Good day traders!

The GBP / USD pair traded in different directions last week, but the British currency still fell in price against the US dollar by 0.67%. Although the data on nonfarm employment, unemployment rate and average hourly wage in the US exceeded the expectations of economists, it was on Friday that the GBP / USD currency pair arose. However, the movement turned out to be very insignificant.

Many European countries are starting to lift the restrictive measures previously introduced to stop the spread of the coronavirus. Even the United Kingdom is not an exception. Starting on May 13, outdoor sports, car trips and adoption of solar procedures will be allowed. With this, British Prime Minister Boris Johnson, who had been ill with COVID-19, urged and reminded fellow citizens to remain vigilant. According to Johnson, although the country already passed the peak of the pandemic, a large-scale weakening of quarantine measures is very dangerous. Thus, the easing consists of five phases. The next stage, which will start on June 1, includes the opening of stores and schools. Hotels and public places, on the other hand, may resume work in July.

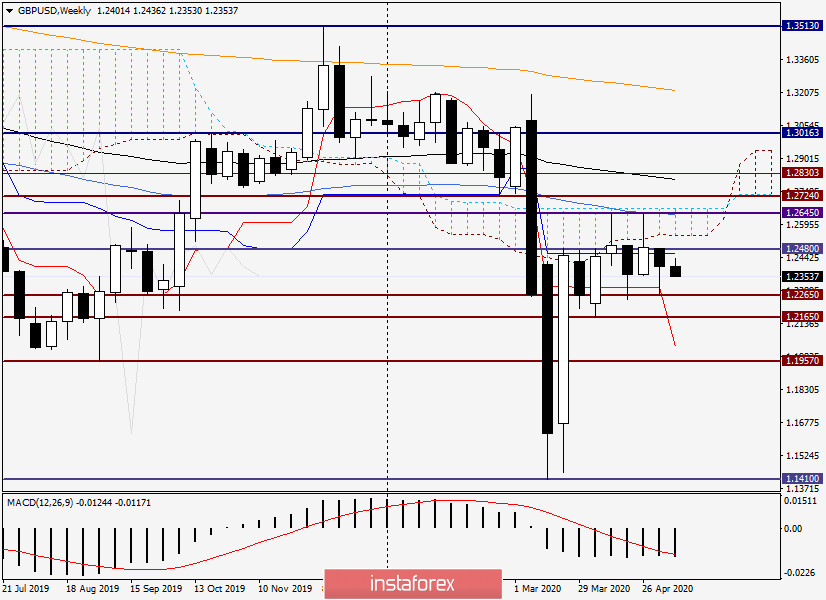

Weekly

Trading on the GBP / USD pair on May 4-8 showed a slight decrease. However, the technical picture on the weekly timeframe did not undergo significant changes.

The decline last week suspended the Tenkan line of the Ichimoku indicator. As a result, the last weekly candle formed a long lower shadow, with the price closing at the level of 1.2400, which has been designated more than once as a determining factor in the further direction of the quote. Equally important level is the psychological mark of 1.2500, above which the pair failed to gain a foothold.

The British currency is currently in a moderate decline against the US dollar. The nearest resistance is located in the area of 1.2462-1.2485, where the Kijun line passes and where last week's highs are located. Overcoming the 1.2485 level will send the pair to the lower border of the weekly cloud, which runs at 1.2543, from which bullish prospects of the British currency will be decided. Closing within the Ichimoku cloud this week will push quotes up to the area of 1.2645-1.2668, where the highs of the week before last were noted, and the upper boundary of the weekly cloud passes. The exit from which will indicate the further strengthening of the pound.

In the case of price consolidation at the level of 1.2265, the next goal will be the level of 1.2165, a break of which will result to a further descent to the area of 1.2030-1.2000, where the Tenkan line is located and the psychological level of 1.2000 passes.

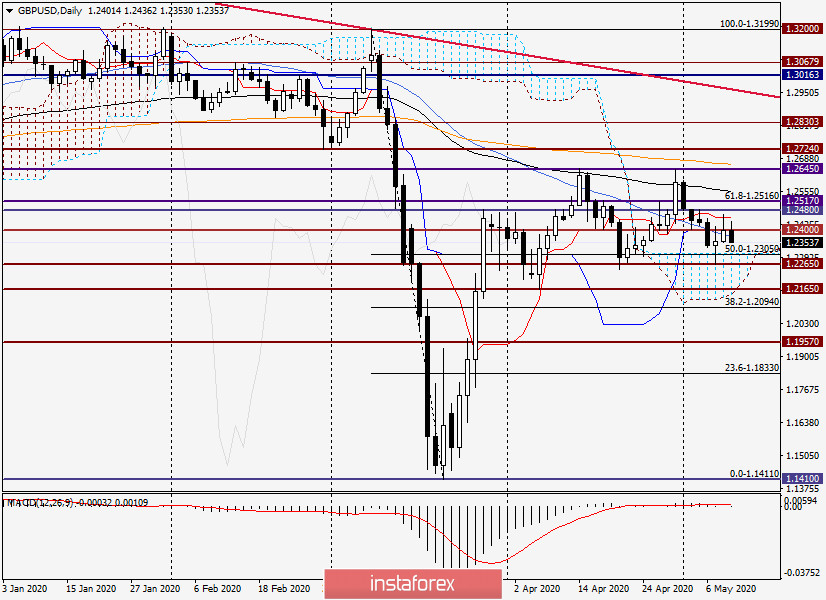

Daily

The signals in the timeframe are unclear. The pair is trading between the 50 SMA, which is trying to provide support to the price, and the Tenkan line (1.2453), which represents the current and nearest resistance.

Only a breakout of May 8's high located at 1.2465 will open the way to the area of 1.2485-1.2556.

Conclusion and trading recommendations for GBP / USD:

Uncertainty remains in the future course of the GBP / USD pair. Thus, consider both options for positioning.

Open buy positions after a short-term decline in the area of 1.2310. Sales should be planned after quotes rise to the area of 1.2400-1.2430. Enter the market based on the candlestick patterns in the lower time frames.

More attention will be given to the GBP / USD pair this week, so conclusions will not be rushed. We will resume analyzing the GBP / USD pair tomorrow, May 12.

Good luck!