To open long positions on GBPUSD, you need:

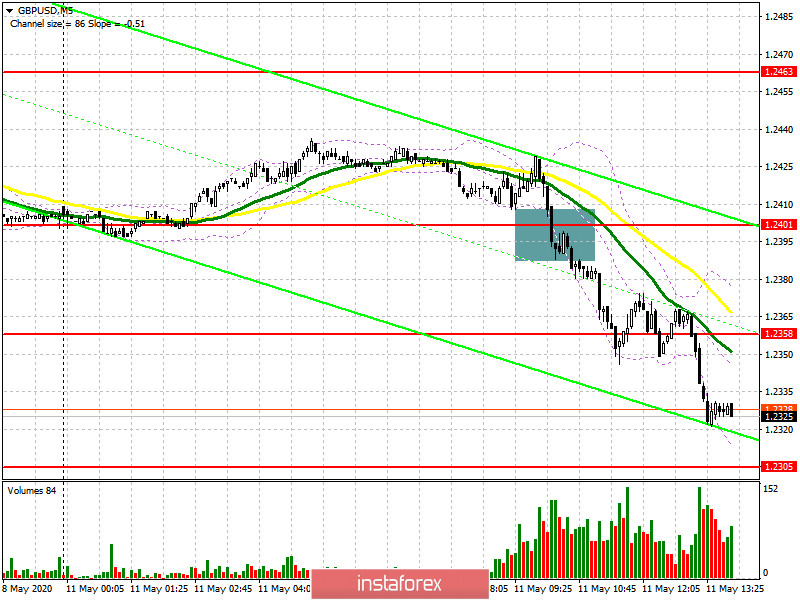

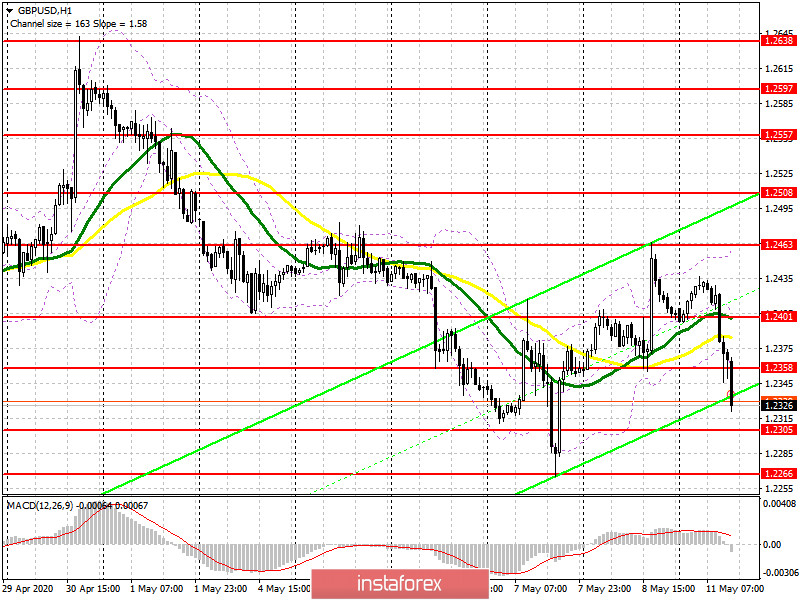

Even in the morning review, I paid attention to the support of 1.2401 and recommended opening short positions after fixing under this level. If you look at the 5-minute chart, as well as the hour chart, you will clearly see how the bears are anchored below the level of 1.2401, and at the close of the hour candle, continue to press the pound lower to the support area of 1.2358. A small rebound from this level, and then a return to it, led to the demolition of the bulls' stop orders and a further sale of the pair. At the moment, the bulls need to focus on the support of 1.2305, from where I recommend opening long positions when forming a false breakout. It is best to buy GBP/USD on the rebound from the larger low of last week in the area of 1.2266. An important task for the bulls will also be to regain the resistance of 1.2358. Closing the day above this level can keep the pair in an upward correction formed from the low of May 7, which will lead to a larger movement of the pair up to the area of 1.2401 and 1.2463.

To open short positions on GBPUSD, you need:

The bears coped with the morning task perfectly and even managed to gain a foothold below the support of 1.2358. The next target is the area of 1.2305, where it is likely to take profit on short positions, so it is not quite right to rush to sell the pound from this level. The bears' longer-term target will be the last week's minimum around 1.2266. However, a more acceptable situation for opening short positions will be a correction and the formation of a false breakout in the resistance area of 1.2358, but you can sell GBP/USD inside the day immediately on a rebound from the level of 1.2401. Given the absence of important fundamental statistics, it is best to proceed with the second scenario, waiting for a false breakout at the resistance of 1.2358.

Signals of indicators:

Moving averages

Trading is below the 30 and 50 daily averages, which indicates an attempt to return sellers of the pound to the market.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of an upward correction, the average border of the indicator around 1.2401 will act as a resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20