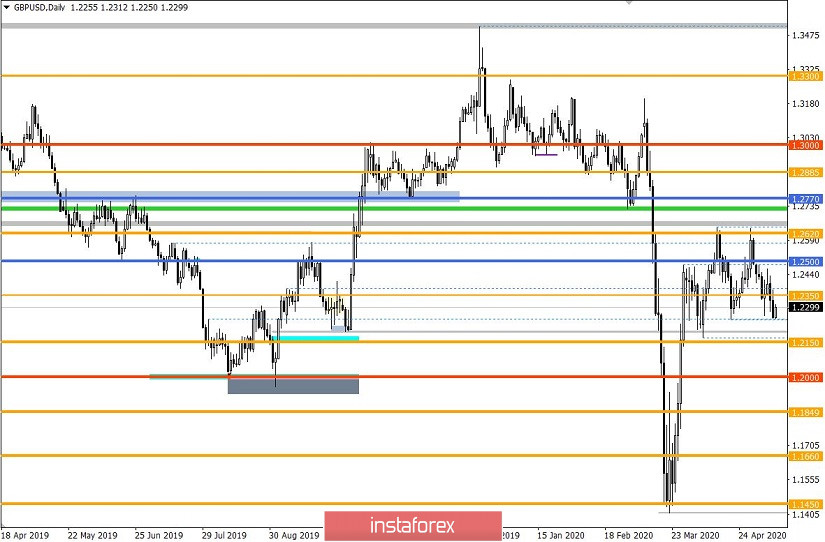

From the point of view of complex analysis, we see a convergence of quotes, where control values were reached.

The past trading day is famous for its intense downward movement, on the basis of which the quote managed to overcome May 7's low - 1.2265, and reached the area of interaction of the trading forces - 1.2250, which reflects the stop on April 21 and the occurrence of a reversal. The 1.2250 level plays a variable role of support, which means that the level may be reached again, and its retest can be expressed in a completely different way than before.

The 1.5-month flat 1.2150 (1.2250) // 1.2350 // 1.2620 can be broken downwards. The level of 1.2250 inside it plays an important role, the breakout of which will be a catalyst for short positions and breakdown of the main level of 1.2150.

In such a case, the theory of downward development will acquire a material basis, since the recovery process relative to the course of March 20 to April 14 will be 40%, and a few points will remain until the theory is confirmed.

Analyzing the past trading day by minutes, we can see that the downward course appeared at the start of the US session, and lasted until the close of the daily candle.

As discussed in a previous review, traders are considering a downward development, but the main signal will be received after passing the level of 1.2150.

In terms of volatility, indicators are fixed above 100 points for 5 days in a row, which can be considered an acceleration of activity, where the coefficient of speculative positions has a high indicator.

Analyzing the daily chart, we see an upward movement, at the top of which a 1.5-month flat was formed. If we analyze the dynamics of the EUR / USD pair, we will see that in the same period, the single currency made a sideways movement, which means that stagnation is general in the market.

Yesterday's news contained the final data on US inflation, where a significant slowdown from 1.5% to 0.3% was recorded, slightly better than the forecasted decrease of 0.5%. With such figures, coupling it with the latest US unemployment rates, it is not surprising why everyone is talking about negative interest rates of the Fed.

The market reaction to such sad data was amazing. Against the pound, the dollar continued to rise, but against other currencies, the US dollar declined.

The reason of which is the effects of the quarantine measures, which are starting to appear in the UK economy. In March, the UK economy shrank by almost 6%, and this is only a small part of the damage. The Bank of England predicts a staggering decline of 25% in the current quarter, which indicates a complete plunge into recession.

Such facts explain why the English currency is so unstable, and its weakening will just continue in the future.

A preliminary estimate of the UK 1st quarter GDP was published today, where the decline was -1.6%, slightly better than the forecast of -2.1%.

Market reaction is almost absent at the time of publication of the GDP data.

Data on US producer prices will be published in the afternoon, where a 0.3% decrease is expected, which will continue to put pressure on the US economy.

Fed Chairman Jerome Powell is scheduled to make a speech today, the contents of which includes the announcement of further measures to support the economy. Market participants may focus on this.

Further development

Analyzing the current trading chart, we see an attempt to work out the level of 1.2250, which drew a pullback in the region of 60 points. The fluctuation was justified by both the technical and fundamental side, so the level of 1.2350 can be considered theoretically. The lateral corridor 1.2150 (1.2250) // 1.2350 // 1.2620 is still valid, but stability in this framework is in question, which means that the theory of downward development has some grounds for reflection.

In terms of the emotional mood of market participants, we see that the rate of speculative operations remains high, which will affect volatility.

Price fluctuation within the range may continue, where a local jump towards the previously passed 1.2350 mark is possible. However, the main goal is still a downward development, so consolidation points must be analyzed.

Based on the information above, we formulated these trading recommendations:

- Open buy positions after a consolidation above 1.2310, towards 1.2350

- Open sell positions below 1.2250, towards 1.2150.

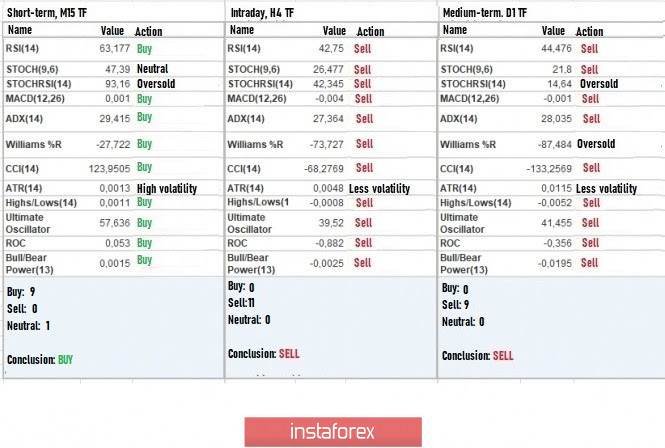

Indicator analysis

Analyzing the time frames (TF), we see that the technical instruments of the hourly and daily periods still signal sales, which corresponds to the current market mood.

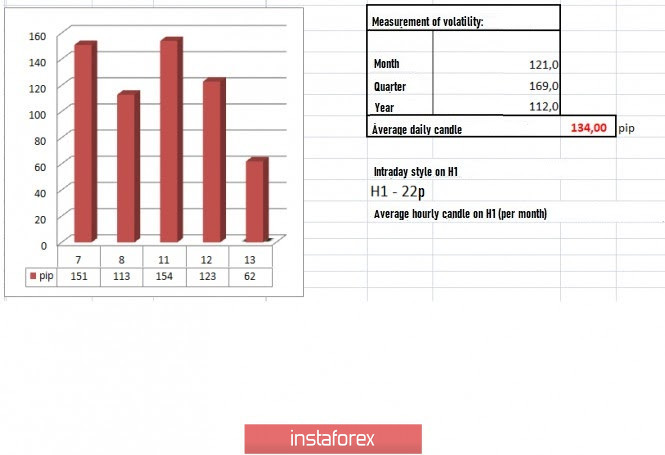

Volatility per week / Measurement of volatility: Month; Quarter Year

The volatility measurement reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(May 13 was built taking into account the time of publication of the article)

Volatility is currently 62 points, which is still considered low, relative to the average daily value. Upcoming news may trigger acceleration.

Key levels

Resistance zones: 1.2350 **; 1.2500; 1.2620; 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1,1000; 1,0800; 1,0500; 1,0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustments