Key data on the growth of the US labor market was expected to be not in favor of the dollar. And although many (almost all) components of April Nonfarms were in the "green zone", the market reacted to the release very clearly. The dollar index returned under the hundredth mark and headed for this week's lows, reflecting general pessimism about the greenback. In turn, buyers of the euro/dollar pair have a reason for a corrective recovery. The past week was not one of the best for the euro – the European Commission's report that was published yesterday put a lot of pressure on the single currency, which fell in price not only in the pair with the dollar but also throughout the market. It should be emphasized that the current growth of the pair is due only to the weakness of the dollar – the euro is still exhausted and can not start "its game." The extremely pessimistic forecast of the European Commission against the background of the resonant decision of the German constitutional court forces the euro to follow the dollar, so the dynamics of euro/dollar depends only on the "health" of the US currency. Today's events served as an additional confirmation of this fact.

Yesterday, the euro/dollar pair was trading at two-week lows, falling to the middle of the seventh figure. But the bears could not approach the support level of 1.0750, after which buyers intercepted the initiative for the pair. The data published today provided additional support to the bulls, although it came out in the "green zone", that is, better than expected. However, not everything is as clear as it seems at first glance.

So, the unemployment rate in April rose to 14.7%, although experts expected it to be around 16 percent. But there is no reason to be optimistic. First, the fact that unemployment is rising to 14% is a kind of anti-record – the situation in the US labor market was worse only during the great depression when this figure increased to 25 percent. And if we talk exclusively about the employment indicator, it has fallen 10 times more than during the peak of the Great Depression (then there was a two-million minimum). Second, these 14 percent did not include the temporarily unemployed – if they were classified as expected (and according to the formula "working, but absent"), this figure would be at the level of 18-19%. A similar situation has developed with salaries. The growth rate of average hourly wage reached an extremely high level – on a monthly basis, at around 4.7% (although, as a rule, the indicator goes in the range of 0.1-0.4%), and in annual terms – at the level of 7.9% (with normal oscillations within 3-3.5%). But even in this case, there is no reason for optimism – these figures have increased due to the disproportionate loss of work by low-paid workers and their reduced wages, and not because of the general increase in wages (which would be very surprising in the current conditions).

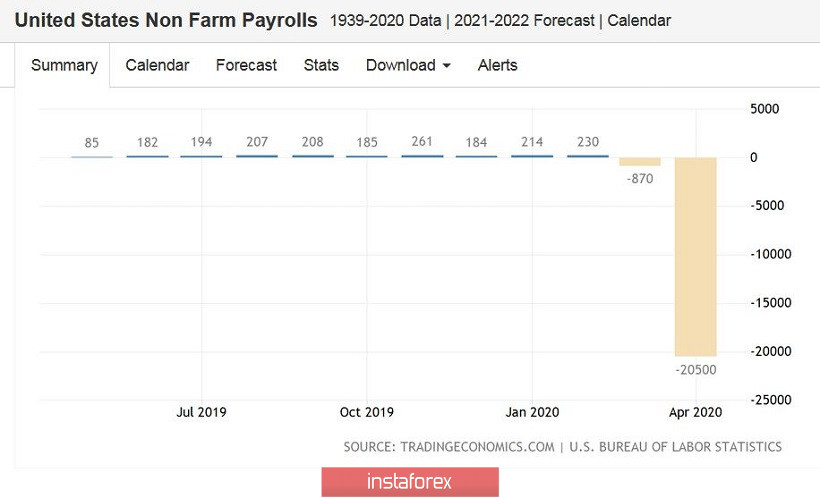

The number of people employed in April fell immediately by 20 million 500 thousand – thus, since the beginning of March, more than 33 million newly unemployed people have been registered in the United States. And here it should be noted that today's Non-Farm covers the situation in the labor market only until mid-April, so the current indicators do not reflect the true scale of the disaster in employment.

Thus, today's release once again reminded market participants of the scale of the coronavirus crisis. The nonfarm structure suggests that the pandemic primarily hit the leisure and hospitality industries (more than 7 million employees lost their jobs), retail (more than 2 million layoffs), and manufacturing (1.3 million laid-off).

Against the background of such data, the euro/dollar bears were unable to continue their southern offensive. But this does not mean that the bulls will be able to reverse the situation on Non-Farm alone – the euro's own problems act as an anchor and if buyers can not impulsively enter the ninth figure (to be more precise, if they do not overcome the mark of 1.0880), then next week the dollar bulls can again show themselves.

It is noteworthy that despite the correction growth, from the point of view of technology, the situation for the pair has not changed since yesterday. The pair is still located between the middle and lower lines of the Bollinger Bands indicator on the daily chart. In addition, the Ichimoku indicator shows a bearish signal "Parade of lines" – all lines of the indicator are above the price chart, thereby demonstrating pressure on the pair. To reverse the situation, the euro/dollar bulls need to overcome the mark of 1.0880 (the average line of the Bollinger Bands indicator, which coincides with the Tenkan-sen and Kijun-sen lines). Only when you pinned above this target, you can go into purchases (with the goal of 1.0975 - the upper line of the Bollinger Bands, which coincides with the lower border of the Kumo cloud on the same timeframe). If buyers do not overcome this level (which is most likely), the pair will again return to the base of the eighth figure with subsequent attempts to storm the seventh price level.