Apparently, the trend for strengthening the dollar is still maintained. After all, nothing else but this, the growth of the dollar can not be explained amid a completely empty macroeconomic calendar. At the same time, the Federal Reserve is making incredible efforts to somehow rectify the situation. Surprisingly, even the worst report in the history of the United States Department of Labor has failed to lead to a noticeable weakening of the dollar. Frankly speaking, it did not affect the position of the US currency at all. So, Neel Kashkari had to step into this matter, who made a promising statement that we should not despair, because the worst is yet to come. This is, of course, about the state of Affairs in the American economy. But in the end, such optimistic statements were not enough to change the mood of market participants in any way.

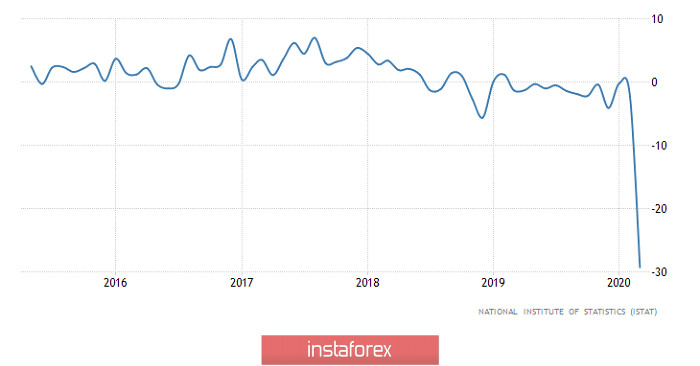

But, let's be honest. We can't say that the macroeconomic calendar was completely empty yesterday, because by doing so we offend Italy, which reported on industrial production yesterday. And the report was just fine. The decline in industrial production accelerated from -2.3% to -29.3%. In other words, industrial production declined by almost a third over the year. It only took a half of downtime. After all, the data for March. On the other hand, restrictive measures, in connection with the coronavirus pandemic, were introduced only in mid-March. However, without any coronaviruses there, Italian industry showed a decline for quite some time now. But in any case, following the results of April, we should expect an even deeper decline in industrial production.

Industrial production (Italy):

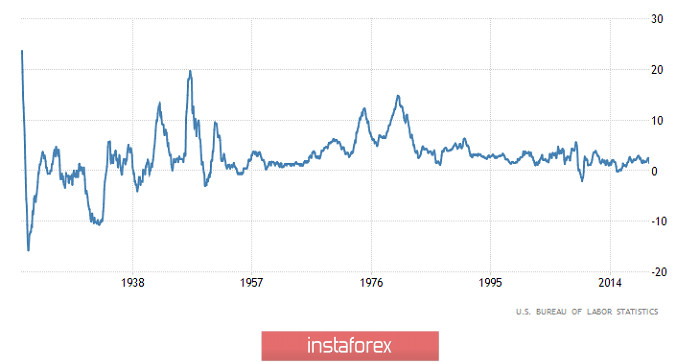

Today, the market will focus only on inflation in the United States, where it is expected to slow down from 1.5% to 0.5%. However, you should not wait for some kind of violent reaction, since even after the publication of preliminary data, the market has already taken into account the sharp decline in inflation in the United States. At the same time, this situation is extremely disturbing in itself. The fact is that after the publication of the worst-ever report by the United States Department of Labor, what is now happening can only be compared to the Great Depression. We may not have reliable data on the labor market at that time, but we have excellent data on inflation. So, the worst economic crisis in history, at least in the United States, was accompanied by a fairly prolonged deflation. And given that the situation in the labor market is somehow comparable, it means that prices will be about the same. After all, when tens of millions of people are out of work, and therefore without means of support, prices have nothing to grow from. People just won't go buying. On the contrary, sellers will try to reduce prices in order to sell something. So we should wait for deflation to start. And given the current trends in economic science, this will inevitably lead to the fact that the Federal Reserve may well think about reducing the refinancing rate to negative values. The investors will have to keep this idea in mind.

Inflation (United States):

The euro/dollar currency pair found variable support in the region of the level of 1.0775 once again, where it slowed down and, as a fact, formed a rebound. It can be assumed that price fluctuations within the control levels of 1.0775 / 1.0850 will continue in the market, where the downward movement will be the main one in case the price is consolidated lower than 1.0775.

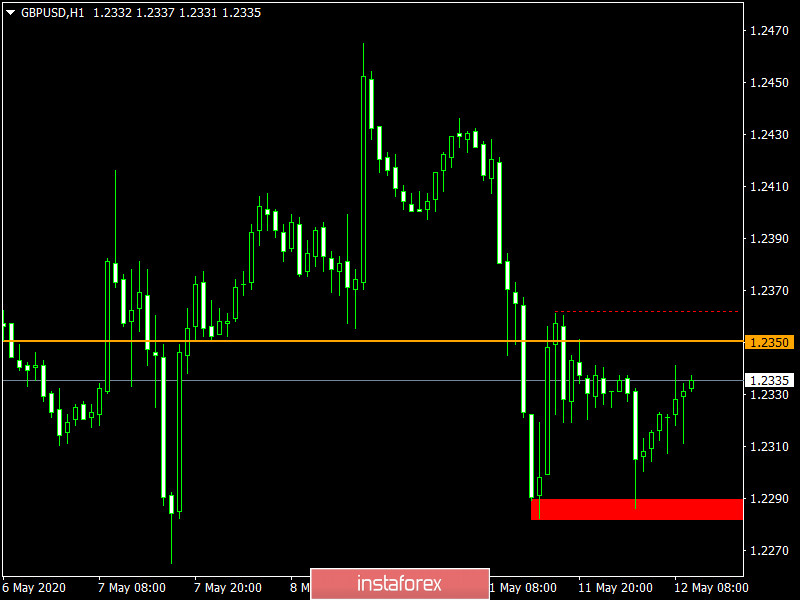

The pound/dollar currency pair continued to show downward interest, bringing the quote around a variable support - 1.2280. It can be assumed that in case of price consolidating lower than 1.2250, the downward interest will lead the quote to the main support level of 1.2150. Otherwise, we are expecting a chatter in the range of 1.2280/1.2350.