US stock indexes closed in the red on Wednesday as a response to gloomy comments from Fed's Chair Jerome Powell. A day earlier, three FOMC officials approved the idea of introducing negative rates. So, markets were alert to the speech by Jerome Powell. In fact, he did not disappoint investors.

The Fed's leader did not speak directly about the intention of applying negative rates but he called such speculations dubious. "For now it's not something that we're considering," Powell said. At the same time, he highlighted uncertain economic prospects and grave risks in the US. The virus is sure to leave an imprint on the national economy. Under the current conditions, mitigating the damage requires massive budget spending, but the country cannot do without it.

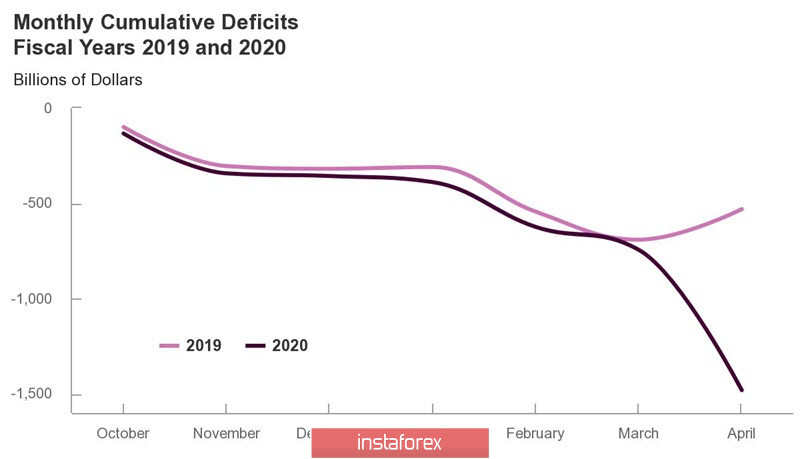

Financial aid really costs a lot to the state budget. The Congress Budget Committee said in the budget overview for May that the federal budget deficit came in at $737 billion in April. Interestingly, April is commonly a month of revenues because of a tax filing period. In April last year, the budget proficit equaled $160 billion.

Over the 7 first months of the 2020 fiscal year, deficit expanded to $1.5 trillion.

No doubt, the budget deficit is set to go on swelling as the financial aid package totals almost $3 trillion. The odds are that the government will allocate more funds for stimulus in the near future.

The bear sentiment is now ruling the market. Risk-off mood boosts demand for safe haven assets, in particular the yen and the US dollar. Meanwhile, all commodity currencies inevitably remain under pressure.

EUR/USD

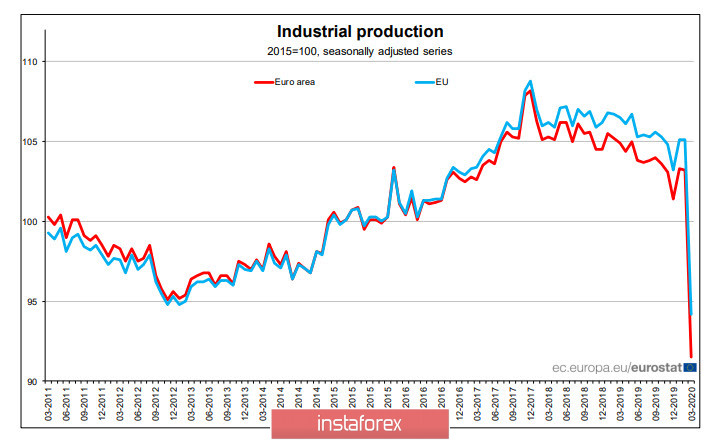

On Wednesday, Eurostat reported a steep 12.9% decline in the eurozone's industrial production on a yearly basis. Notably, the coronavirus is partially to blame for the severe downturn. The lockdown certainly intensified a slump, but the downtrend originated in 2017.

The escalating crisis in the eurozone is getting more involved in the politics, rather than relates to the economy. Germany's Finance Ministry stated that it would obey the ruling of the Constitutional Court who confirmed that the ECB purchases of T-bills were unlawful defying the Constitution. Such actions had the same legal force as depriving Germany some of its sovereignty.

On Friday, the economic calendar reminds us of Q1 GDP data on the eurozone and Germany. So, there is no reason to rely on the euro's growth. EUR/USD is now trading sideways with prospects for breaking the lower border of the trading range. I assume the nearest support levels at 1.0765 and 1.0725 with a target at 1.0635.

GBP/USD

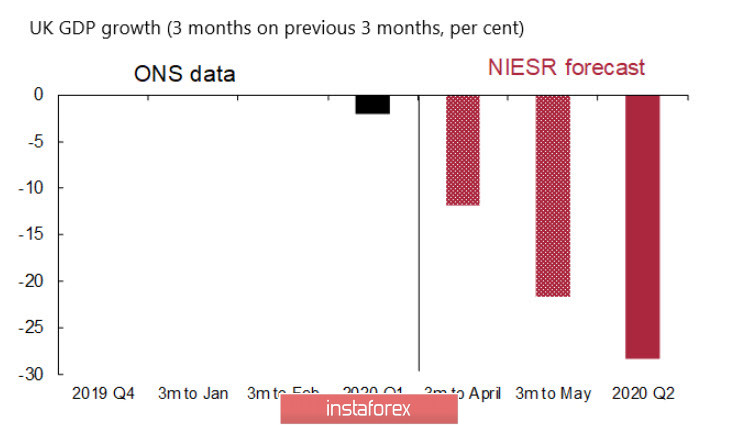

Macroeconomic data for Q1 turned out to be better than expected, but it was of little help to the pound sterling. The UK economy shrank to a great extent in March. Industrial production tumbled 8.2% on year, while the manufacturing sector contracted 9.7% annually. Trade balance also worsened a lot. GDP went down to -1.6% sequentially.

These are the first sings of a further severe downturn. The UK economy is set to extend weakness in April despite lifting lockdown measures. NIESR warns of a deeper slump in gross domestic product which could collapse to -25% in June.

The official data is not able to hide a slowdown, but there are some tricks to cushion the negative impression. The Office for National Statistics is revising methods of assessing inflation with a view to soothing a steep drop of consumer prices. What a brilliant idea! Why not downplay those metrics which revealed a sharp fall? In other words, the authorities greenlight statistics manipulation as a tool for containing panic mood. So, there are bleak prospects for the sterling to strengthen under the current conditions. Another headwind is imminent failure of the trade talks with the EU.

In my previous article, I identified support of 1.2245/60 as the nearest target which has been tested by Thursday. I set the next target at 1.2160. The outlook for the pound sterling remains bearish. It is going to extend weakness amid mounting fears. Consider short positions on retracement with the target at 1.1950/60.