Looking at what is happening on the market, the single European currency grew quite logically. Indeed, the United States is starting to think not only about deflation, but also about some interesting things. And in theory, the pound should have also grown, but the coronavirus intervened. More precisely, not the virus itself, but Boris Johnson, who announced yesterday the beginning of the gradual lifting of the restrictive measures previously introduced just because of the coronavirus pandemic. And as an evil, he did this at about the same time that inflation data was published in the United States. It would be better if he did not say anything. After all, the market hoped for at least some hope that this nightmare would end soon. However, all the most interesting things, in the form of work permits for non-food stores, bars with restaurants, hairdressers, and so on, are postponed until June. And then, if only the epidemiological situation will not worsen. Moreover, they will all be allowed to work only if they provide a social distance regime. This is especially true for cinemas. In addition, they introduced criminal liability for employers if they cannot protect the health of their employees. Moreover, it refers to the coronavirus. That is, if your employee picked up this infection somewhere on the way to work, then you will be sent to jail. We can already predict these wild lines from entrepreneurs hurrying to file an application to resume their activities. Well, to finish it off was that all the announced measures so far concern only England. That is, Scotland, Wales and Northern Ireland continue to be in strict quarantine. The market was clearly expecting something else. Moreover, for about two weeks already, the very prospect of opening all kinds of shops and cafes was discussed precisely during the first stage of lifting restrictive measures. But nothing is clear at all. In addition, no clarity and understanding of how all this will happen. Apparently, politicians all over the world have no idea what to do in this situation.

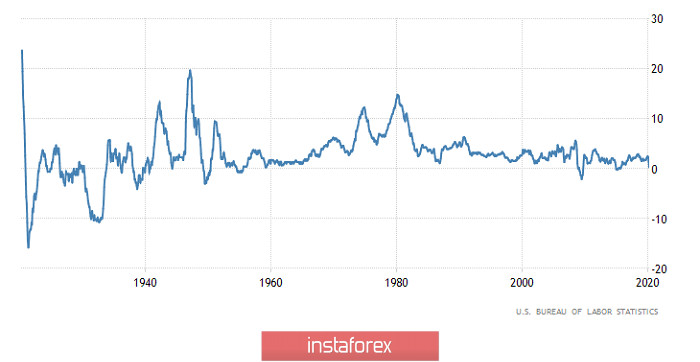

At the same time, the dollar had enough reasons to weaken, while the pound stood out and went on its way. So, the final inflation data for April showed a slowdown in consumer price growth from 1.5% to 0.3%. But they were expecting a decline of only 0.5%. Such a large-scale slowdown in inflation is already a concern, but if you look at monthly data rather than annual data, it becomes generally scary. So, in monthly comparison, the level of consumer prices decreased by 0.8%. In other words, this is already the beginning of deflation. It can only be officially recognized if the decline is recorded in annual terms. But if the monthly data already shows a noticeable decline, then the annual data will soon show exactly the same. And the trouble is that after the publication of the most terrible report in the history of the United States Department of labor, the current crisis can only be compared to the Great Depression. However, there are no exact statistics on the labor market for that period. It was the Great Depression that made everyone think about the need to constantly monitor the state of the labor market. Nevertheless, everyone still understands that there has never been such a nightmare in the labor market since the Great Depression. So, if we don't have data on unemployment for that period, then there is plenty of data on prices. And the Great Depression was accompanied by prolonged deflation. So even the price dynamics suggest that the current crisis will not become another slight inconvenience, as was the 2008 crisis or the dotcom crisis. And it is not surprising that against this background, discussions about the possibility of reducing the Federal Reserve's refinancing rate to negative values begin in earnest while these thoughts are expressed by some commercial banks. But if the situation continues to develop in the same spirit, then representatives of the Federal Reserve System may begin to voice similar prospects.

