Crypto Industry News:

Michael Saylor, CEO of MicroStrategy's corporate data analytics firm, announced via a Twitter post that the company had purchased an additional 7,002 Bitcoin worth approximately $ 414.4 million at an average price of $ 59,187 per coin. MicroStrategy sold 571,001 shares of the company between October 1 and November 29 for $ 732.16 per share, raising a total of $ 414.4 million.

The company currently has 121,044 Bitcoins worth up to $ 3.57 billion. They were acquired at an average price of $ 29,534 and include the capital appreciation of the previous coins.

In August 2020, MicroStrategy announced that it would adopt Bitcoin as its treasury reserve asset, citing digital currency as a "reliable means of custody" and an attractive investment with a greater long-term return potential than cash. In addition, the company stressed that stimulus packages printed by governments to combat COVID-19 are a catalyst for potential inflation and the subsequent depreciation of fiat currencies. Since then, MicroStrategy has almost consistently been buying Bitcoin every quarter.

Technical Market Outlook

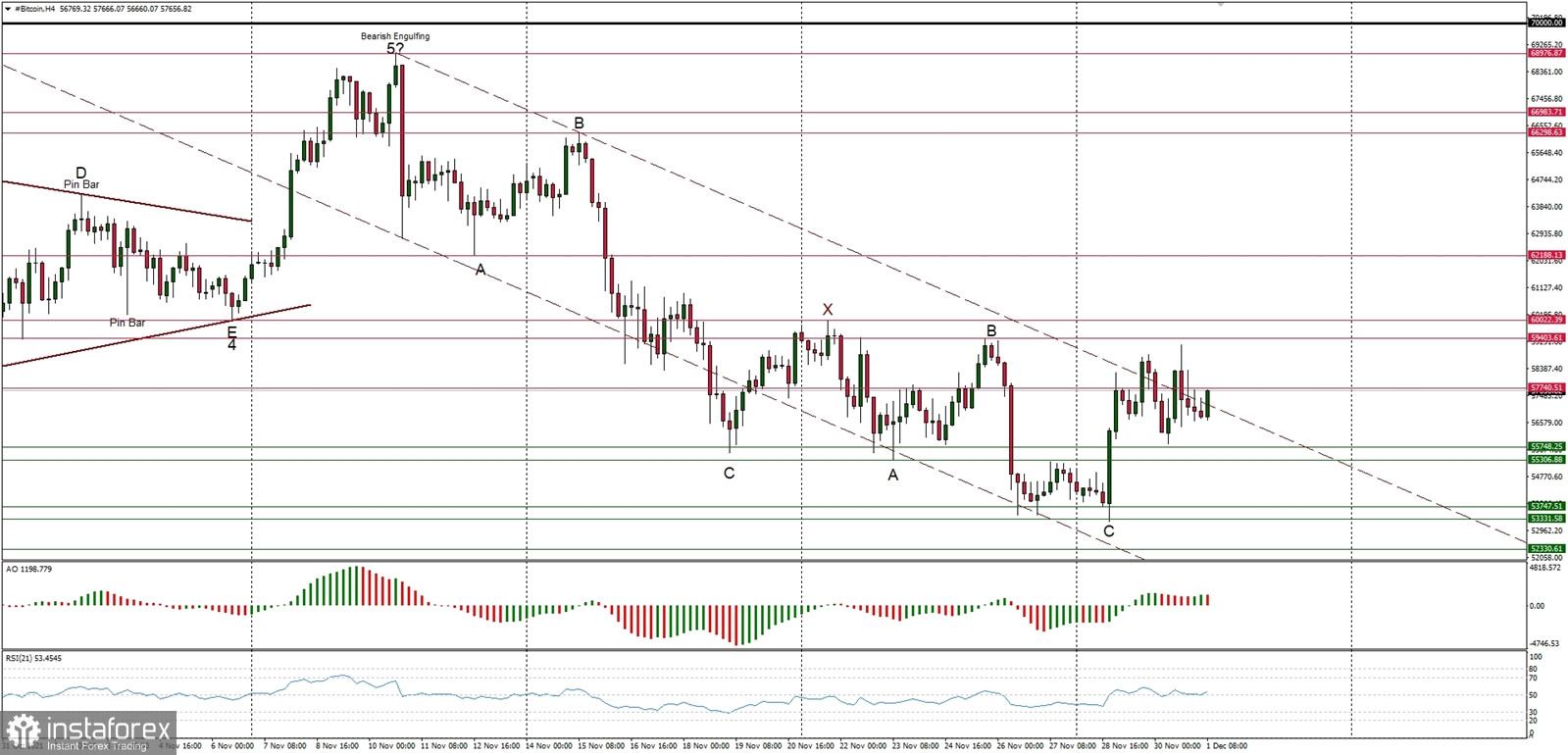

After the ABCxABC complex corrective pattern might have been completed at the level of $53,331 the BTC/USD pair has bounced towards the wave B high seen at $59,403. The bulls are ready to resume the up trend again. The recent local high was made at the level of $59,195, but in order to confirm the up trend continuation bulls must break through the wave X high located at $60,013. The nearest technical support is seen at the level of $55,748 and $53,306. The larger time frame trend is still up.

Weekly Pivot Points:

WR3 - $65,476

WR2 - $62,564

WR1 - $59,328

Weekly Pivot - $56,242

WS1 - $53,008

WS2 - $49,857

WS3 - $46,541

Trading Outlook:

The ABCxABC complex corrective cycle might be terminated. According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $52,943 is clearly broken on the daily time frame chart (daily candle close below $52,000).