The single European currency came under strong pressure after the decision of the High Court of Germany regarding previously taken measures of broad stimulation of the ECB. He said that the regulator should justify the purchase of government bonds in the region, otherwise the Bundesbank will leave the participants in this process.

This news shocked the markets and led to an increase in the euro decline on the currency market, as it showed again the reality of relations in the European region between the countries during the coronavirus pandemic. It can be recalled that southern Europe, which traditionally includes Italy, Spain, Greece and several others, is not only in a difficult situation related to the COVID-19 pandemic, but also in an economic sense. The so-called "southern" countries mostly have not been able to recover from the negative impact of the 2008-09 crisis that came from the United States. They have a significant leverage. This primarily applies to Italy. Therefore, the previously existing confrontation between the countries of the south and the north, somewhat retouched, came to the fore again. Increasing tensions between countries have a negative impact on the strength of ties in the EU and can serve as an incentive to strengthen the centrifugal forces between them.

Of course, this development has a negative impact on the exchange rate of the single currency. Given the contradictions within the EU, and if they are not overcome, and the "Northern" countries led by Germany will continue to pull the financial blanket over themselves, the Euro crisis will only worsen, and then it will not help either stimulating the economy or its recovery after the coronavirus pandemic.

Against the background of the continued negative trends, the EUR/USD pair will continue to fall, as well as a significant long-term decline in the EUR/JPY cross rate.

At the same time, we believe that our forecast for the dynamics of commodity currencies will remain valid. Signs of rising demand for oil, as well as commodity assets such as metals, will support exports from Canada, Russia, and Australia. This will eventually encourage the strengthening of the exchange rates of these countries; however, there is also one serious pitfall in the face of the United States and its President.

As part of his election program, D. Trump increased pressure on China, accusing it of an inadequate assessment of the impact of coronavirus. At the same time, he strongly disclaims responsibility for the fact that he did not respond to it in time and did not close the country. If the pressure of the States increases, then it will be difficult for commodity and commodity currencies. But locally, we believe that they have a great potential for growth in the currency market.

Forecast of the day:

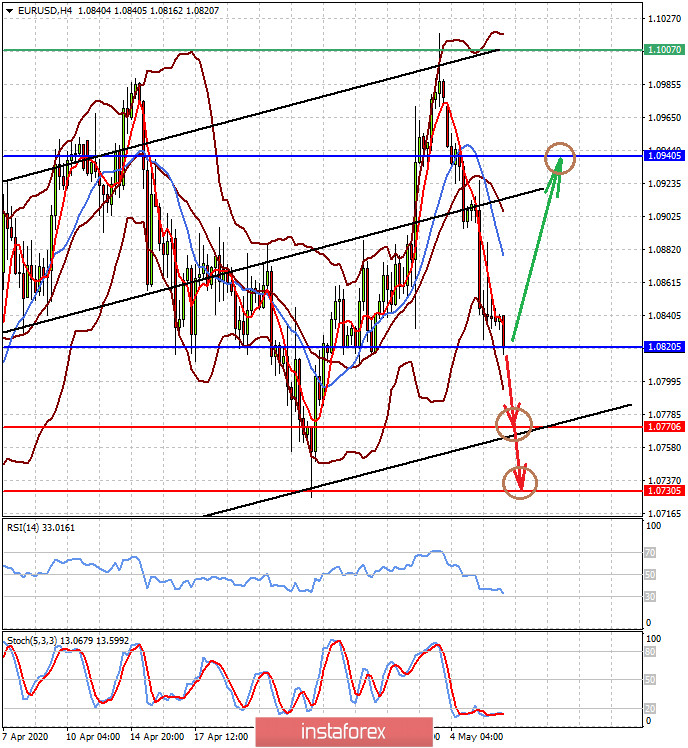

The EUR/USD pair is under pressure. If it breaks the level of 1.0820, there is a high probability of continuing to fall first to 1.0770, and then to 1.0730. But consolidating the price above this level will lead to a pullback to the level of 1.0940.

The USD/CAD pair may continue to fall if crude oil quotes remain in an upward trend. Price decline below the level of 1.4020 will lead to the continuation of its fall to 1.3860.