Hello, dear colleagues!

At yesterday's trading, the main currency pair of the Forex market was subject to downward dynamics. In the absence of macroeconomic statistics, all the attention of market participants was focused on the second wave of the COVID-19 epidemic, the probability of which is quite high.

So, in South Korea, the number of infected people rose to the maximum values of the month. After the easing of restrictions and the opening of a number of enterprises, the number of coronavirus infections in Germany also increased. Yesterday, salons and shops opened in many cities in France, but the situation there is still far from ideal. After the coronavirus holidays, it is again necessary to establish supply chains for goods that are still experiencing interruptions.

Nevertheless, the Europeans are optimistic that these are temporary difficulties, and the situation will begin to improve in the very near future.

Today at 13:30 (London time), the US will publish the consumer price index, which is the main inflation indicator in the country. Also this week, numerous speeches by monetary officials of the US Federal Reserve are expected, among which it is necessary to highlight the speech of Fed Chairman Jerome Powell.

The trade contradictions between Washington and Beijing, which also cause investors to worry and discourage risk appetite, have not gone away.

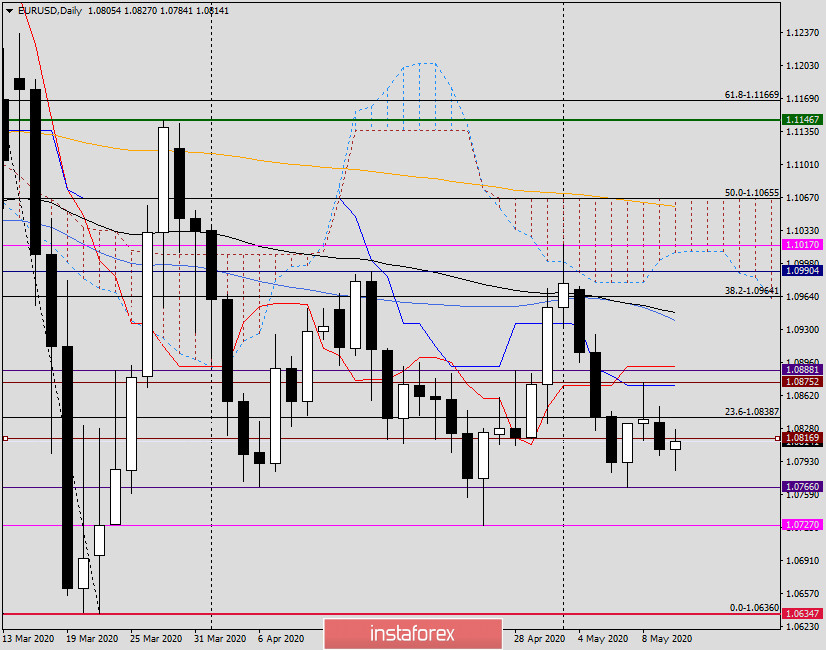

Daily

So, yesterday's attempts of EUR/USD to grow very quickly came to naught, and already from the strong technical level of 1.0850, the pair turned to decline, ending Monday's session at 1.0806. Friday's doji candle with a longer upper shadow did not remain unnoticed by market participants, and from a technical point of view, it caused a bearish trend that appeared in yesterday's trading.

After the opening of today's trading, the decline continued, but at 1.0784, the pair gained support, and at the time of writing, the euro/dollar is moderately strengthening. If the rise continues, its immediate target will be yesterday's highs at 1.0850, the census of which will send the pair to the area of 1.0875-1.0892. This is where the Kijun and Tenkan lines of the Ichimoku indicator are located, and the maximum trading values on May 8 are marked. The selected area of resistance is quite important and strong, but its overcoming will not indicate an unambiguous alignment of forces. Already near 1.0940, euro bulls will face a serious test in the form of overcoming 50 simple and 89 exponential moving averages.

To resume bearish sentiment, it is necessary to break through the strong support level of 1.0766, after which the next target of the players to lower the rate will be 1.0727.

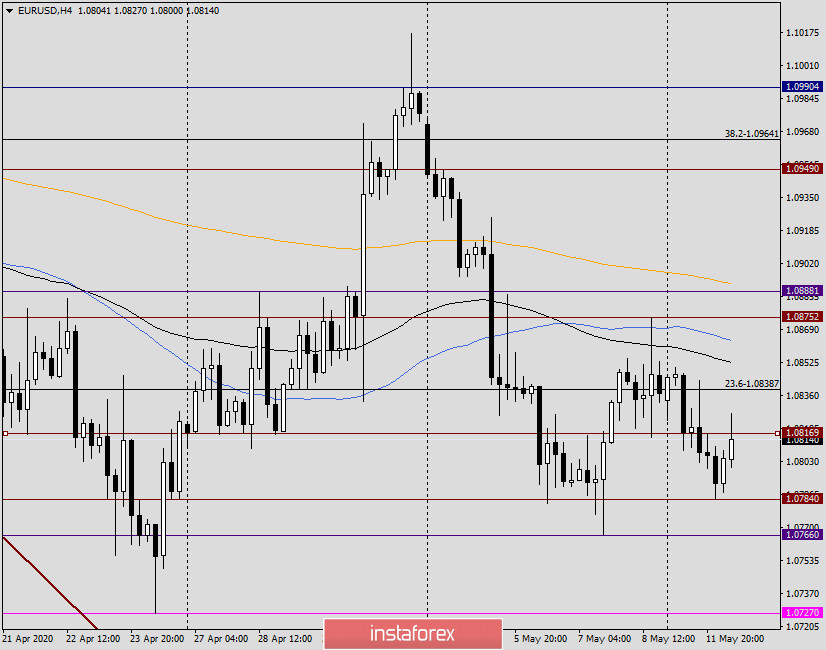

H4

On the 4-hour timeframe, the pair breaks through the nearest resistance near 1.0817 at the end of the review. However, after the breakout of this level, players need to go up to 1.0823. Only then will the road open to yesterday's highs of 1.0850 and higher, in the price zone of 1.0875-1.0893.

A bearish scenario will be indicated by a breakout of the support of 1.0784, after which the next target will be the level of 1.0766.

Conclusion and trading recommendations for EUR/USD:

At the moment, the most relevant is the continuation of the downward scenario. However, it is necessary to monitor the candle signals and only after they appear in the price zones of 1.0817-1.0823 and 1.0850-1.0875 open deals for sale.

Purchases with small goals are recommended to be considered after a true breakout of the resistance at 1.0850, on a pullback to the broken level. But even with this positioning, it is better to limit yourself to fixing deals in the area of 1.0875-1.0890, where the end of the upward dynamics is likely and a reversal in the south direction.

Don't forget about today's publication of the consumer price index of the United States. This indicator can have a significant impact on the course and results of today's trading on the euro/dollar.

Good luck!