4-hour timeframe

Average volatility over the past five days: 94p (high).

The EUR/USD pair spent the fourth trading day of the week in absolutely calm trading. The volatility of the day at the time of writing is not more than 40 points. Thus, traders continue to ignore the entire macroeconomic background, fundamental background, and even the general predisposition of traders and investors to purchases of the US dollar during the crisis does not really help the US currency. In the past few days, the US currency has been growing and one day (today) is not an indication that traders do not want to buy the dollar. However, we have repeatedly said in all previous articles that a fall to the 1.0740-1.0750 region is almost guaranteed, despite the absence or presence of a fundamental background. Just because it's the lower border of the side channel. The lowest day of the day is 1.0777. The pair can move up, without even waiting for the development of the designated area. It can still work out one of the levels of 1.0740 and 1.0750, or even both. However, the main strategy now is to consolidate the euro in a fairly wide side channel (about 250 points). Actually, this is exactly what we are observing now. We do not expect a trend to form until the quotes leave this channel.

Today, all the attention of the market was directed to the meeting of the Bank of England and its results. However, the European Union and the United States also had something to pay attention to. Early in the morning, Germany published a report on industrial production for March, which is expected to drop. It fell as well as almost all other indices and indicators in the EU and the US. In annual terms, industrial production decreased by 11.6%, and in monthly terms - by 9.2%. The situation is no better in other countries of the bloc. For example, in France, industrial production fell by 16.2% on a monthly basis. So in Germany, the situation is not as bad as in the countries that have been most severely affected by the coronavirus pandemic.

The next report on applications for US unemployment benefits for the week of May 1 was published. The total number of initial applications has increased again, this time by 3.2 million and is now almost 33 million. However, a more significant indicator in the current environment - the number of secondary applications for benefits - rose to 22.65 million applications in the week of April 24. Recall that this indicator lags behind the initial applications for the week. Thus, in a week the number of secondary applications for benefits could grow to 25 or 26 million. We add several million Americans who were unemployed before the pandemic and the crisis, and we get the figure of about 30 million unemployed from the total economically active population of about 160 million. Using simple mathematical calculations, we obtain an unemployment rate of about 18-19%. This is absolutely disappointing, however, as we see, traders are not particularly saddened by such a high level of unemployment. There have been no hints of a decline in the US currency today. The pair will continue to move slowly towards the lower border of the side channel. Thus, the fact that traders continue to ignore any data coming into their possession is obvious.

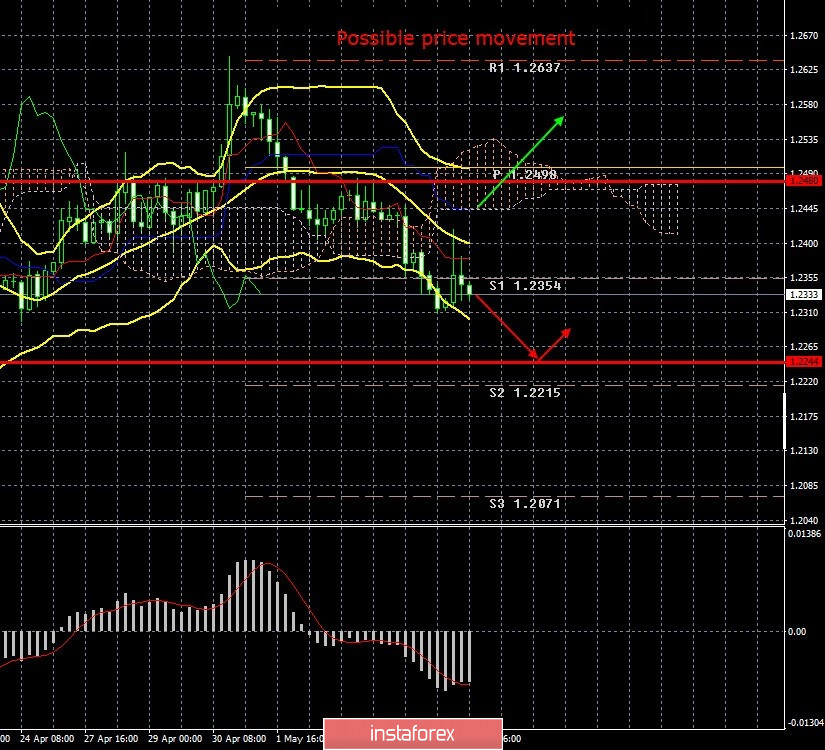

4-hour timeframe

Average volatility over the past five days: 118p (high).

