Due to the COVID-19 pandemic, the US government increased its loans, raising the budget deficit to about $ 4 trillion this year. However, according to a Wall Street observer, such would be "positive for gold."

"What thrives in massive changes to the Treasury's outstanding debt? Gold, of course," wrote Jeff de Graaff, founder of Renaissance Macro, in a note. According to de Graaf, the increase in debt is closely related to the forecast of profit for gold, the demand of which decreases as reserves and the US dollar increases, which makes commodities valued in currencies more expensive for users of other currencies.

Last week, the US Treasury Department announced its plans to borrow about $ 3 trillion this quarter to finance emergency programs approved by the Congress to keep the economy afloat.

According to the Congressional Budget Office, such will cause the deficit to reach a record level of $ 3.7 trillion in 2020, well above the previous $ 1.413 trillion seen in 2009.

De Graaff said that one of the reasons for gold's unsatisfactory condition is the slow increase of outstanding debt.

Meanwhile, the report published by the Shanghai Gold Exchange (SGE) suggests that the demand for gold in China may begin to grow, as the country is gradually emerging from restrictions.

The data for April revealed gold withdrawals of about 13.5 tons more than in March, indicating that the total annual demand for gold in China will be significantly lower than in the past few years. The annual volume of gold seizures from SGE also declined by more than 50% compared with the figures for each of the previous six years.

Demand levels were already declining last year so the overall fall in demand for gold this year may not be as large as the figures suggest today.

SGE analysts equate gold withdrawals as a measure of the total gold consumption in China. The results of SGE gold seizures are much closer to well-known gold imports to mainland China, as well as to domestic gold production in China, plus a discount on scrap conversion and some other unknown types of imports.

The telephone conversation between the US and China included a promise to create favorable conditions for the first phase of the trade agreement between the two countries, which helped support gold, but at the same time limited any potential for its further growth.

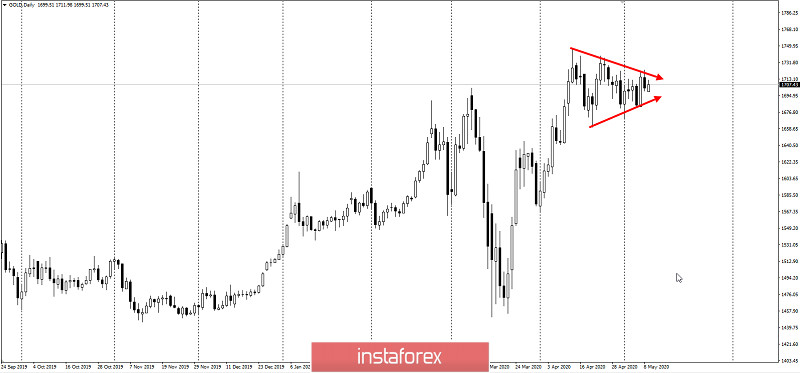

The price of gold is quite high at the moment. Even the worst-recorded US employment rates could not lead to such high gold prices.

"Gold continues to fluctuate around $ 1,700 because it continues to seek direction," Craig Erlam, an OANDA strategist, said. "It has been consolidating for the past month, and today's price movement does not suggest that anything will change," he added.