The pound returned to the area of the 23rd pattern amid the general strengthening of the greenback this week. The ambiguous results of the May meeting of the Bank of England did not allow the British currency to get out of the price range and indicate the vector of its medium-term movement. For the second week, the GBP/USD pair has been trading in the range of 1.2300-1.2450, alternately starting from its borders. However, the coming events may push the pound out of this "vicious circle" since the US inflation data will be published today and the key figures on the UK economic growth are expected tomorrow. These releases will attract the attention of traders.

At the start of the current trading week, the greenback strengthened slightly. The adverse impact of extremely negative Nonfarms has passed and dollar bulls are now trying to regain their lost positions. Today, the dollar index was able to return to the area of the hundredth mark due to a surge in anti-risk sentiment. It happened as a result of the poor Chinese data that came out in the red zone.Thus, inflation collapsed to around 3.3% (with a forecast of a slowdown to 3.7%). As a comparison, at the beginning of this year, the CPI index was above five percent, showing steady growth over five months. Meanwhile, the Chinese producer price index, with a forecast of decline to -2.6%, fell to the level of -3.1% (long-term anti-record). In other words, macroeconomic reports from China were not in line with forecasts, reflecting the recession in the Chinese economy. Traders are again worried about the fate of the global economy, as indicators from China serve as a kind of marker of the overall situation. In response to today's releases, the market has increased demand for safe-haven assets - primarily for the greenback and, to a lesser extent, for the yen and gold.

However, looking ahead, it should be noted that this can be a short-term reaction of traders as market participants will focus on the US inflation reports during the American session on Tuesday. The GBP/USD pair will not be an exception: the pound will follow the dollar today, while it will depend on its fundamental factors tomorrow.

According to preliminary forecasts, US inflation is likely to significantly disappoint investors. The general consumer price index is expected to go deeper into the negative zone and reach -0.7% m/m. In annual terms, the indicator can drop to 0.4% from a 1.5%. The core index, excluding food and energy prices, in March was relatively stable, particularly on a yearly basis (-0.1% m/m and 2.1% y/y). However, April figures are unlikely to please dollar bulls. According to most experts, the indicator will drop to -0.3% m/m, and to 1.7% in annual terms. If the real numbers are lower than forecast, dollar bulls are unlikely to be able to maintain their regained positions.

However, a possible weakness of the greenback will not help buyers turn the tide over the pair. Bulls can count on the growth of the pair to the borders of the 24th pattern. In anticipation of tomorrow's reports from the UK, market participants are hesitant to buy the pound. According to preliminary forecasts, the key economic indicators of the UK will be in the negative zone.

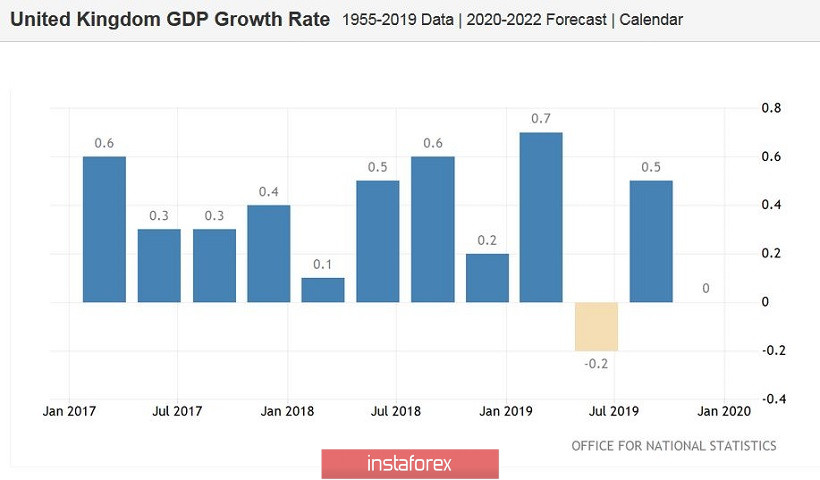

Thus, the volume of GDP in the first quarter is likely to be reduced by 2.5% on a quarterly basis and by 1.6% in annual terms. March data will also be published. According to experts, that month the British economy contracted by almost 8% on a monthly basis and by -2.9% in quarterly terms. In addition, the industrial production data for March will be released tomorrow. Based on general expectations, it will drop to -5.5 m/m and to -9.2 y/y. The situation can be even worse in the field of processing industry. The indicator is expected to decline to -6.1 m/m and -10.2 y/y. The monthly and annual construction activity will also be released which is also expected to be negative.

Some experts warn that these data may come out in the red zone, even despite such pessimistic forecasts. Most importantly, that tomorrow mainly March data will be published, while quarantine restrictions in the UK have been introduced from March 24. Consequently, the British economy survived the main blow in April. Thus, its consequences will be announced later.

All this suggests that the GBP/USD pair retains the potential for its decline. After the release of the US inflation data, it is better to consider short positions. The first downward target is at the 1.2250 mark, which is the bottom line of the Bollinger Bands indicator on the daily chart. A more ambitious target is the 1.2150 level which is the lower border of the Kumo cloud on the same time frame. However, if tomorrow's data from Britain disappoints traders, the price could fall to the designated target in just a few hours. It is preferable to place a Stop Loss order at around 1.2470 (two-week maximum price). If the pair overcomes this level, the bearish scenario will no longer be relevant.