Inflation (United States):

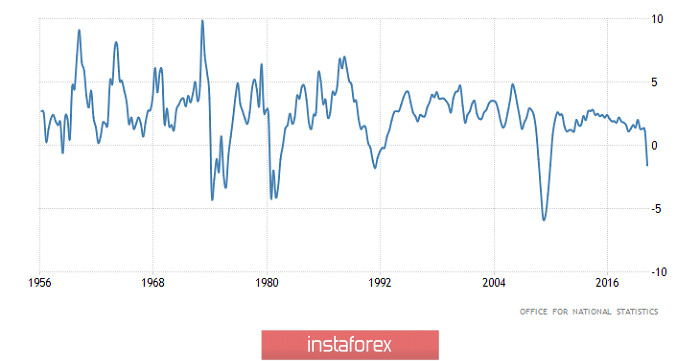

Since the early morning, a clear confirmation was received that the pound is still in the grip of a coronavirus situation. After all, it literally ignored the morning publication of data on GDP and industrial production. But macroeconomic statistics turned out to be slightly better than forecasts, and in combination with yesterday's inflation data in the United States, this should have given the pound another opportunity for growth. So, preliminary data on GDP for the first quarter showed that the decline was not 2.0%, but 1.6%. Of course, this is still a recession, and a significant one. Moreover, restrictive measures in the UK were introduced only closer to the end of March. That is literally at the very end of the first quarter. And for such a situation, the recession is clearly impressive. However, they expected that everything would turn out to be much worse. Hence, the decline in the second quarter may also be somewhat smaller. In addition, the decline in industrial production accelerated from 3.4% to 8.2%, and not to 9.9%, as predicted. In other words, although the situation is depressing, it is not as catastrophic as intended.

GDP growth rate (UK):

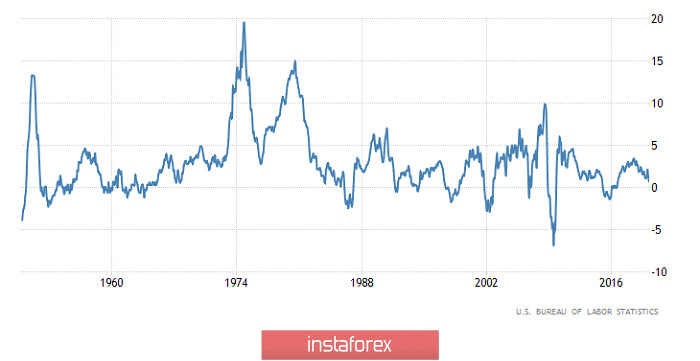

Most likely, the single European currency will also ignore its statistics. Although data on industrial production can depress anyone. After all, the rate of decline in industrial production should accelerate from -1.9% to -13.6%. Of course, we can say that the decline was somewhat greater in 2009. However, do not forget that restrictive measures were introduced in Europe only from mid-March. That is, in just a half a month, the pace of decline has accelerated several times. Moreover, industry in Europe grew before the crisis of 2008-2009. And now we have such a situation that without any epidemic, industrial production in Europe has been declining for more than a year. So the scale of the fall should be smaller. But something tells us that by the end of April, a record will be broken in the rate of decline in industrial production in the euro area.

Industrial Production (Europe):

It is clear that the market is now more focused on US statistics. Moreover, priority is given to data on prices. And just today, data on producer prices are published, and, according to forecasts, their growth rate of 0.7% should be replaced by a decline of 0.3%. It turns out that consumer prices are already falling in monthly terms, and producer prices show a decline already in annual terms. This combination clearly indicates that consumer prices in annual terms are about to show a negative value. In other words, deflation is more a given than a prospect. Thus, the dollar may decline for the second day in a row. Another thing is that all this is only temporary, since Europe will not escape the same fate.

Producer Price Index (United States):

By the way, the emerging decline in the single European currency is just confirmation that the trend for strengthening the dollar is not going anywhere yet. So, the publication of data on producer prices will help the single European currency to increase around 1.0875 and even a small jump to 1.0925 is possible. However, the single European currency will not be able to consolidate in these levels.

Of course, the pound will attempt to return to the level of 1.2375, but it will still decline in the medium-term.