The GBP/USD pair is also continuing its downward movement on May 7. The bulls tried to seize the initiative and jumped at the very beginning of the European trading session, during the publication of the results of the meeting of the Bank of England. However, buyers lost all advantage over the next few hours, and the downward movement resumed. The pound/dollar was trading more actively today than the euro/dollar, however, in general, trading was also quite calm. As in the case of the euro, quotes move to the lower border of the 400-point side channel, which runs near the price level of 1.2250. Thus, no more than 60 points remain to pass to this level, which is not an impossible task for the pound.

Today was quite an important event in the UK. The meeting of the Bank of England and, looking a little ahead, we finally state the fact that market participants reacted to this event. Nothing else can explain the sharp rise in the pound this morning. However, the fact that there was a market reaction does not mean that this reaction was logical. As we already know, the pound rose in the morning. But on what basis? The key parameters of monetary policy remained unchanged. The British regulator left unchanged the key rate (0.1%), as well as the volume of the asset purchase program (645 billion pounds). The only thing that could be noticed was that two members of the monetary committee voted in favor of expanding the asset purchase program. However, seven voted for its volume to remain unchanged, so nothing has changed. The head of the Bank of England Andrew Bailey made a speech much later on. The regulator's final communique says: "The spread of COVID-19 and the measures taken to combat it have a significant impact on the UK. Economic activity has declined sharply since the beginning of the year, and unemployment has increased significantly." In other words, the BoE limited itself to general phrases and did not share information with market participants about its possible actions in the future and plans to change monetary policy.

For example, many traders were interested in whether the British regulator can withdraw its key rate below zero? Instead of orienting the markets, the BoE announced its forecasts on the main indicators of the state of the economy. In accordance with these forecasts, the UK's GDP will decline by 25% in the second quarter of 2020, the unemployment rate will rise to 9%, and by the end of 2020, and a contraction in the economy by a record 14%. This is reported to be the largest decline in GDP over the past 311 years, from 1709. Such a serious decline in the economy, noted in the communique, is inevitable, despite large-scale stimulus programs. In 2021, recovery is expected, with which immediately by 15%. However, firstly, such an option will only be possible if, during 2020, it is possible to defeat the coronavirus or find a vaccine against it, put it into mass production and provide vaccinations to a large part of the world's population. If the pandemic persists, certain restrictions related to quarantine measures will remain. Accordingly, the economy will not be able to earn at full power. Experts also note that the British after the next crisis may start less willing to spend money, which will also negatively affect the prospects for economic recovery. Not to mention the fact that the new trade war between the US and China will affect the entire world economy, respectively, and the British. In general, if a decline of at least 14% is almost inevitable, then the subsequent growth of 15% is a big question. Not a single positive news for the British pound, which grew in the European session. Thus, we do not think that the reaction of the traders was logical. But the subsequent drop in British quotes is more justified.

Recommendations for EUR/USD:

For short positions:

The EUR/USD pair continues to move down on the 4-hour timeframe. Thus, you are advised to sell the euro with targets in the range of 1.0750 - 1.0740, near which a reversal may occur. At the same time, overcoming this range will keep the shorts open with the target of 1.0717.

For long positions:

Long positions will become relevant with the target resistance level of 1.1063, when the price consolidates above the Kijun-sen line.

Recommendations for GBP / USD:

For short positions:

The pound/dollar also continues to move down. Thus, traders are advised to continue selling the pound with targets at 1.2244 and 1.2215 until the price rebounds from any target or the MACD indicator turns up.

For long positions:

Purchases of the GBP/USD pair will again become relevant with the goals of 1.2480 and 1.2637 not before consolidating the price above the Kijun-sen critical line.

Explanations for illustrations:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator - 3 yellow lines.

The MACD indicator is a red line and a histogram with white bars in the indicators window.

Classic support / resistance levels - red and gray dashed lines with price symbols.

Pivot level - yellow solid line.

Volatility levels are red solid lines.

Possible price movement options:

Red and green arrows.