GBP/USD

Analysis:

In the upward wave of the British pound from March 18, the formation of a corrective structure continues. Previously, the target zone is located near the beginning of the 122nd price figure. Quotes at the time of analysis are located in a narrow corridor between the opposite levels.

Forecast:

Today, the pound is expected to move in the price corridor between the nearest counter zones. In the first half of the day, the end of the upward pullback is possible. Then you can count on a reversal and even prices down. A break in the lower border of the support zone is not excluded today.

Potential reversal zones

Resistance:

- 1.2360/1.2390

Support:

- 1.2280/1.2250

Recommendations:

Trading the pound on the market today is only possible within the intraday style. Purchases are possible with a reduced lot. When reversal signals appear, the main focus is on the pair's sales.

USD/JPY

Analysis:

The direction of the short-term trend of the Japanese yen is set by the upward wave from March 9. The correction part (B) is nearing completion in the structure. The ascending section from May 6 has a reversal potential. The price has reached a strong resistance level.

Forecast:

After trying to put pressure on the resistance zone, you can expect a price pullback down today. The level of expected decline is indicated by the limits of calculated support.

Potential reversal zones

Resistance:

- 107.70/108.00

Support:

- 107.00/106.70

Recommendations:

For purchases on the yen market today, there is no condition yet. Today, short-term sales of the instrument from the boundaries of the calculated resistance are possible. It is better to reduce the lot.

USD/CHF

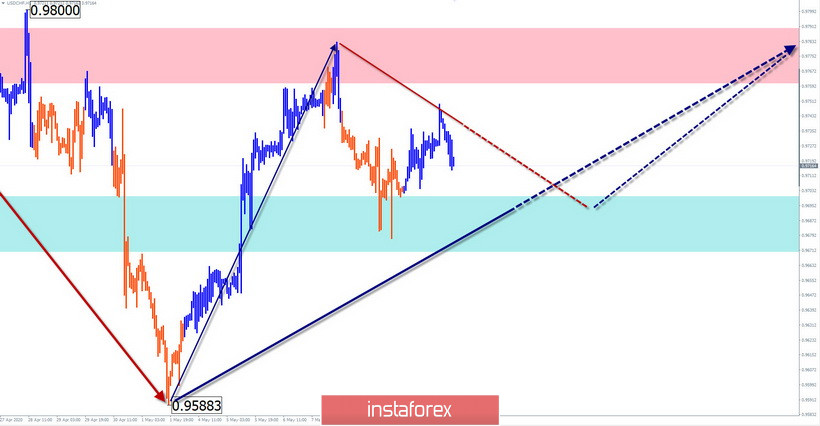

Analysis:

A promising direction for the Swiss franc is set by the upward wave from March 9. In its structure over the past month and a half, a correction has taken shape, in the form of a horizontal pennant. It is nearing completion. The section from May 1 has a reversal potential.

Forecast:

Today, it is worth waiting for the price to move in a narrow corridor between the nearest counter zones. In the morning, the European session is expected to decline in quotes. A break in the lower limit of support is possible but unlikely. By the end of the day, you can count on a change of course and the beginning of the rise.

Potential reversal zones

Resistance:

- 0.9760/0.9790

Support:

- 0.9700/0.9670

Recommendations:

The most reasonable thing to do today is to refrain from entering the franc market until the end of the current decline. For intraday supporters, short-term sales with little experience are possible. In the support area, you should look for signals to buy the pair.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!