Gold continues to move sideways after reaching a strong support zone. It is trapped within a range pattern. XAU/USD bounced back. Now, it is trading at the 1,789.81 level. In the short term, the US dollar index seems heavy after its failure to come back towards the previous high. DXY's potential drop could push the price of gold higher.

Later today, the US is to release its CB Consumer Confidence which could drop from 113.8 to 110.8 points, while the Chicago PMI is expected around 67.1 points below 68.4. If so, the US dollar may decline and XAU/USD could rise. Fed Chair Jerome Powell will give a speech that could bring more volatility.

Don't forget that the Canadian GDP could report a 0.0% growth. This is seen as a high-impact event as well, so it could have a big impact as well.

XAU/USD Rejection!

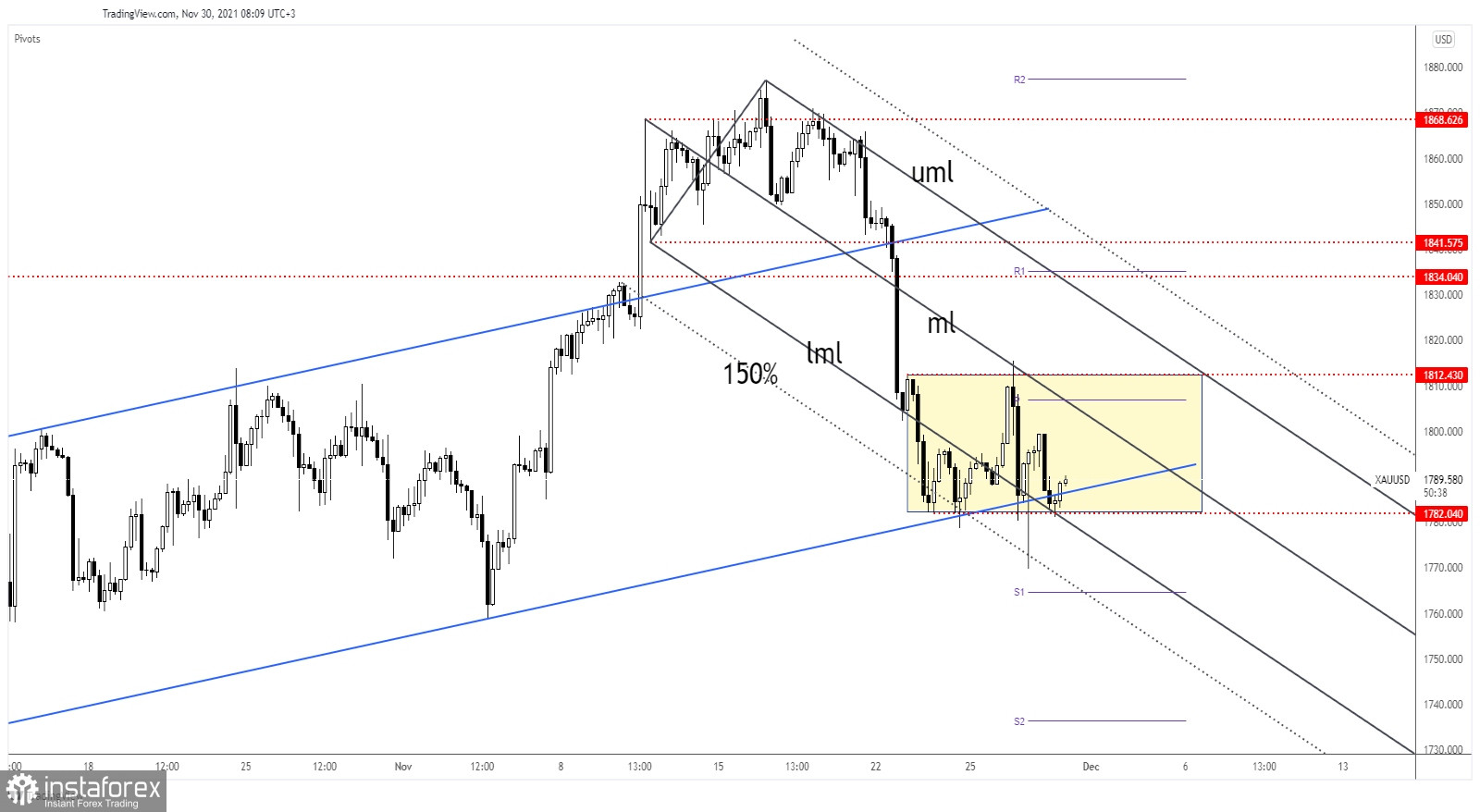

XAU/USD is growing at the time of writing after registering another false breakdown below 1,782.04 static support. It has managed to stay above the uptrend line and above the descending pitchfork's lower median line (lml).

Technically, the median line (ml) stands as a dynamic resistance. Also, the 1,812.43 level represents strong static resistance. After registering only false breakdowns below the range's support, XAU/USD could try to make an upside breakout from this pattern.

Gold Outlook!

In the short term, XAU/USD could climb higher after retesting 1,782.04 and the lower median line (lml). The first upside target stands at the 1,800 psychological level around the median line (ml).

Personally, I believe that only a valid breakout through 1,812.43 could really validate a strong swing higher. On the other hand, dropping, closing, and stabilizing below 1,782.04 could signal that XAU/USD could approach and reach 1,769.80 previous low.