The non-reaction of traders on the US labor market data released on Friday once again showed the confidence of investors that the US economy will begin to recover quickly after the pandemic recedes in the country. They expect the US labor market to draw a V-shaped recovery, despite the fact that the bottom has not yet been reached.

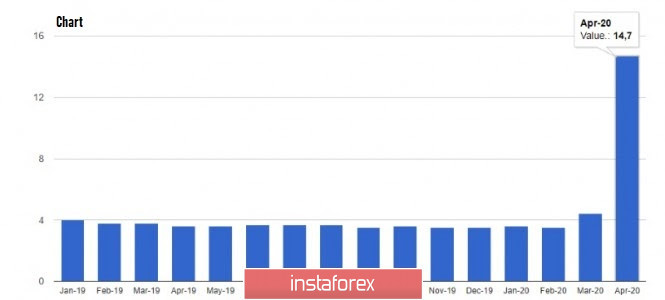

The data published on Friday revealed that unemployment rate in the US reached 14.7% in April this year, which is the worst figure recorded since 1940. However, as soon as quarantine measures are lifted in the US, employment will begin to rise rapidly, but will take a very long time to return to pre-crisis levels. Unemployment will most likely be at the level of 8% -10% this year, and its normally smooth decrease should not be expected before the 2nd to 3rd quarter of 2021.

A report by the US Department of Labor said that the number of jobs in the US fell by 20.5 million. This bigger-than-expected drop was due to the closure of a number of enterprises, as well as job cuts, triggered by the quarantine introduced to combat the coronavirus pandemic. It was more widespread than anticipated, thus, the number of jobs in the US manufacturing sector fell by 11.49 million in April this year, after falling by 1.33 million in March. The loss of jobs recorded in April are mostly temporary lay-offs, but job losses recorded previously were due to the closure of business and permanent lay-offs.

The bottom is expected to be reached in May of this year, after which the lifting of quarantine measures will benefit the US labor market. Due to the pandemic, unemployment rate in the US is predicted to increase to 20% by June this year. A similar statement was made by the White House economic adviser Kevin Hassett on Sunday, who said that he expects unemployment to reach 20%, after which it will begin to decline.

Meanwhile, the data on US wholesale inventories in March did not significantly affect the market, especially since a significant reduction in the index was not recorded. According to the report of the US Department of Commerce, inventories declined for the second month in a row, decreasing by 0.8% in March compared with February. Compared with the same period of last year, stocks fell by 2%.

Statistics on Europe, which was released last Friday, also did not affect the markets. The report published by Moody's said that the pandemic, as well as the quarantine measures of governments, has greatly reduced household consumption, which will negatively affect GDP. Largest declines were recorded in Italy and Spain, followed by the UK. The growth in consumption will directly depend on the lifting of quarantine and the mood of consumers, which will obviously be negative due to massive lay-offs and slowdown in wage growth caused by the quarantine. However, the observed effect is just temporary, because as soon as the incidence of COVID-19 decreases, everything will return to its place.

The decline in German exports was not surprising. According to the report published by the Federal Statistical Office of Germany on Friday, due to the coronavirus pandemic, German exports recorded an 11.8% decrease in March 2020, worse than the 5.0% forecast. Imports also declined by 5.1%. The positive foreign trade balance of Germany amounted to € 12.8 billion, while economists predicted the figure to be € 24.5 billion.

Weak data on industrial production in Spain also disappointed market participants, but since Spain is one of the countries that need financial assistance, the sharp decline in indicators was not surprising. According to the report of INE, industrial production in Spain fell by 11.9% in March compared with February. The indicator grew by 0.1% back in February.

As for the current technical picture of the EUR/USD pair, the prospects for movement are unclear. Buyers of risky assets need a return to the resistance level at 1.0880, a breakout of which will provide a more powerful impulse that can lead to the update of significant levels in the areas of 1.0930 and 1.1020. But if the demand for risky assets does not resume at the beginning of the week, another wave of decline to the lows of 1.0770 and 1.0725 is possible, the break of which will quickly return the pair to the lows of the year.

CAD

Ignoring weak fundamental statistics relative to oil quotes, the Canadian dollar continued to strengthen its position against the US dollar.

Due to the coronavirus pandemic, lay-offs in Canada increased, which could lead to a deeper recession in the future. A report by the Canadian Bureau of Statistics revealed that the number of jobs in Canada fell by 1.99 million in April this year, raising the unemployment rate from 7.8% to 13%. About 36.0% of potential labor did not work or worked less than half of normal time in April, indicating a paralysis of economic activity.

Despite the terrible data, trading of the pair continues, as the market already expected such figures. In addition, the oil market is developing well, the growth of which will allow the Canadian economy to more smoothly survive the crisis.

The data on new homes in Canada, although indicated a decline, did not greatly interest the traders. According to the report of the Canada Mortgage and Housing Corporation, the index decreased by 12% and amounted to 171,265 houses per year.

As for the technical picture of the USD/CAD pair, selling the pair is becoming more and more dangerous, as the trading instrument is gradually approaching the large support level at 1.3850, which represents April's low, and has repeatedly rescued buyers. Only its break will provide a larger decline in the pair in the areas of 1.3735 and 1.3640, but this will happen only after the stabilization of the oil market and the recovery of the economy after the pandemic. Open long positions from the lows of 1.3850 to return the quotes to the upper border of the wide side channel at 1.4260.