4-hour timeframe

Average volatility over the past five days: 95p (high).

The EUR/USD pair continued to trade lower on the third trading day of the week. Despite the fact that the fundamental background has been present in recent days and is quite interesting (but not significant for currency traders), nor the fact that macroeconomic reports are published both in the United States and in the European Union, nevertheless, the euro/dollar continues to trade exclusively in accordance with the technical scenario . We said that in the event of a price rebound from the psychological level of 1.1000, which is also the previous local high, the pair could rush to the bottom line of the side channel of consolidation, which lies at a price value of about 1.0750. At the moment, the quotes fell to the 1.0800 level, so we can say that our scenario has already been worked out by 80%. In principle, we can work with the 1.0750 level by today or tomorrow, next to it is the volatility level of May 6, 1.0744, as well as the Murray level "0/8" at 1.0740, according to the Linear Regression Channels . Thus, it is very likely that the price will rebound from this level and turn up with a further upward movement to the upper border of the side channel - 1.1000. But overcoming the 1.0740-1.0750 area could trigger forming a new downward trend.

As we said above, the fundamental background is quite interesting now, but it does not have any effect on the movement of the pair. For example, the economic forecast of the European Commission was announced today. The European Commissioner for Economy Paolo Gentiloni said: "Europe is experiencing an economic shock such as has not been seen since the Great Depression," and this phrase says it all. According to the forecasts of the European Commission, the EU economy may lose 7.7% in 2020, but in 2021 the recovery will begin and GDP will grow by 6%. The forecasts are not the worst they could have been. No one has any illusions that the GDP will sink and the figure will be high for a long time. In the United States, it is generally expected to be -20 percent in the second quarter. Thus, -7.7% is not a lot in the conditions of total quarantine and a worldwide pandemic. But the forecast for 2021, from our point of view, is quite optimistic. After all, it depends, in fact, on whether the coronavirus epidemic ends in 2020. If the European Commission believes that the recovery will begin in 2021, then it expects the end of the pandemic this year. However, who said that the pandemic will be curbed, that the second and third waves will not start, that the COVID-2019 virus will not become seasonal, and that they will invent a vaccine next year? In this case, the economy may continue to decline during 2021.

The unemployment rate, according to forecasts of the European Commission, will increase to 9% this year, and could reach 8% next year. Also quite a bit compared to the United States, where unemployment is projected at 25%. The European Commission also expects an increase in budget deficits of all EU countries to a total of 8.5% of GDP. Next year, the deficit will decrease to 3.5% of GDP. The largest losses in the economy are expected in the countries that have suffered the most from the coronavirus, and even before the epidemic had budget deficits and debt problems that have plagued them since the time of the debt crisis. It is about Italy, Spain, Greece. The GDP of these countries may fall by more than 9% this year. "The depth of the recession and the timing of recovery are unknown. They will depend on how quickly countries quarantine, on how much each country depends on industries such as tourism, as well as on the financial resources at their disposal," Gentiloni said.

Macroeconomic statistics from the EU today, as expected, turned out to be a failure. However, this fact did not upset market participants at all. It was difficult to expect anything else, which means the reports were not unexpected. Production orders in Germany fell by 15.6% in March, with a forecast of -10% in monthly terms. The index of business activity in the service sector fell to 16.2 in Germany and to 12 in the European Union as a whole. Retail sales in the European Union decreased in volume in March by 9.2% year-on-year and by 11.2% month-on-month. In the US, the statistics were no better, but traders were absolutely ready for it. Data on the change in the number of employed Americans from ADP, and it turned out that their number fell by 20.236 million at the end of April. In fact, this is the same level of unemployment in absolute terms. This is exactly the figure indicated in the report on secondary applications for unemployment benefits. So no surprise. Objectively, both in the United States and in the EU, the statistics turned out to be a failure, but the euro still continued to lose positions against the dollar for most of the day. Thus, we still believe that if the impact of the macroeconomic background on the pair's movement is present, it is minimal.

