EUR / USD

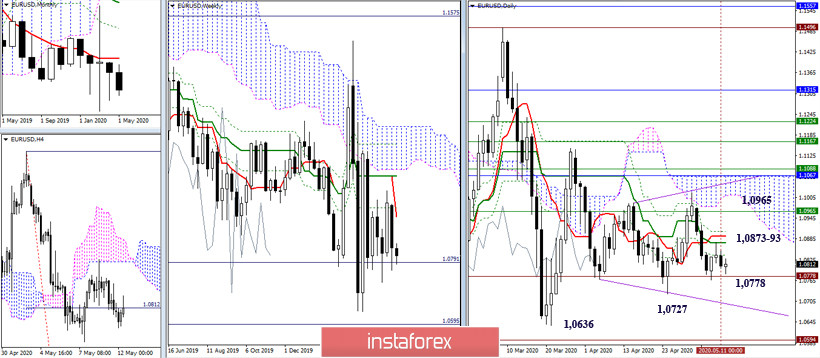

After testing the center of gravity, which is now the day cross (Kijun 1.0873 + Tenkan 1.0893), the pair declined again to support historical levels of 1.0778.Prolonged slowdown at the support will return the pair to the daily cross, and consolidation above the cross may contribute to the activity of players to increase. On the other hand, the breakdown of the level of 1.0778 and daily consolidation below will allow us to hope for a continued decline, while the minimum extremes of 1.0727 - 1.0636 and the trend line will become bearish interests.

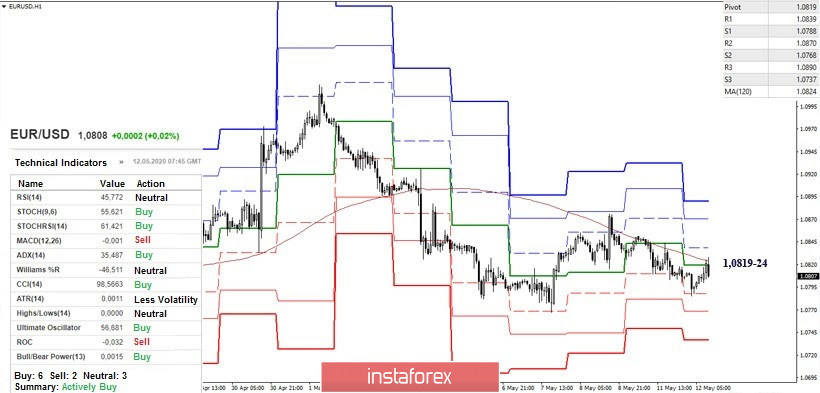

The last few days in the lower half, the development of events rests on the key resistances that have joined forces and stand guard over bearish interests, not allowing players to turn the situation around on the rise. It should be noted that players do not leave attempts to increase, and such tactics often bring positive results. At the moment, the key resistance of the lower halves is being tested for strength again and they are joining forces at 1.0819-24 (central Pivot level + weekly long-term trend) today. Now, a reliable consolidation above will give the main advantages to players on increase on H1. The upward reference points within the day are now the resistance of the classic Pivot levels 1.0839 - 1.0870 - 1.0890. The support for classic Pivot levels are located today at 1.0788 -1.0768 - 1.0737.

GBP / USD

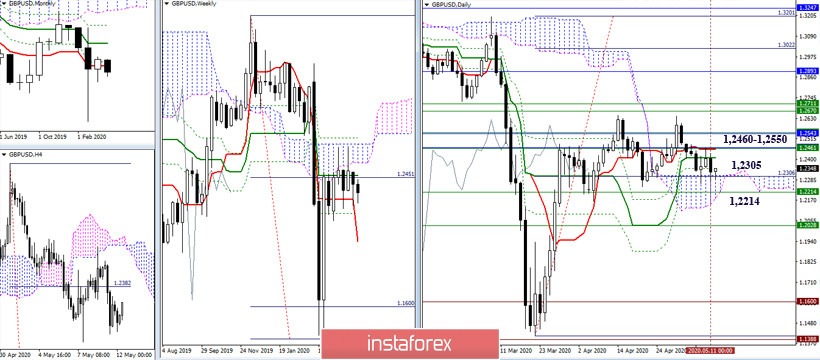

The pair continues to work and consolidate within the previously designated levels, which have entered a horizontal position and maintain uncertainty. The inability of downside players to cope with the met support of the daily cloud (1.2305) will return the pair to the resistances that are currently attracting, being at 1.2406 - 1.2460 - 1.2540 - 50. In case of breakdown of the upper boundary of the daily cloud (1.2305), the main task of the players to decline will be to move down to the lower boundary and exit from the cloud, with the relative daily cloud consolidating in the bearish zone.

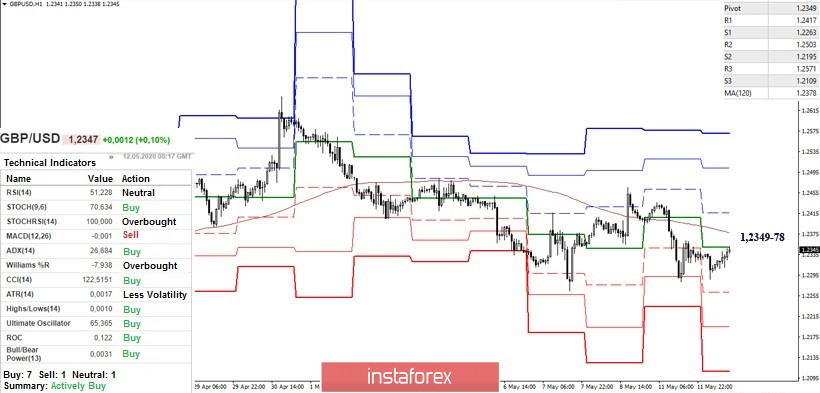

The pound has been working in the correction zone for a long time in the lower halves, while it has not yet been able to break through the most significant resistance, testing of which is now observed. On the hourly (H1) chart, the key resistances are located today in the zone 1.2349 - 78 (central Pivot level + weekly long-term trend). Finding a pair under resistance preserves the main advantages of H1 on the side of the players to decline. The bearish pivot points within the day are the support of the classic Pivot levels 1.2263 - 1.2195 - 1.2109. Now, consolidation above 1.2349 - 78 and the reversal of the moving average will return the hope that the players on the increase will be able to cope with the resistance of the upper timeframes, which strengthen the resistance of the classic pivot levels today on H1 1.2417 - 1.2503 - 1.2571.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)