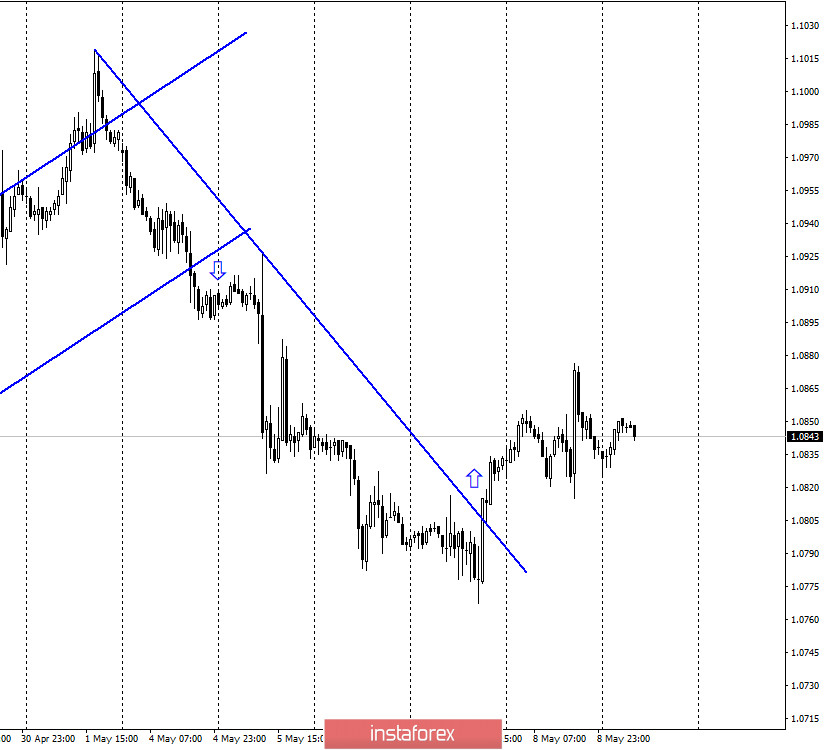

EUR/USD – 1H.

Hello, traders! The EUR/USD pair continued the growth on the hourly chart on May 8 after fixing above the downward trend line. Thus, the growth can be continued this week, as the mood of traders has changed to "bullish". There are no new graphical constructions now since too little time has passed since the trend line was crossed. There are not enough support points to build a new trend line or channel. The latest news was quite interesting for the market. According to the latest information, US trade representative Robert Lighthizer, US Treasury Secretary Steven Mnuchin, and Vice Premier of the State Council of China Liu He held telephone conversations, which resulted in new oral agreements to cooperate in the areas of macroeconomics and health. Traders took this information as the cancellation of a new trade war. However, US President Donald Trump has not yet spoken out on this issue, who has recently actively criticized China, accusing it of deliberately not containing the spread of the COVID-2019 epidemic.

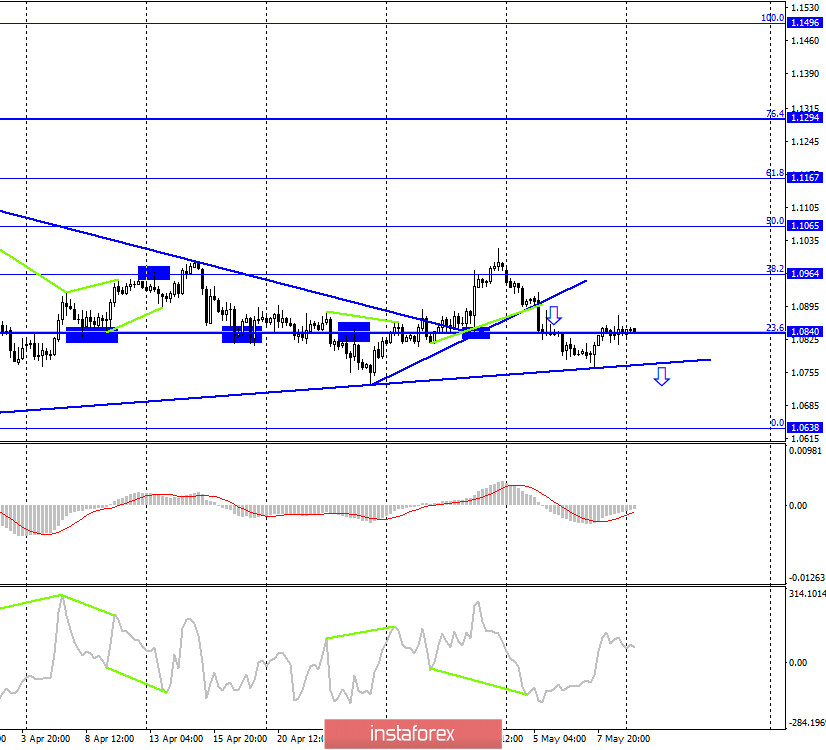

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed a rebound from the upward trend line and began the growth, having already returned to the corrective level of 23.6% (1.0840). Nothing is happening with the further growth of the pair yet, however, since the closing under the trend line did not happen, it is the "bullish" mood that is now identified among traders. In addition, the pair closed above the trend line on the hourly chart. Based on this, the growth of quotes can be continued on May 11 in the direction of the corrective level of 38.2% (1.0964). There are no pending divergences in any indicator. Closing the pair's exchange rate under the upward trend line will work in favor of the US dollar and significantly increase the probability of a further drop in quotes.

