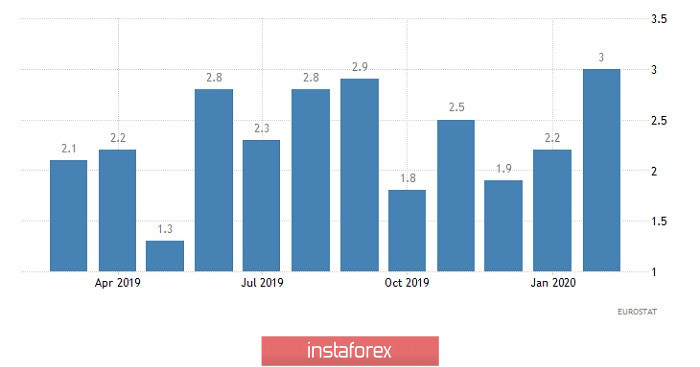

However, the dollar did not have any special reasons for confident growth. The final data on business activity indices only confirmed further deterioration of the economic situation. Thus, the index of business activity in the service sector decreased from 39.8 to 26.7. The composite index of business activity decreased from 40.9 to 27.0. Another thing is that the preliminary assessment showed about the same, so the market was somewhat prepared for such a development. But in any case, these data should have at least stopped the euro from weakening further. But this did not happen. And it's all about the decision of the German constitutional court.

The composite index of business activity (United States):

Europe will report on business activity indices today, and this does not bring any good to the single currency. The index of business activity in the service sector should collapse from 26.4 to 11.4. The composite index could fall from 29.7 to 13.2. At least, the preliminary assessment showed something similar. And we can say that the market has long taken into account the next anti-records on business activity indices in Europe. However, the situation is further compounded by data on retail sales, which should show that the growth rate of 0.3% will be replaced by a decline of 8.4%. And this is not for April, but for March. But the restrictive measures were introduced only in mid-March. In other words, in just half a month, retail sales fell back several years. And it is clear that the situation will only get worse by the end of April.

Retail sales (Europe):

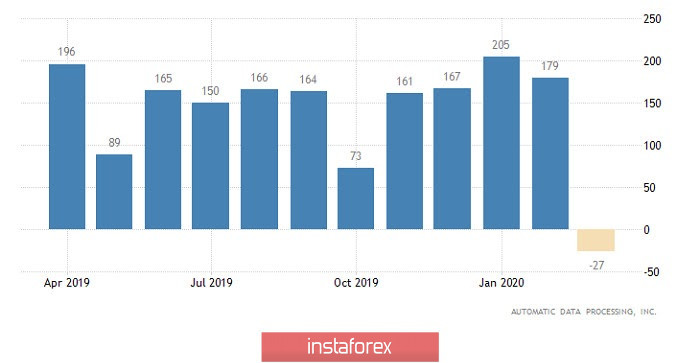

At the same time, one should not think that the single European currency will only decline. The opening of the US session is likely to be accompanied by a rebound. Albeit small. It will be caused by ADP employment data, which should show a decrease. An impressive reduction in employment will not pass without a trace, and investors will at least slightly reduce their dollar positions. Moreover, ADP data precede the publication of a report by the United States Department of Labor. And the content of this April report itself should show the catastrophe that is happening on the labor market. And the worst thing is that it is still far from complete.

Employment ADP (United States):

From the point of view of technical analysis, we see an intense downward move, which returned the quote to the area of the level of 1.0850. It turns into an interesting picture, the rally of the past days did not lead to anything drastic, although the momentum reached 1.1017, but as a result, the concentration of trading forces arose in the same familiar values of 1.0825/1.0860.

In terms of a general review of the trading chart, the daily period, high activity is visible, but the global downward trend remains unchanged.

It can be assumed that the existing consolidation movement will not last long, where impulsive surges can occur as a result, and if we refer to the nearby statistics for Europe, we will expect further downward descent. Until this fluctuation occurs, it is worthwhile to carefully analyze the boundaries of 1.0825 and 1.0860, using the breakout method.

We specify all of the above into trading signals:

- We consider selling positions as major transactions lower than 1.0825, towards 1.0810-1.0800.

- We consider the buy positions as an alternative scenario, where the entry point is higher than 1.0860, or after the descent to the value of 1.0800.

From the point of view of a comprehensive indicator analysis, we see a sell signal relative to hourly and daily periods. Minute intervals due to narrow consolidation have a neutral signal.