The Australian dollar made a fairly strong leap at the close of the last trading week - it reached the middle of the 65th figure paired with the US currency. Moreover, this price dynamics was caused not only by the general weakening of the greenback - by itself, the aussie also showed character and rose in price despite ambiguous fundamental factors. Bulls were able to maintain optimism, focusing only on positive signals. And there were many of them - both events and encouraging theses. Against the background of general pessimism, the Australian dollar not only stood its ground, but also showed growth, clinging to any factors of a positive nature. And today's decline should be seen solely as a correction, as a good opportunity to go buy with an upward target of 0.6550.

Let me remind you that at the beginning of last week, the Australian dollar strengthened due to the fact that the Reserve Bank of Australia announced the preservation of a wait-and-see position, while announcing a reduction in the volume and frequency of bond purchases. Although the RBA emphasized in a separate line that the interest rate would not be increased until the key inflation indicators and the level of employment reached their target levels, this fact did not prevent the bulls from heading up.

A RBA quarterly report on monetary policy prospects was published last week. Actually, the prospects themselves were outlined at the May meeting, so this document was interesting only in the context of updated forecasts. According to the Australian regulator, the country's economy will contract by eight percent by the end of June, but then will be stably recovering, moreover, "at an accelerated pace." The RBA report said that "the initial stages of this restoration may begin quite soon, as the authorities are gradually weakening restrictive quarantine measures."

Coincidentally, simultaneously with the publication of the RBA report, Australian Prime Minister Scott Morrison announced a three-stage quarantine exit plan, calculated before the end of July. At the first stage, restaurants, cafes, shops, libraries, community centers, playgrounds and training camps will be opened, ten people will be allowed to gather in public places. At this stage, cafes and restaurants will have to comply with the restrictions of ten visitors. At the second stage of the quarantine exit program, meetings for up to 20 people will be allowed, sports halls, beauty salons, cinemas, galleries and amusement parks will open. Interstate trips will also be allowed. And in the end, by July, the government plans to complete the first and second stages and begin to implement the final stage. During this period, most workers will return to work, pubs and clubs will open again, meetings will be allowed for up to one hundred people, as well as travel abroad. Naturally, provided that in the first two stages Australia does not face the second wave of the epidemic.

By the way, today's pullback is due to the fact that the largest states of the country, where the infection level is still high, decided to postpone quarantine. In particular, New South Wales and Victoria, where Sydney and Melbourne are located, which account for almost two-thirds of coronavirus cases in the country, have decided so far to mitigate only those measures that relate to small and medium-sized businesses. This fact alarmed investors, and the pair justifiably retreated. But the governors of these states said that if the positive dynamics in the number of cases remained, they would join the government's quarantine exit strategy.

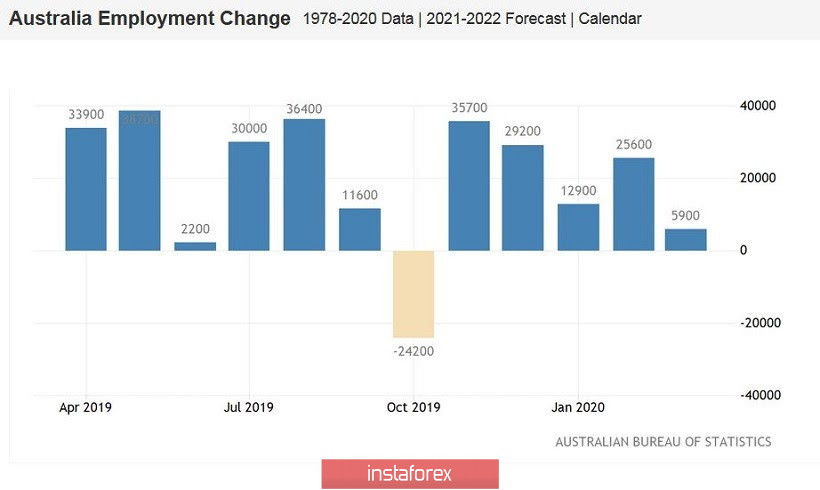

Therefore, the aussie recession may be temporary, after which the upward dynamics of AUD/USD will resume - especially if the Australian labor market data comes out better than expected. Let me remind you that the March release came out better than expected - instead of rising unemployment to 5.4%, the indicator rose to 5.2%; and instead of a decline in the number of employees to -30 thousand, the indicator has grown to almost 6,000. But it is necessary to take into account that these figures reflected only the first two weeks of March, while strict quarantine was introduced in the country in the second half of the month before last. Therefore, this week we will be able to assess the full extent of the coronavirus crisis: according to preliminary data, unemployment will increase to 8.3%, and the number of employees will decrease by 550,000 people. But if the indicators come out in the green zone, the aussie will receive very strong support, even despite the actual decline in the labor market. This will mean that the country does not follow the most pessimistic scenario and, therefore, faster than the announced forecasts will recover in the second half of the year.

From a technical point of view, the pair on the daily chart is between the middle and lower lines of the Bollinger Bands indicator, as well as above the Kumo cloud with all the lines of the Ichimoku indicator. This indicates the priority of the upward movement. You can buy the pair from current positions with an upward target of 0.6550 (the upper line of the Bollinger Bands indicator on the same timeframe). Stop loss can be placed at 0.6400 - this is the middle line of the Bollinger Bands trend indicator.