And finally, the news from the White House, because not a single article can do without them. This time, Donald Trump said that if he had not been elected president in 2016, then his country was already in a state of military conflict with the DPRK. "Remember how everyone claimed that I would start a war within 24 hours (after assuming the presidency) because of my character? Those people did not understand me. If you weren't elected, you would be at war with North Korea right now," Trump said.

4 hour timeframe

Average volatility over the past five days: 115p (high).

The GBP/USD pair also continued to decline on May 6. The UK released a report on the index of business activity in the construction sector, which broke the records of all other indices and amounted to 8.2 points. Again, you can hardly associate this indicator with the pound's fall today. Otherwise, the US dollar would also be cheaper in the US session as it also received a weak report from ADP. But no, this did not happen. It should also be noted that the British pound is not pressured by uncertainty over the central bank's capabilities, as the euro has. That is why we believe that the decision of the German court, which everyone talks about the second day, has no effect on the market. From a technical point of view, the GBP/USD pair is also moving towards the lower border of the side channel - near the 1.2267 level. Thus, about 100 points remain to this goal. Both major pairs can reach their target levels in the coming days.

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair moved down and overcame the Ichimoku cloud today on the 4-hour timeframe. Thus, you are advised to consider selling the euro with targets in the range of 1.0750–1.0740, near which the downward movement may stop. At the same time, overcoming this range will keep the shorts open.

For long positions:

Long positions will become relevant with the targets of 1.0935 and 1.1063 if the price consolidates above the Kijun-sen line.

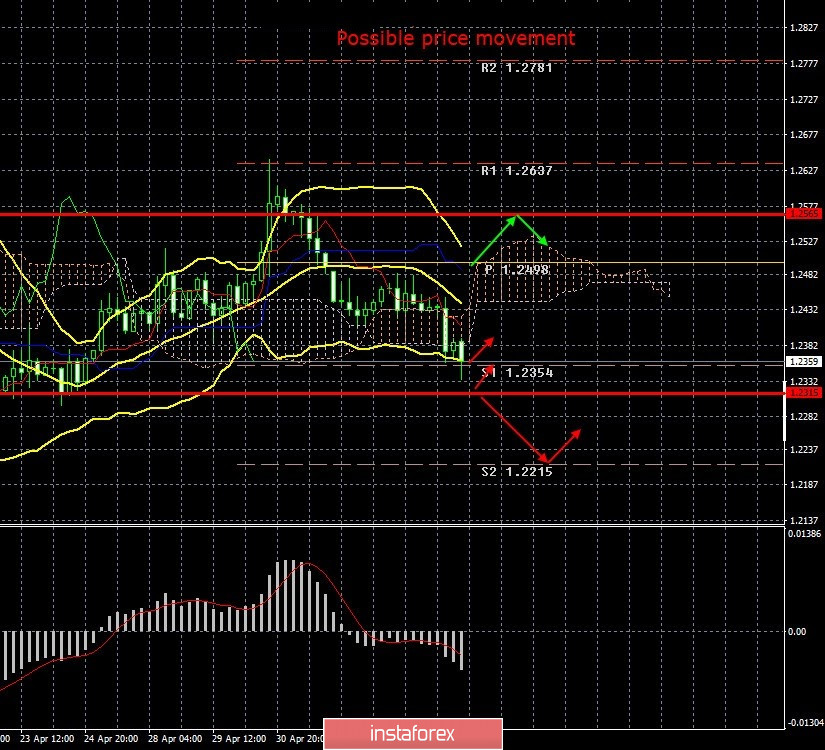

Recommendations for GBP/USD:

For short positions:

The pound/dollar also continues to move down. Thus, traders are advised to continue selling the British currency with targets at 1.2315 and 1.2267 until the price rebounds from any target or the MACD indicator turns up.

For long positions:

Purchases of the GBP/USD pair will again become relevant with the objectives of 1.2565 and 1.2637 not before consolidating the price above the critical line.

Explanation of illustrations:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator - 3 yellow lines.

The MACD indicator is a red line and a histogram with white bars in the indicators window.

Classic support / resistance levels - red and gray dashed lines with price symbols.

Pivot level is a yellow solid line.

Volatility levels are red solid lines.

Possible price movements:

Red and green arrows.