EUR/USD – Daily.

On the daily chart, the EUR/USD pair made a consolidation under the corrective level of 23.6% (1.0840). Thus, the fall in quotes can be continued in the direction of the next Fibo level of 0.0% (1.0637). The mood of traders in global terms is characterized as "bearish" due to the downward trend corridor.

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 8, the European Union hosted another speech by ECB President Christine Lagarde, which, as on the previous day, did not give traders any important information. In America, the unemployment rate rose to a record 14.7%, and the number of people employed in the non-agricultural sector was 20.5 million. Thus, the fall of the US dollar was caused by the information background.

News calendar for the United States and the European Union:

On May 11, the US and EU news calendars are empty, so the background information will be absent, and the activity of traders may decrease.

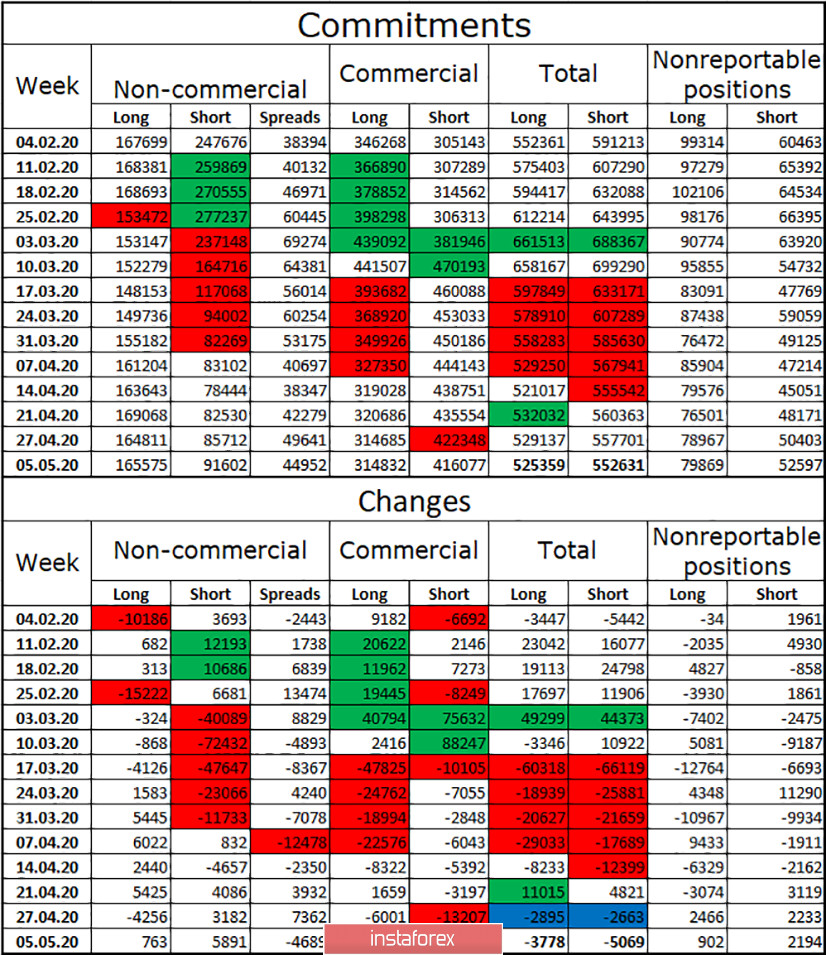

COT (Commitments of Traders) report:

On Friday, a new COT report was released, which again showed minimal changes. For example, it became known that in the reporting week of May 5, professional players increased short-contracts, the number of which increased by almost 6,000. But speculators bought the euro very reluctantly, only +763 contracts. Thus, for three weeks in a row, large speculators have been increasing sales for the euro. At the same time, the total number of long contracts remains twice as high as short, and over the past 7 weeks, the "Non-commercial" group has been increasing them, too. Thus, we can say that both types of contracts are in demand among large traders. As for the "Commercial" group, it is less important for determining trends and forecasting. During the reporting week, this group got rid of short contracts. In general, during the reporting week, the number of both long and short contracts decreased (due to the closing of opposite positions "spreads" and short positions by hedgers). And the overall advantage remains with sales contracts.

Forecast for EUR/USD and recommendations for traders:

I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I do not recommend buying a pair today.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.